Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

AXA World Funds - Euro 7-10<br />

150<br />

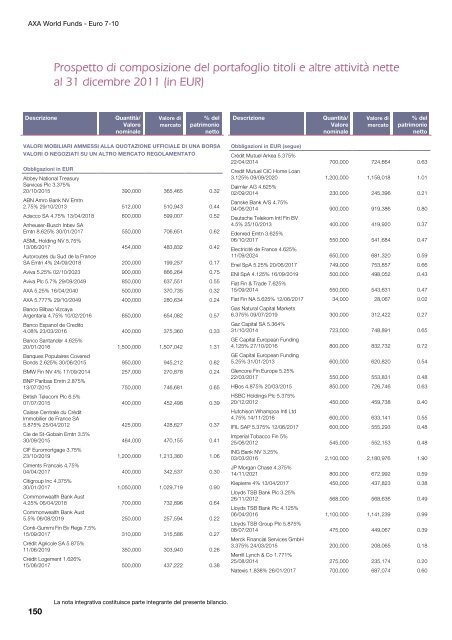

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in EUR)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

VALORI MOBILIARI AMMESSI ALLA QUOTAZIONE UFFICIALE DI UNA BORSA<br />

VALORI O NEGOZIATI SU UN ALTRO MERCATO REGOLAMENTATO<br />

Obbligazioni in EUR<br />

Abbey National Treasury<br />

Services Plc 3.375%<br />

20/10/2015<br />

ABN Amro Bank NV Emtn<br />

390,000 365,465 0.32<br />

2.75% 29/10/2013 512,000 510,943 0.44<br />

Adecco SA 4.75% 13/04/2018<br />

Anheuser-Busch Inbev SA<br />

600,000 599,007 0.52<br />

Emtn 8.625% 30/01/2017<br />

ASML Hol<strong>di</strong>ng NV 5.75%<br />

550,000 706,651 0.62<br />

13/06/2017<br />

Autoroutes du Sud de la France<br />

454,000 483,832 0.42<br />

SA Emtn 4% 24/09/2018 200,000 199,257 0.17<br />

Aviva 5.25% 02/10/2023 900,000 866,264 0.75<br />

Aviva Plc 5.7% 29/09/2049 850,000 637,551 0.55<br />

AXA 5.25% 16/04/2040 500,000 370,735 0.32<br />

AXA 5.777% 29/10/2049<br />

Banco Bilbao Vizcaya<br />

400,000 280,634 0.24<br />

Argentaria 4.75% 10/02/2016<br />

Banco Espanol de Cre<strong>di</strong>to<br />

650,000 654,082 0.57<br />

4.08% 23/03/2016<br />

Banco Santander 4.625%<br />

400,000 375,360 0.33<br />

20/01/2016<br />

Banques Populaires Covered<br />

1,500,000 1,507,042 1.31<br />

Bonds 2.625% 30/06/2015 950,000 945,212 0.82<br />

BMW Fin NV 4% 17/09/2014<br />

BNP Paribas Emtn 2.875%<br />

257,000 270,878 0.24<br />

13/07/2015<br />

British Telecom Plc 6.5%<br />

750,000 746,681 0.65<br />

07/07/2015<br />

Caisse Centrale du Cré<strong>di</strong>t<br />

Immobilier de France SA<br />

400,000 452,498 0.39<br />

5.875% 25/04/2012<br />

Cie de St-Gobain Emtn 3.5%<br />

425,000 428,627 0.37<br />

30/09/2015<br />

CIF Euromortgage 3.75%<br />

464,000 470,155 0.41<br />

23/10/2019<br />

Ciments Francais 4.75%<br />

1,200,000 1,213,380 1.06<br />

04/04/2017<br />

Citigroup Inc 4.375%<br />

400,000 342,537 0.30<br />

30/01/2017<br />

Commonwealth Bank Aust<br />

1,050,000 1,029,719 0.90<br />

4.25% 06/04/2018<br />

Commonwealth Bank Aust<br />

700,000 732,896 0.64<br />

5.5% 06/08/2019<br />

Conti-Gummi Fin Bv Regs 7.5%<br />

250,000 257,594 0.22<br />

15/09/2017<br />

Cré<strong>di</strong>t Agricole SA 5.875%<br />

310,000 315,586 0.27<br />

11/06/2019<br />

Cré<strong>di</strong>t Logement 1.626%<br />

350,000 303,940 0.26<br />

15/06/2017 500,000 437,222 0.38<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Obbligazioni in EUR (segue)<br />

