Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

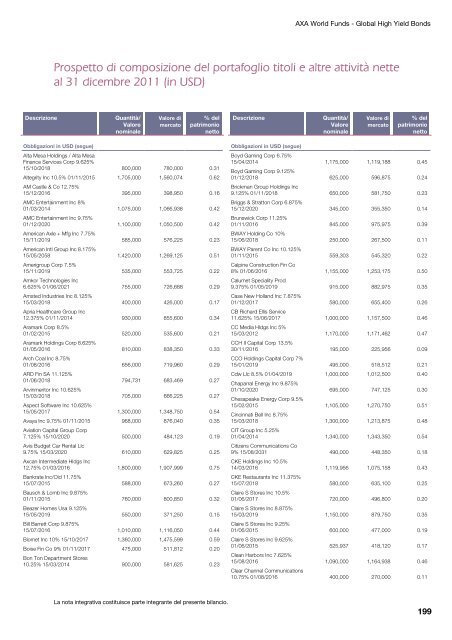

AXA World Funds - Global High Yield Bonds<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in USD)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Obbligazioni in USD (segue)<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Alta Mesa Hol<strong>di</strong>ngs / Alta Mesa<br />

Finance Services Corp 9.625%<br />

15/10/2018 800,000 780,000 0.31<br />

Altegrity Inc 10.5% 01/11/2015<br />

AM Castle & Co 12.75%<br />

1,705,000 1,560,074 0.62<br />

15/12/2016<br />

AMC Entertainment Inc 8%<br />

395,000 398,950 0.16<br />

01/03/2014<br />

AMC Entertainment Inc 9.75%<br />

1,075,000 1,066,938 0.42<br />

01/12/2020<br />

American Axle + Mfg Inc 7.75%<br />

1,100,000 1,050,500 0.42<br />

15/11/2019<br />

American Intl Group Inc 8.175%<br />

585,000 576,225 0.23<br />

15/05/2058<br />

Amerigroup Corp 7.5%<br />

1,420,000 1,269,125 0.51<br />

15/11/2019<br />

Amkor Technologies Inc<br />

535,000 553,725 0.22<br />

6.625% 01/06/2021<br />

Amsted Industries Inc 8.125%<br />

755,000 726,688 0.29<br />

15/03/2018<br />

Apria Healthcare Group Inc<br />

400,000 426,000 0.17<br />

12.375% 01/11/2014<br />

Aramark Corp 8.5%<br />

930,000 855,600 0.34<br />

01/02/2015<br />

Aramark Hol<strong>di</strong>ngs Corp 8.625%<br />

520,000 535,600 0.21<br />

01/05/2016<br />

Arch Coal Inc 8.75%<br />

810,000 838,350 0.33<br />

01/08/2016<br />

ARD Fin SA 11.125%<br />

656,000 719,960 0.29<br />

01/06/2018<br />

Arvinmeritor Inc 10.625%<br />

794,731 683,469 0.27<br />

15/03/2018<br />

Aspect Software Inc 10.625%<br />

705,000 666,225 0.27<br />

15/05/2017 1,300,000 1,348,750 0.54<br />

Avaya Inc 9.75% 01/11/2015<br />

Aviation Capital Group Corp<br />

968,000 876,040 0.35<br />

7.125% 15/10/2020<br />

Avis Budget Car Rental Llc<br />

500,000 484,123 0.19<br />

9.75% 15/03/2020<br />

Axcan Interme<strong>di</strong>ate Hldgs Inc<br />

610,000 629,825 0.25<br />

12.75% 01/03/2016<br />

Bankrate Inc/Old 11.75%<br />

1,800,000 1,907,999 0.75<br />

15/07/2015<br />

Bausch & Lomb Inc 9.875%<br />

588,000 673,260 0.27<br />

01/11/2015<br />

Beazer Homes Usa 9.125%<br />

760,000 800,850 0.32<br />

15/05/2019<br />

Bill Barrett Corp 9.875%<br />

550,000 371,250 0.15<br />

15/07/2016 1,010,000 1,116,050 0.44<br />

Biomet Inc 10% 15/10/2017 1,360,000 1,475,599 0.59<br />

Boise Fin Co 9% 01/11/2017<br />

Bon Ton Department Stores<br />

475,000 511,812 0.20<br />

10.25% 15/03/2014 900,000 581,625 0.23<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Obbligazioni in USD (segue)<br />

Boyd Gaming Corp 6.75%<br />

15/04/2014<br />

Boyd Gaming Corp 9.125%<br />

1,175,000 1,119,188 0.45<br />

01/12/2018<br />

Brickman Group Hol<strong>di</strong>ngs Inc<br />

625,000 596,875 0.24<br />

9.125% 01/11/2018<br />

Briggs & Stratton Corp 6.875%<br />

650,000 581,750 0.23<br />

15/12/2020<br />

Brunswick Corp 11.25%<br />

345,000 355,350 0.14<br />

01/11/2016<br />

BWAY Hol<strong>di</strong>ng Co 10%<br />

845,000 975,975 0.39<br />

15/06/2018<br />

BWAY Parent Co Inc 10.125%<br />

250,000 267,500 0.11<br />

01/11/2015<br />

Calpine Construction Fin Co<br />

559,303 545,320 0.22<br />

8% 01/06/2016<br />

Calumet Speciality Prod<br />

1,155,000 1,253,175 0.50<br />

9.375% 01/05/2019<br />

Case New Holland Inc 7.875%<br />

915,000 882,975 0.35<br />

01/12/2017<br />

CB Richard Ellis Service<br />

580,000 655,400 0.26<br />

11.625% 15/06/2017<br />

CC Me<strong>di</strong>a Hldgs Inc 5%<br />

1,000,000 1,157,500 0.46<br />

15/03/2012<br />

CCH II Capital Corp 13.5%<br />

1,170,000 1,171,462 0.47<br />

30/11/2016<br />

CCO Hol<strong>di</strong>ngs Capital Corp 7%<br />

195,000 225,956 0.09<br />

15/01/2019 495,000 518,512 0.21<br />

Cdw Llc 8.5% 01/04/2019<br />

Chaparral Energy Inc 9.875%<br />

1,000,000 1,012,500 0.40<br />

01/10/2020<br />

Chesapeake Energy Corp 9.5%<br />

695,000 747,125 0.30<br />

15/02/2015<br />

Cincinnati Bell Inc 8.75%<br />

1,105,000 1,270,750 0.51<br />

15/03/2018<br />

CIT Group Inc 5.25%<br />

1,300,000 1,213,875 0.48<br />

01/04/2014<br />

Citizens Communications Co<br />

1,340,000 1,343,350 0.54<br />

9% 15/08/2031<br />

CKE Hol<strong>di</strong>ngs Inc 10.5%<br />

490,000 448,350 0.18<br />

14/03/2016<br />

CKE Restaurants Inc 11.375%<br />

1,119,956 1,075,158 0.43<br />

15/07/2018<br />

Claire S Stores Inc 10.5%<br />

580,000 635,100 0.25<br />

01/06/2017<br />

Claire S Stores Inc 8.875%<br />

720,000 496,800 0.20<br />

15/03/2019<br />

Claire S Stores Inc 9.25%<br />

1,150,000 879,750 0.35<br />

01/06/2015<br />

Claire S Stores Inc 9.625%<br />

600,000 477,000 0.19<br />

01/06/2015<br />

Clean Harbors Inc 7.625%<br />

525,937 418,120 0.17<br />

15/08/2016<br />

Clear Channel Communications<br />

1,090,000 1,164,938 0.46<br />

10.75% 01/08/2016 400,000 270,000 0.11<br />

199