Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

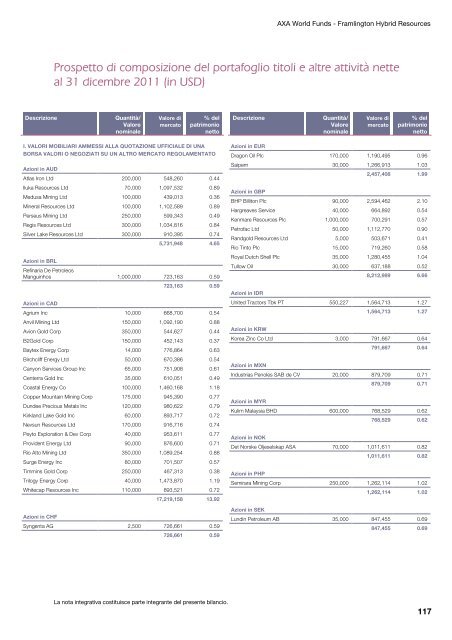

AXA World Funds - Framlington Hybrid Resources<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in USD)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

I. VALORI MOBILIARI AMMESSI ALLA QUOTAZIONE UFFICIALE DI UNA<br />

BORSA VALORI O NEGOZIATI SU UN ALTRO MERCATO REGOLAMENTATO<br />

Azioni in AUD<br />

Atlas Iron Ltd 200,000 548,260 0.44<br />

Iluka Resources Ltd 70,000 1,097,532 0.89<br />

Medusa Mining Ltd 100,000 439,013 0.36<br />

Mineral Resources Ltd 100,000 1,102,589 0.89<br />

Perseus Mining Ltd 250,000 599,343 0.49<br />

Regis Resources Ltd 300,000 1,034,816 0.84<br />

Silver Lake Resources Ltd 300,000 910,395 0.74<br />

5,731,948 4.65<br />

Azioni in BRL<br />

Refinaria De Petroleos<br />

Manguinhos 1,000,000 723,163 0.59<br />

723,163 0.59<br />

Azioni in CAD<br />

Agrium Inc 10,000 668,700 0.54<br />

Anvil Mining Ltd 150,000 1,092,190 0.88<br />

Avion Gold Corp 350,000 544,627 0.44<br />

B2Gold Corp 150,000 452,143 0.37<br />

Baytex Energy Corp 14,000 776,864 0.63<br />

Birchcliff Energy Ltd 50,000 670,386 0.54<br />

Canyon Services Group Inc 65,000 751,908 0.61<br />

Centerra Gold Inc 35,000 610,051 0.49<br />

Coastal Energy Co 100,000 1,460,168 1.18<br />

Copper Mountain Mining Corp 175,000 945,390 0.77<br />

Dundee Precious Metals Inc 120,000 980,622 0.79<br />

Kirkland Lake Gold Inc 60,000 893,717 0.72<br />

Nevsun Resources Ltd 170,000 916,716 0.74<br />

Peyto Exploration & Dev Corp 40,000 953,611 0.77<br />

Provident Energy Ltd 90,000 876,600 0.71<br />

Rio Alto Mining Ltd 350,000 1,089,254 0.88<br />

Surge Energy Inc 80,000 701,507 0.57<br />

Timmins Gold Corp 250,000 467,313 0.38<br />

Trilogy Energy Corp 40,000 1,473,870 1.19<br />

Whitecap Resources Inc 110,000 893,521 0.72<br />

17,219,158 13.92<br />

Azioni in CHF<br />

Syngenta AG 2,500 726,661 0.59<br />

726,661 0.59<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Azioni in EUR<br />

Dragon Oil Plc 170,000 1,190,495 0.96<br />

Saipem 30,000 1,266,913 1.03<br />

2,457,408 1.99<br />

Azioni in GBP<br />

BHP Billiton Plc 90,000 2,594,462 2.10<br />

Hargreaves Service 40,000 664,892 0.54<br />

Kenmare Resources Plc 1,000,000 700,291 0.57<br />

Petrofac Ltd 50,000 1,112,770 0.90<br />

Randgold Resources Ltd 5,000 503,671 0.41<br />

Rio Tinto Plc 15,000 719,260 0.58<br />

Royal Dutch Shell Plc 35,000 1,280,455 1.04<br />

Tullow Oil 30,000 637,188 0.52<br />

8,212,989 6.66<br />

Azioni in IDR<br />

United Tractors Tbk PT 550,227 1,564,713 1.27<br />

1,564,713 1.27<br />

Azioni in KRW<br />

Korea Zinc Co Ltd 3,000 791,667 0.64<br />

791,667 0.64<br />

Azioni in MXN<br />

Industrias Penoles SAB de CV 20,000 879,709 0.71<br />

879,709 0.71<br />

Azioni in MYR<br />

Kulim Malaysia BHD 600,000 768,529 0.62<br />

768,529 0.62<br />

Azioni in NOK<br />

Det Norske Oljeselskap ASA 70,000 1,011,611 0.82<br />

1,011,611 0.82<br />

Azioni in PHP<br />

Semirara Mining Corp 250,000 1,262,114 1.02<br />

1,262,114 1.02<br />

Azioni in SEK<br />

Lun<strong>di</strong>n Petroleum AB 35,000 847,455 0.69<br />

847,455 0.69<br />

117