- Page 1 and 2:

ORDINARY MEETING OF COUNCIL TO BE H

- Page 3 and 4:

GB.3 Policy on the Payment of Expen

- Page 5 and 6:

GB.10 Alcohol Free Zones 181 . File

- Page 7 and 8:

NM.3 Beechworth to Warragal Rezonin

- Page 9 and 10:

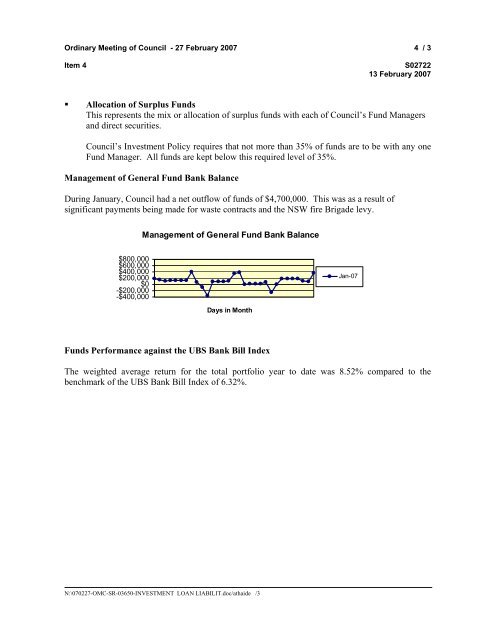

Ordinary Meeting of Council - 27 Fe

- Page 11 and 12:

Ordinary Meeting of Council - 27 Fe

- Page 13 and 14:

Ordinary Meeting of Council - 27 Fe

- Page 15 and 16:

Ordinary Meeting of Council - 27 Fe

- Page 17 and 18:

Ordinary Meeting of Council - 27 Fe

- Page 19 and 20:

Ordinary Meeting of Council - 27 Fe

- Page 21 and 22:

Ordinary Meeting of Council - 27 Fe

- Page 23 and 24:

Ordinary Meeting of Council - 27 Fe

- Page 25 and 26:

Ordinary Meeting of Council - 27 Fe

- Page 35 and 36:

Ordinary Meeting of Council - 27 Fe

- Page 37 and 38:

Ordinary Meeting of Council - 27 Fe

- Page 39 and 40:

Ordinary Meeting of Council - 27 Fe

- Page 41 and 42:

Ordinary Meeting of Council - 27 Fe

- Page 43 and 44:

Ordinary Meeting of Council - 27 Fe

- Page 45 and 46:

Ordinary Meeting of Council - 27 Fe

- Page 47 and 48:

Ordinary Meeting of Council - 27 Fe

- Page 49 and 50:

Ordinary Meeting of Council - 27 Fe

- Page 51 and 52:

Ordinary Meeting of Council - 27 Fe

- Page 53 and 54:

Ordinary Meeting of Council - 27 Fe

- Page 55 and 56:

Ordinary Meeting of Council - 27 Fe

- Page 57 and 58:

Ordinary Meeting of Council - 27 Fe

- Page 59 and 60:

Ordinary Meeting of Council - 27 Fe

- Page 61 and 62:

Ordinary Meeting of Council - 27 Fe

- Page 63 and 64:

Ordinary Meeting of Council - 27 Fe

- Page 65 and 66:

Ordinary Meeting of Council - 27 Fe

- Page 67 and 68:

Ordinary Meeting of Council - 27 Fe

- Page 69 and 70:

Ordinary Meeting of Council - 27 Fe

- Page 71 and 72:

Ordinary Meeting of Council - 27 Fe

- Page 73 and 74:

Ordinary Meeting of Council - 27 Fe

- Page 75 and 76:

Ordinary Meeting of Council - 27 Fe

- Page 77 and 78:

Ordinary Meeting of Council - 27 Fe

- Page 79 and 80:

Ordinary Meeting of Council - 27 Fe

- Page 81 and 82:

Ordinary Meeting of Council - 27 Fe

- Page 83 and 84:

Ordinary Meeting of Council - 27 Fe

- Page 85 and 86:

Ordinary Meeting of Council - 27 Fe

- Page 87 and 88:

Ordinary Meeting of Council - 27 Fe

- Page 89 and 90:

Ordinary Meeting of Council - 27 Fe

- Page 91 and 92:

