27 February 2007 - Ordinary Meeting of Council (pdf. 14MB)

27 February 2007 - Ordinary Meeting of Council (pdf. 14MB)

27 February 2007 - Ordinary Meeting of Council (pdf. 14MB)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Ordinary</strong> <strong>Meeting</strong> <strong>of</strong> <strong>Council</strong> - <strong>27</strong> <strong>February</strong> <strong>2007</strong> 4 / 2<br />

Item 4<br />

S0<strong>27</strong>22<br />

13 <strong>February</strong> <strong>2007</strong><br />

PURPOSE OF REPORT<br />

To present to <strong>Council</strong> investment allocations, returns on investments and details <strong>of</strong> loan liabilities<br />

for January <strong>2007</strong>.<br />

BACKGROUND<br />

<strong>Council</strong>’s investments are made in accordance with the Local Government Act (1993), the Local<br />

Government (General) Regulation 2005 and <strong>Council</strong>’s Investment Policy which was adopted by<br />

<strong>Council</strong> on 18 July 2006 (Minute No. 254).<br />

This policy allows <strong>Council</strong> to utilise the expertise <strong>of</strong> external fund managers or make direct<br />

investments for the investment <strong>of</strong> <strong>Council</strong>’s surplus funds.<br />

COMMENTS<br />

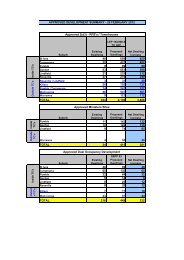

During the month <strong>of</strong> January, <strong>Council</strong> had a net cash outflow <strong>of</strong> $4,700,000 and gross interest and<br />

capital appreciation on <strong>Council</strong>’s investments was $269,000.<br />

<strong>Council</strong>’s total investment portfolio at the end <strong>of</strong> January <strong>2007</strong> is $46,459,400. This compares to an<br />

opening balance <strong>of</strong> $36,366,900 as at 1 July 2006.<br />

<strong>Council</strong>’s interest on investments for January year to date is $1,646,000 compared to a year to date<br />

budget <strong>of</strong> $1,612,000. This is a positive result as <strong>Council</strong> is achieving higher than expected rates <strong>of</strong><br />

returns on investments and is meeting budget despite funds from the sale <strong>of</strong> <strong>Council</strong>’s Depot not<br />

being received as anticipated.<br />

<strong>Council</strong>’s total debt as at 31 January <strong>2007</strong> stands at $10,299,200.<br />

PERFORMANCE MEASUREMENT<br />

<strong>Council</strong>’s investment portfolio is monitored and assessed based on the following criteria:<br />

• Management <strong>of</strong> General Fund Bank Balance<br />

The aim is to keep the general fund bank balance as low as possible and hence maximise the<br />

amount invested on a daily basis.<br />

• Performance against the UBS Bank Bill Index<br />

This measures the annualised yield (net <strong>of</strong> fees and charges) for each <strong>of</strong> <strong>Council</strong>’s portfolios.<br />

The weighted average return for the total portfolio <strong>of</strong> funds is compared to the industry<br />

benchmark <strong>of</strong> the UBS Bank Bill Index.<br />

N:\0702<strong>27</strong>-OMC-SR-03650-INVESTMENT LOAN LIABILIT.doc/athaide /2