Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

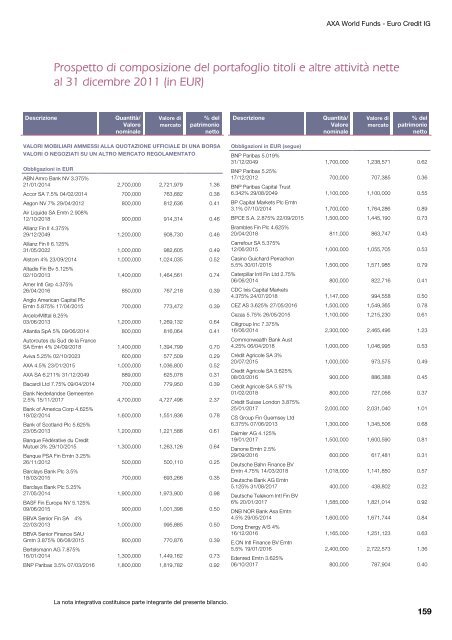

AXA World Funds - Euro Cre<strong>di</strong>t IG<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in EUR)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

VALORI MOBILIARI AMMESSI ALLA QUOTAZIONE UFFICIALE DI UNA BORSA<br />

VALORI O NEGOZIATI SU UN ALTRO MERCATO REGOLAMENTATO<br />

Obbligazioni in EUR<br />

ABN Amro Bank NV 3.375%<br />

21/01/2014 2,700,000 2,721,979 1.36<br />

Accor SA 7.5% 04/02/2014 700,000 763,682 0.38<br />

Aegon NV 7% 29/04/2012<br />

Air Liquide SA Emtn 2.908%<br />

800,000 812,636 0.41<br />

12/10/2018<br />

Allianz Fin II 4.375%<br />

900,000 914,314 0.46<br />

29/12/2049<br />

Allianz Fin II 6.125%<br />

1,200,000 908,730 0.46<br />

31/05/2022 1,000,000 982,605 0.49<br />

Alstom 4% 23/09/2014<br />

Alta<strong>di</strong>s Fin Bv 5.125%<br />

1,000,000 1,024,035 0.52<br />

02/10/2013<br />

Amer Intl Grp 4.375%<br />

1,400,000 1,464,561 0.74<br />

26/04/2016<br />

Anglo American Capital Plc<br />

850,000 767,218 0.39<br />

Emtn 5.875% 17/04/2015<br />

ArcelorMittal 8.25%<br />

700,000 773,472 0.39<br />

03/06/2013 1,200,000 1,269,132 0.64<br />

Atlantia SpA 5% 09/06/2014<br />

Autoroutes du Sud de la France<br />

800,000 816,064 0.41<br />

SA Emtn 4% 24/09/2018 1,400,000 1,394,799 0.70<br />

Aviva 5.25% 02/10/2023 600,000 577,509 0.29<br />

AXA 4.5% 23/01/2015 1,000,000 1,036,800 0.52<br />

AXA SA 6.211% 31/12/2049 889,000 625,078 0.31<br />

Bacar<strong>di</strong> Ltd 7.75% 09/04/2014<br />

Bank Nederlandse Gemeenten<br />

700,000 779,950 0.39<br />

2.5% 15/11/2017<br />

Bank of America Corp 4.625%<br />

4,700,000 4,727,496 2.37<br />

18/02/2014<br />

Bank of Scotland Plc 5.625%<br />

1,600,000 1,551,936 0.78<br />

23/05/2013<br />

Banque Fédérative du Cre<strong>di</strong>t<br />

1,200,000 1,221,588 0.61<br />

Mutuel 3% 29/10/2015<br />

Banque PSA Fin Emtn 3.25%<br />

1,300,000 1,263,126 0.64<br />

26/11/2012<br />

Barclays Bank Plc 3.5%<br />

500,000 500,110 0.25<br />

18/03/2015<br />

Barclays Bank Plc 5.25%<br />

700,000 693,266 0.35<br />

27/05/2014<br />

BASF Fin Europe NV 5.125%<br />

1,900,000 1,973,900 0.98<br />

09/06/2015<br />

BBVA Senior Fin SA 4%<br />

900,000 1,001,398 0.50<br />

22/03/2013<br />

BBVA Senior Finance SAU<br />

1,000,000 995,885 0.50<br />

Gmtn 3.875% 06/08/2015<br />

Bertelsmann AG 7.875%<br />