Ordinary Meeting of Council - 27 Fe

- Page 116 and 117: Ordinary Meeting of Council - 27 Fe

- Page 118 and 119: Ordinary Meeting of Council - 27 Fe

- Page 120 and 121: Contents Page Part 1 Introduction 1

- Page 122 and 123: • Participation, equity and acces

- Page 124 and 125: (4) Within 28 days after adopting a

- Page 126 and 127: Part 2 PAYMENT OF EXPENSES GENERAL

- Page 128 and 129: Where applicable the standard of an

- Page 130 and 131: Council shall meet the following co

- Page 132 and 133: Travel Outside the Local Government

- Page 134 and 135: Legal Expenses and Obligations 2.11

- Page 136 and 137: Part 3 PROVISION OF FACILITIES GENE

- Page 138 and 139: Meals and Refreshments Prior to or

- Page 140 and 141: ADDITIONAL EQUIPMENT AND FACILITIES

- Page 142 and 143: Part 4 OTHER MATTERS Acquisition an

- Page 146 and 147: Ordinary Meeting of Council - 27 Fe

- Page 148 and 149: Ordinary Meeting of Council - 27 Fe

- Page 150 and 151: Ordinary Meeting of Council - 27 Fe

- Page 152 and 153: Ordinary Meeting of Council - 27 Fe

- Page 154 and 155: Ordinary Meeting of Council - 27 Fe

- Page 156 and 157: Ku-ring-gai Council Comparative Inf

- Page 158 and 159: Below is a summary of the aims and

- Page 160 and 161: • Domestic Waste per capita The p

- Page 162 and 163: Average Rate per Residential Assess

- Page 164 and 165: Outstanding Rates, Charges and Fees

- Page 166 and 167: Reliance on Rates Revenue Reliance

- Page 168 and 169: Dissection of Operating Expenses Th

- Page 170 and 171: Total Operating Expenses (per capit

- Page 172 and 173: Debt Service Ratio This indicator i

- Page 174 and 175: Library Operating Expenses This ind

- Page 176 and 177: Average Charge for Domestic Waste M

- Page 178 and 179: Recyclables - Kilograms (per capita

- Page 180 and 181: Number of Development Applications

- Page 182 and 183: Legal Expenses to Total Planning an

- Page 184 and 185: Net Recreation and Leisure Expenses

- Page 186 and 187: N S W DEPARTMENT OF LOCAL GOVERNMEN

- Page 188 and 189: Average Rate per Residential Assess

- Page 190 and 191: Total Operating Revenue (per capita

- Page 192 and 193: Debt Service Ratio 9.00% 8.00% 7.00

- Page 194 and 195:

Average Domestic Waste charge per R

- Page 196 and 197:

Number of Development Applications

- Page 198 and 199:

Net Recreation & Leisure Expenses (

- Page 200 and 201:

Ordinary Meeting of Council - 27 Fe

- Page 202 and 203:

Ordinary Meeting of Council - 27 Fe

- Page 204 and 205:

Ordinary Meeting of Council - 27 Fe

- Page 206 and 207:

No Date Lodged Appeal # Appellant P

- Page 208 and 209:

Subdivision 1 December 14, 2004 115

- Page 210 and 211:

Ordinary Meeting of Council - 27 Fe

- Page 212 and 213:

Ordinary Meeting of Council - 27 Fe

- Page 214 and 215:

2 The substation is listed on the S

- Page 217 and 218:

Ordinary Meeting of Council - 27 Fe

- Page 219 and 220:

Ordinary Meeting of Council - 27 Fe

- Page 221:

Ku-ring-gai Local Environmental Pla

- Page 226 and 227:

Ordinary Meeting of Council - 27 Fe

- Page 228:

Ordinary Meeting of Council - 27 Fe

- Page 232 and 233:

Ordinary Meeting of Council - 27 Fe

- Page 234 and 235:

Ordinary Meeting of Council - 27 Fe

- Page 236 and 237:

1 3 28 3 5 7 22 20 35 33 D PROPOSED

- Page 238 and 239:

From: Keiron Jeanes [mailto:jean1ke

- Page 240 and 241:

Ordinary Meeting of Council - 27 Fe

- Page 242 and 243:

Ordinary Meeting of Council - 27 Fe

- Page 244 and 245:

Ordinary Meeting of Council - 27 Fe

- Page 246 and 247:

Ordinary Meeting of Council - 27 Fe

- Page 248 and 249:

Ordinary Meeting of Council - 27 Fe

- Page 278 and 279:

Ordinary Meeting of Council - 27 Fe

- Page 280 and 281:

Ordinary Meeting of Council - 27 Fe

- Page 282 and 283:

Ordinary Meeting of Council - 27 Fe

- Page 284 and 285:

Ordinary Meeting of Council - 27 Fe

- Page 286 and 287:

Ordinary Meeting of Council - 27 Fe

- Page 288 and 289:

Appendix A: Summary Review Summary

- Page 290 and 291:

Department: COMMUNITY SERVICES CC R

- Page 292 and 293:

Department: PLANNING & ENVIRONMENT

- Page 294 and 295:

Department: TECHNICAL SERVICES CC R

- Page 296 and 297:

Department: FINANCE & BUSINESS CC R

- Page 298 and 299:

Department: FINANCE & BUSINESS CC R

- Page 300 and 301:

Department: DEVELOPMENT & REGULATIO

- Page 302:

Department: CAPITAL WORKS PN RC Tas

- Page 375 and 376:

Ordinary Meeting of Council - 27 Fe