Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

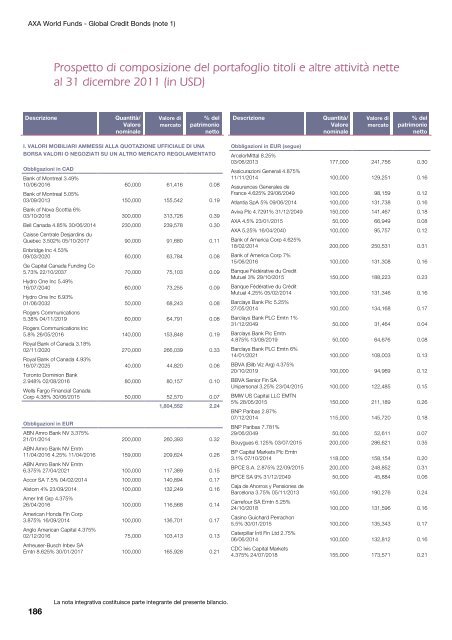

AXA World Funds - Global Cre<strong>di</strong>t Bonds (note 1)<br />

186<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in USD)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

I. VALORI MOBILIARI AMMESSI ALLA QUOTAZIONE UFFICIALE DI UNA<br />

BORSA VALORI O NEGOZIATI SU UN ALTRO MERCATO REGOLAMENTATO<br />

Obbligazioni in CAD<br />

Bank of Montreal 3.49%<br />

10/06/2016<br />

Bank of Montreal 5.05%<br />

60,000 61,416 0.08<br />

03/09/2013<br />

Bank of Nova Scottia 6%<br />

150,000 155,542 0.19<br />

03/10/2018 300,000 313,726 0.39<br />

Bell Canada 4.85% 30/06/2014<br />

Caisse Centrale Desjar<strong>di</strong>ns du<br />

230,000 239,578 0.30<br />

Quebec 3.502% 05/10/2017<br />

Enbridge Inc 4.53%<br />

90,000 91,680 0.11<br />

09/03/2020<br />

Ge Capital Canada Fun<strong>di</strong>ng Co<br />

60,000 63,784 0.08<br />

5.73% 22/10/2037<br />

Hydro One Inc 5.49%<br />

70,000 75,103 0.09<br />

16/07/2040<br />

Hydro One Inc 6.93%<br />

60,000 73,255 0.09<br />

01/06/2032<br />

Rogers Communications<br />

50,000 68,243 0.08<br />

5.38% 04/11/2019<br />

Rogers Communications Inc<br />

60,000 64,791 0.08<br />

5.8% 26/05/2016<br />

Royal Bank of Canada 3.18%<br />

140,000 153,848 0.19<br />

02/11/2020<br />

Royal Bank of Canada 4.93%<br />

270,000 266,039 0.33<br />

16/07/2025<br />

Toronto Dominion Bank<br />

40,000 44,820 0.06<br />

2.948% 02/08/2016<br />

Wells Fargo Financial Canada<br />

80,000 80,157 0.10<br />

Corp 4.38% 30/06/2015 50,000 52,570 0.07<br />

1,804,552 2.24<br />

Obbligazioni in EUR<br />

ABN Amro Bank NV 3.375%<br />

21/01/2014<br />

ABN Amro Bank NV Emtn<br />

200,000 260,393 0.32<br />

11/04/2016 4.25% 11/04/2016<br />

ABN Amro Bank NV Emtn<br />

159,000 209,624 0.26<br />

6.375% 27/04/2021 100,000 117,389 0.15<br />

Accor SA 7.5% 04/02/2014 100,000 140,894 0.17<br />

Alstom 4% 23/09/2014<br />

Amer Intl Grp 4.375%<br />

100,000 132,249 0.16<br />

26/04/2016<br />

American Honda Fin Corp<br />

100,000 116,568 0.14<br />

3.875% 16/09/2014<br />

Anglo American Capital 4.375%<br />

100,000 136,701 0.17<br />

02/12/2016<br />

Anheuser-Busch Inbev SA<br />

75,000 103,413 0.13<br />

Emtn 8.625% 30/01/2017 100,000 165,928 0.21<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Obbligazioni in EUR (segue)<br />

ArcelorMittal 8.25%<br />

03/06/2013<br />

Assicurazioni Generali 4.875%<br />

177,000 241,756 0.30<br />

11/11/2014<br />

Assurances Generales de<br />

100,000 129,251 0.16<br />

France 4.625% 29/06/2049 100,000 98,159 0.12<br />

Atlantia SpA 5% 09/06/2014 100,000 131,738 0.16<br />

Aviva Plc 4.7291% 31/12/2049 150,000 141,467 0.18<br />

AXA 4.5% 23/01/2015 50,000 66,949 0.08<br />

AXA 5.25% 16/04/2040<br />

Bank of America Corp 4.625%<br />

100,000 95,757 0.12<br />

18/02/2014<br />

Bank of America Corp 7%<br />

200,000 250,531 0.31<br />

15/06/2016<br />

Banque Fédérative du Cre<strong>di</strong>t<br />

100,000 131,308 0.16<br />

Mutuel 3% 29/10/2015<br />

Banque Fédérative du Cré<strong>di</strong>t<br />

150,000 188,223 0.23<br />

Mutuel 4.25% 05/02/2014<br />

Barclays Bank Plc 5.25%<br />

100,000 131,346 0.16<br />

27/05/2014<br />

Barclays Bank PLC Emtn 1%<br />

100,000 134,168 0.17<br />

31/12/2049<br />

Barclays Bank Plc Emtn<br />

50,000 31,464 0.04<br />

4.875% 13/08/2019<br />

Barclays Bank PLC Emtn 6%<br />

50,000 64,676 0.08<br />

14/01/2021<br />

BBVA (Bilb Viz Arg) 4.375%<br />

100,000 108,003 0.13<br />

20/10/2019<br />

BBVA Senior Fin SA<br />

100,000 94,969 0.12<br />

Unipersonal 3.25% 23/04/2015<br />

BMW US Capital LLC EMTN<br />

100,000 122,485 0.15<br />

5% 28/05/2015<br />

BNP Paribas 2.87%<br />

150,000 211,189 0.26<br />

07/12/2014<br />

BNP Paribas 7.781%<br />

115,000 145,720 0.18<br />

29/06/2049 50,000 52,611 0.07<br />

Bouygues 6.125% 03/07/2015<br />

BP Capital Markets Plc Emtn<br />

200,000 286,621 0.35<br />

3.1% 07/10/2014 118,000 158,154 0.20<br />

BPCE S.A. 2.875% 22/09/2015 200,000 248,852 0.31<br />

BPCE SA 9% 31/12/2049<br />

Caja de Ahorros y Pensiones de<br />

50,000 45,884 0.06<br />

Barcelona 3.75% 05/11/2013<br />

Carrefour SA Emtn 5.25%<br />

150,000 190,276 0.24<br />

24/10/2018<br />

Casino Guichard Perrachon<br />

100,000 131,596 0.16<br />

5.5% 30/01/2015<br />

Caterpillar Intl Fin Ltd 2.75%<br />

100,000 135,343 0.17<br />

06/06/2014<br />

CDC Ixis Capital Markets<br />

100,000 132,812 0.16<br />

4.375% 24/07/2018 155,000 173,571 0.21