Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

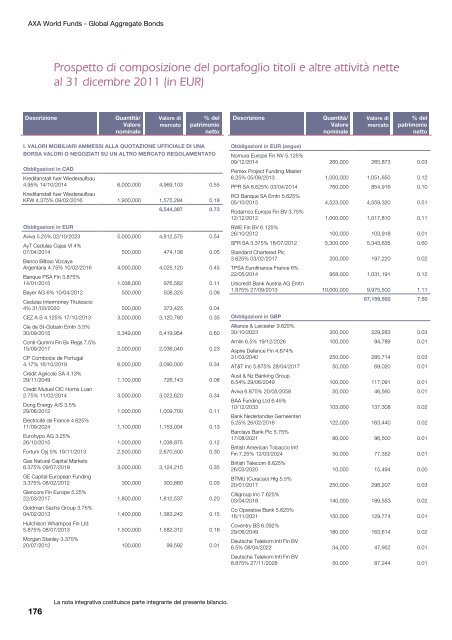

AXA World Funds - Global Aggregate Bonds<br />

176<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in EUR)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

I. VALORI MOBILIARI AMMESSI ALLA QUOTAZIONE UFFICIALE DI UNA<br />

BORSA VALORI O NEGOZIATI SU UN ALTRO MERCATO REGOLAMENTATO<br />

Obbligazioni in CAD<br />

Kre<strong>di</strong>tanstalt fuer Wiederaufbau<br />

4.95% 14/10/2014<br />

Kre<strong>di</strong>tanstalt fuer Wiederaufbau<br />

6,000,000 4,969,103 0.55<br />

KFW 4.375% 09/02/2016 1,900,000 1,575,284 0.18<br />

6,544,387 0.73<br />

Obbligazioni in EUR<br />

Aviva 5.25% 02/10/2023<br />

AyT Cedulas Cajas VI 4%<br />

5,000,000 4,812,575 0.54<br />

07/04/2014<br />

Banco Bilbao Vizcaya<br />

500,000 474,138 0.05<br />

Argentaria 4.75% 10/02/2016<br />

Banque PSA Fin 3.875%<br />

4,000,000 4,025,120 0.45<br />

14/01/2015 1,038,000 976,582 0.11<br />

Bayer AG 6% 10/04/2012<br />

Cedulas Intermoney Titulizacio<br />

500,000 506,325 0.06<br />

4% 31/03/2020 500,000 373,425 0.04<br />

CEZ A.S 4.125% 17/10/2013<br />

Cie de St-Gobain Emtn 3.5%<br />

3,000,000 3,120,780 0.35<br />

30/09/2015<br />

Conti-Gummi Fin Bv Regs 7.5%<br />

5,349,000 5,419,954 0.60<br />

15/09/2017<br />

CP Comboios de Portugal<br />

2,000,000 2,036,040 0.23<br />

4.17% 16/10/2019<br />

Cré<strong>di</strong>t Agricole SA 4.13%<br />

6,000,000 3,090,000 0.34<br />

29/11/2049<br />

Cre<strong>di</strong>t Mutuel CIC Home Loan<br />

1,100,000 726,143 0.08<br />

2.75% 11/02/2014<br />

Dong Energy A/S 3.5%<br />

3,000,000 3,022,620 0.34<br />

29/06/2012<br />

Electricité de France 4.625%<br />

1,000,000 1,009,700 0.11<br />

11/09/2024<br />

Eurohypo AG 3.25%<br />

1,100,000 1,153,004 0.13<br />

26/10/2015 1,000,000 1,038,875 0.12<br />

Fortum Oyj 5% 19/11/2013<br />

Gas Natural Capital Markets<br />

2,500,000 2,670,500 0.30<br />

6.375% 09/07/2019<br />

GE Capital European Fun<strong>di</strong>ng<br />

3,000,000 3,124,215 0.35<br />

3.375% 08/02/2012<br />

Glencore Fin Europe 5.25%<br />

300,000 300,880 0.03<br />

22/03/2017<br />

Goldman Sachs Group 3.75%<br />

1,800,000 1,812,537 0.20<br />

04/02/2013<br />

Hutchison Whampoa Fin Ltd<br />

1,400,000 1,383,242 0.15<br />

5.875% 08/07/2013<br />

Morgan Stanley 3.375%<br />

1,500,000 1,582,312 0.18<br />

20/07/2012 100,000 99,592 0.01<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Obbligazioni in EUR (segue)<br />

Nomura Europe Fin NV 5.125%<br />

09/12/2014<br />

Pemex Project Fun<strong>di</strong>ng Master<br />

260,000 265,873 0.03<br />

6.25% 05/08/2013 1,000,000 1,051,650 0.12<br />

PPR SA 8.625% 03/04/2014<br />

RCI Banque SA Emtn 5.625%<br />

760,000 854,916 0.10<br />

05/10/2015<br />

Rodamco Europe Fin BV 3.75%<br />

4,523,000 4,559,320 0.51<br />

12/12/2012<br />

RWE Fin BV 6.125%<br />

1,000,000 1,017,810 0.11<br />

26/10/2012 100,000 103,918 0.01<br />

SFR SA 3.375% 18/07/2012<br />

Standard Chartered Plc<br />

5,300,000 5,343,635 0.60<br />

3.625% 03/02/2017<br />

TPSA Eurofinance France 6%<br />

200,000 197,220 0.02<br />

22/05/2014<br />

Unicre<strong>di</strong>t Bank Austria AG Emtn<br />

958,000 1,031,191 0.12<br />

1.875% 27/09/2013 10,000,000 9,975,500 1.11<br />

67,159,592 7.50<br />

Obbligazioni in GBP<br />

Alliance & Leicester 9.625%<br />

30/10/2023 200,000 229,283 0.03<br />

Amlin 6.5% 19/12/2026<br />

Aspire Defence Fin 4.674%<br />

100,000 94,789 0.01<br />

31/03/2040 250,000 285,714 0.03<br />

AT&T Inc 5.875% 28/04/2017<br />

Aust & Nz Banking Group<br />

50,000 69,020 0.01<br />

6.54% 29/06/2049 100,000 117,091 0.01<br />

Aviva 6.875% 20/05/2058<br />

BAA Fun<strong>di</strong>ng Ltd 6.45%<br />

50,000 46,560 0.01<br />

10/12/2033<br />

Bank Nederlandse Gemeenten<br />

103,000 137,308 0.02<br />

5.25% 26/02/2016<br />

Barclays Bank Plc 5.75%<br />

122,000 163,440 0.02<br />

17/08/2021<br />

British American Tobacco Intl<br />

80,000 96,500 0.01<br />

Fin 7.25% 12/03/2024<br />

British Telecom 8.625%<br />

50,000 77,352 0.01<br />

26/03/2020<br />

BTMU (Curacao) Hlg 5.5%<br />

10,000 15,494 0.00<br />

20/01/2017<br />

Citigroup Inc 7.625%<br />

250,000 298,207 0.03<br />

03/04/2018<br />

Co Operative Bank 5.625%<br />

140,000 189,553 0.02<br />

16/11/2021<br />

Coventry BS 6.092%<br />

150,000 129,774 0.01<br />

29/06/2049<br />

Deutsche Telekom Intl Fin BV<br />

180,000 163,614 0.02<br />

6.5% 08/04/2022<br />

Deutsche Telekom Intl Fin BV<br />

34,000 47,952 0.01<br />

8.875% 27/11/2028 50,000 87,244 0.01