800,000 770,876 0.39<br />

16/01/2014 1,300,000 1,449,162 0.73<br />

BNP Paribas 3.5% 07/03/2016 1,800,000 1,819,782 0.92<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Obbligazioni in EUR (segue)<br />

BNP Paribas 5.019%<br />

31/12/2049<br />

BNP Paribas 5.25%<br />

1,700,000 1,238,571 0.62<br />

17/12/2012<br />

BNP Paribas Capital Trust<br />

700,000 707,385 0.36<br />

6.342% 29/08/2049<br />

BP Capital Markets Plc Emtn<br />

1,100,000 1,100,000 0.55<br />

3.1% 07/10/2014 1,700,000 1,764,286 0.89<br />

BPCE S.A. 2.875% 22/09/2015<br />

Brambles Fin Plc 4.625%<br />

1,500,000 1,445,190 0.73<br />

20/04/2018<br />

Carrefour SA 5.375%<br />

811,000 863,747 0.43<br />

12/06/2015<br />

Casino Guichard Perrachon<br />

1,000,000 1,055,705 0.53<br />

5.5% 30/01/2015<br />

Caterpillar Intl Fin Ltd 2.75%<br />

1,500,000 1,571,985 0.79<br />

06/06/2014<br />

CDC Ixis Capital Markets<br />

800,000 822,716 0.41<br />

4.375% 24/07/2018 1,147,000 994,558 0.50<br />

CEZ AS 3.625% 27/05/2016 1,500,000 1,549,365 0.78<br />

Cezas 5.75% 26/05/2015<br />

Citigroup Inc 7.375%<br />

1,100,000 1,215,230 0.61<br />

16/06/2014<br />

Commonwealth Bank Aust<br />

2,300,000 2,465,496 1.23<br />

4.25% 06/04/2018<br />

Cré<strong>di</strong>t Agricole SA 3%<br />

1,000,000 1,046,995 0.53<br />

20/07/2015<br />

Cre<strong>di</strong>t Agricole SA 3.625%<br />

1,000,000 973,575 0.49<br />

08/03/2016<br />

Cré<strong>di</strong>t Agricole SA 5.971%<br />

900,000 886,388 0.45<br />

01/02/2018<br />

Cré<strong>di</strong>t Suisse London 3.875%<br />

800,000 727,056 0.37<br />

25/01/2017<br />

CS Group Fin Guernsey Ltd<br />

2,000,000 2,031,040 1.01<br />

6.375% 07/06/2013<br />

Daimler AG 4.125%<br />

1,300,000 1,345,506 0.68<br />

19/01/2017<br />

Danone Emtn 2.5%<br />

1,500,000 1,600,590 0.81<br />

29/09/2016<br />

Deutsche Bahn Finance BV<br />

600,000 617,481 0.31<br />

Emtn 4.75% 14/03/2018<br />

Deutsche Bank AG Emtn<br />

1,018,000 1,141,850 0.57<br />

5.125% 31/08/2017<br />

Deutsche Telekom Intl Fin BV<br />

400,000 438,802 0.22<br />

6% 20/01/2017<br />

DNB NOR Bank Asa Emtn<br />

1,585,000 1,821,014 0.92<br />

4.5% 29/05/2014<br />

Dong Energy A/S 4%<br />

1,600,000 1,671,744 0.84<br />

16/12/2016<br />

E.ON Intl Finance BV Emtn<br />

1,165,000 1,251,123 0.63<br />

5.5% 19/01/2016<br />

Edenred Emtn 3.625%<br />

2,400,000 2,722,573 1.36<br />

06/10/2017 800,000 787,904 0.40<br />

159