27 February 2007 - Ordinary Meeting of Council (pdf. 14MB)

27 February 2007 - Ordinary Meeting of Council (pdf. 14MB)

27 February 2007 - Ordinary Meeting of Council (pdf. 14MB)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

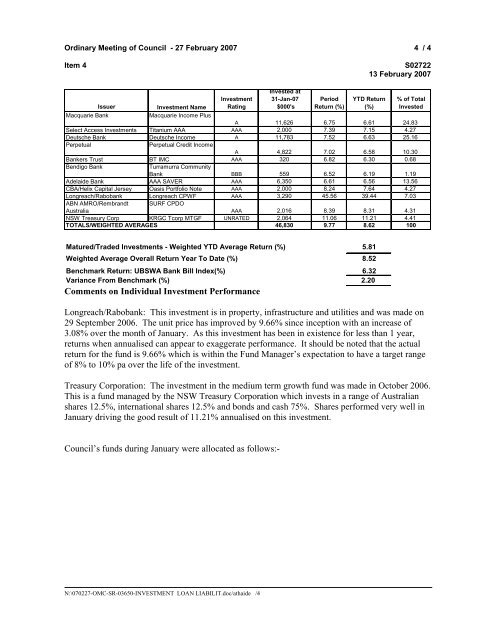

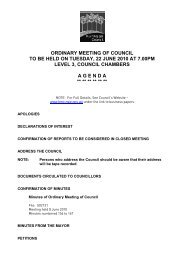

<strong>Ordinary</strong> <strong>Meeting</strong> <strong>of</strong> <strong>Council</strong> - <strong>27</strong> <strong>February</strong> <strong>2007</strong> 4 / 4<br />

Item 4<br />

S0<strong>27</strong>22<br />

13 <strong>February</strong> <strong>2007</strong><br />

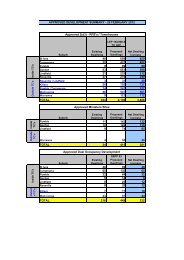

Investment<br />

Rating<br />

Invested at<br />

31-Jan-07<br />

$000's<br />

Period<br />

Return (%)<br />

YTD Return<br />

(%)<br />

% <strong>of</strong> Total<br />

Invested<br />

Issuer<br />

Investment Name<br />

Macquarie Bank<br />

Macquarie Income Plus<br />

A 11,626 6.75 6.61 24.83<br />

Select Access Investments Titanium AAA AAA 2,000 7.39 7.15 4.<strong>27</strong><br />

Deutsche Bank Deutsche Income A 11,783 7.52 6.63 25.16<br />

Perpetual<br />

Perpetual Credit Income<br />

A 4,822 7.02 6.58 10.30<br />

Bankers Trust BT IMC AAA 320 6.82 6.30 0.68<br />

Bendigo Bank<br />

Turramurra Community<br />

Bank BBB 559 6.52 6.19 1.19<br />

Adelaide Bank AAA SAVER AAA 6,350 6.61 6.56 13.56<br />

CBA/Helix Capital Jersey Oasis Portfolio Note AAA 2,000 8.24 7.64 4.<strong>27</strong><br />

Longreach/Rabobank Longreach CPWF AAA 3,290 45.56 39.44 7.03<br />

ABN AMRO/Rembrandt<br />

Australia<br />

SURF CPDO<br />

AAA 2,016 8.39 8.31 4.31<br />

NSW Treasury Corp KRGC Tcorp MTGF UNRATED 2,064 11.06 11.21 4.41<br />

TOTALS/WEIGHTED AVERAGES 46,830 9.77 8.62 100<br />

Matured/Traded Investments - Weighted YTD Average Return (%) 5.81<br />

Weighted Average Overall Return Year To Date (%) 8.52<br />

Benchmark Return: UBSWA Bank Bill Index(%) 6.32<br />

Variance From Benchmark (%) 2.20<br />

Comments on Individual Investment Performance<br />

Longreach/Rabobank: This investment is in property, infrastructure and utilities and was made on<br />

29 September 2006. The unit price has improved by 9.66% since inception with an increase <strong>of</strong><br />

3.08% over the month <strong>of</strong> January. As this investment has been in existence for less than 1 year,<br />

returns when annualised can appear to exaggerate performance. It should be noted that the actual<br />

return for the fund is 9.66% which is within the Fund Manager’s expectation to have a target range<br />

<strong>of</strong> 8% to 10% pa over the life <strong>of</strong> the investment.<br />

Treasury Corporation: The investment in the medium term growth fund was made in October 2006.<br />

This is a fund managed by the NSW Treasury Corporation which invests in a range <strong>of</strong> Australian<br />

shares 12.5%, international shares 12.5% and bonds and cash 75%. Shares performed very well in<br />

January driving the good result <strong>of</strong> 11.21% annualised on this investment.<br />

<strong>Council</strong>’s funds during January were allocated as follows:-<br />

N:\0702<strong>27</strong>-OMC-SR-03650-INVESTMENT LOAN LIABILIT.doc/athaide /4