Postal Manual Vol. VIII - India Post

Postal Manual Vol. VIII - India Post

Postal Manual Vol. VIII - India Post

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

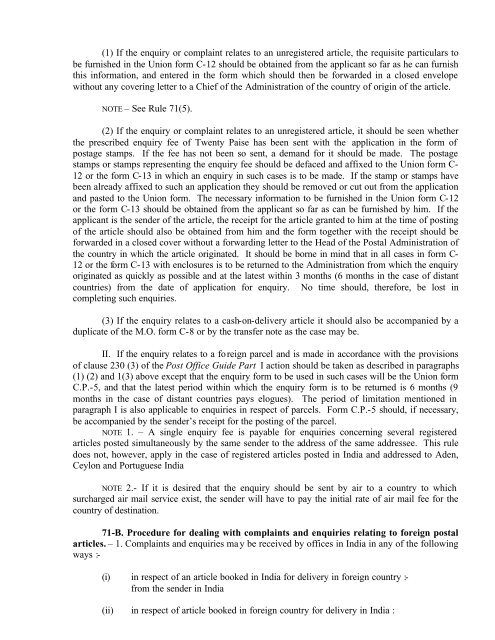

(1) If the enquiry or complaint relates to an unregistered article, the requisite particulars to<br />

be furnished in the Union form C-12 should be obtained from the applicant so far as he can furnish<br />

this information, and entered in the form which should then be forwarded in a closed envelope<br />

without any covering letter to a Chief of the Administration of the country of origin of the article.<br />

NOTE – See Rule 71(5).<br />

(2) If the enquiry or complaint relates to an unregistered article, it should be seen whether<br />

the prescribed enquiry fee of Twenty Paise has been sent with the application in the form of<br />

postage stamps. If the fee has not been so sent, a demand for it should be made. The postage<br />

stamps or stamps representing the enquiry fee should be defaced and affixed to the Union form C-<br />

12 or the form C-13 in which an enquiry in such cases is to be made. If the stamp or stamps have<br />

been already affixed to such an application they should be removed or cut out from the application<br />

and pasted to the Union form. The necessary information to be furnished in the Union form C-12<br />

or the form C-13 should be obtained from the applicant so far as can be furnished by him. If the<br />

applicant is the sender of the article, the receipt for the article granted to him at the time of posting<br />

of the article should also be obtained from him and the form together with the receipt should be<br />

forwarded in a closed cover without a forwarding letter to the Head of the <strong><strong>Post</strong>al</strong> Administration of<br />

the country in which the article originated. It should be borne in mind that in all cases in form C-<br />

12 or the form C-13 with enclosures is to be returned to the Administration from which the enquiry<br />

originated as quickly as possible and at the latest within 3 months (6 months in the case of distant<br />

countries) from the date of application for enquiry. No time should, therefore, be lost in<br />

completing such enquiries.<br />

(3) If the enquiry relates to a cash-on-delivery article it should also be accompanied by a<br />

duplicate of the M.O. form C-8 or by the transfer note as the case may be.<br />

II. If the enquiry relates to a foreign parcel and is made in accordance with the provisions<br />

of clause 230 (3) of the <strong>Post</strong> Office Guide Part I action should be taken as described in paragraphs<br />

(1) (2) and 1(3) above except that the enquiry form to be used in such cases will be the Union form<br />

C.P.-5, and that the latest period within which the enquiry form is to be returned is 6 months (9<br />

months in the case of distant countries pays elogues). The period of limitation mentioned in<br />

paragraph I is also applicable to enquiries in respect of parcels. Form C.P.-5 should, if necessary,<br />

be accompanied by the sender’s receipt for the posting of the parcel.<br />

NOTE 1. – A single enquiry fee is payable for enquiries concerning several registered<br />

articles posted simultaneously by the same sender to the address of the same addressee. This rule<br />

does not, however, apply in the case of registered articles posted in <strong>India</strong> and addressed to Aden,<br />

Ceylon and Portuguese <strong>India</strong><br />

NOTE 2.- If it is desired that the enquiry should be sent by air to a country to which<br />

surcharged air mail service exist, the sender will have to pay the initial rate of air mail fee for the<br />

country of destination.<br />

71-B. Procedure for dealing with complaints and enquiries relating to foreign postal<br />

articles. – 1. Complaints and enquiries may be received by offices in <strong>India</strong> in any of the following<br />

ways :-<br />

(i) in respect of an article booked in <strong>India</strong> for delivery in foreign country :-<br />

from the sender in <strong>India</strong><br />

(ii) in respect of article booked in foreign country for delivery in <strong>India</strong> :