Cré<strong>di</strong>t Mutuel Arkea 5.375%<br />

22/04/2014<br />

Cre<strong>di</strong>t Mutuel CIC Home Loan<br />

700,000 724,664 0.63<br />

3.125% 09/09/2020<br />

Daimler AG 4.625%<br />

1,200,000 1,158,018 1.01<br />

02/09/2014<br />

Danske Bank A/S 4.75%<br />

230,000 245,396 0.21<br />

04/06/2014<br />

Deutsche Telekom Intl Fin BV<br />

900,000 919,386 0.80<br />

4.5% 25/10/2013<br />

Edenred Emtn 3.625%<br />

400,000 419,920 0.37<br />

06/10/2017<br />

Electricité de France 4.625%<br />

550,000 541,684 0.47<br />

11/09/2024 650,000 681,320 0.59<br />

Enel SpA 5.25% 20/06/2017 749,000 753,857 0.66<br />

ENI SpA 4.125% 16/09/2019<br />

Fiat Fin & Trade 7.625%<br />

500,000 498,052 0.43<br />

15/09/2014 550,000 543,631 0.47<br />

Fiat Fin NA 5.625% 12/06/2017<br />

Gas Natural Capital Markets<br />

34,000 28,067 0.02<br />

6.375% 09/07/2019<br />

Gaz Capital SA 5.364%<br />

300,000 312,422 0.27<br />

31/10/2014<br />

GE Capital European Fun<strong>di</strong>ng<br />

723,000 748,891 0.65<br />

4.125% 27/10/2016<br />

GE Capital European Fun<strong>di</strong>ng<br />

800,000 832,732 0.72<br />

5.25% 31/01/2013<br />

Glencore Fin Europe 5.25%<br />

600,000 620,820 0.54<br />

22/03/2017 550,000 553,831 0.48<br />

HBos 4.875% 20/03/2015<br />

HSBC Hol<strong>di</strong>ngs Plc 5.375%<br />

850,000 726,746 0.63<br />

20/12/2012<br />

Hutchison Whampoa Intl Ltd<br />

450,000 459,738 0.40<br />

4.75% 14/11/2016 600,000 633,141 0.55<br />

IFIL SAP 5.375% 12/06/2017<br />

Imperial Tobacco Fin 5%<br />

600,000 555,293 0.48<br />

25/06/2012<br />

ING Bank NV 3.25%<br />

545,000 552,153 0.48<br />

03/03/2016<br />

JP Morgan Chase 4.375%<br />

2,100,000 2,180,976 1.90<br />

14/11/2021 800,000 672,992 0.59<br />

Klepierre 4% 13/04/2017<br />

Lloyds TSB Bank Plc 3.25%<br />

450,000 437,823 0.38<br />

26/11/2012<br />

Lloyds TSB Bank Plc 4.125%<br />

568,000 568,636 0.49<br />

06/04/2016<br />

Lloyds TSB Group Plc 5.875%<br />

1,100,000 1,141,239 0.99<br />

08/07/2014<br />

Merck Financial Services GmbH<br />

475,000 449,067 0.39<br />

3.375% 24/03/2015<br />

Merrill Lynch & Co 1.771%<br />

200,000 208,065 0.18<br />

25/08/2014 275,000 235,174 0.20<br />

Natexis 1.838% 26/01/2017 700,000 687,074 0.60