Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

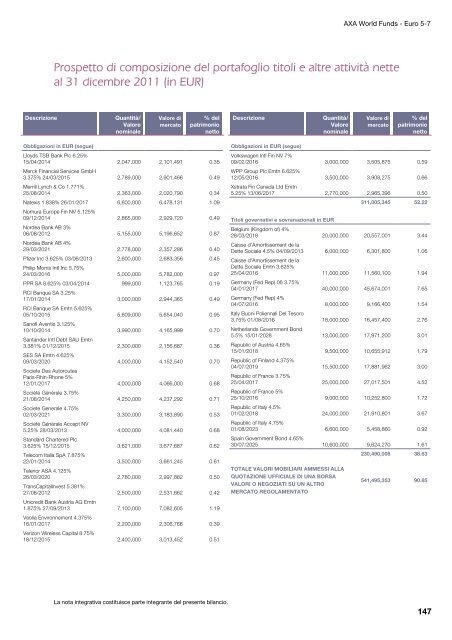

AXA World Funds - Euro 5-7<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in EUR)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Obbligazioni in EUR (segue)<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Lloyds TSB Bank Plc 6.25%<br />

15/04/2014<br />

Merck Financial Services GmbH<br />

2,047,000 2,101,491 0.35<br />

3.375% 24/03/2015<br />

Merrill Lynch & Co 1.771%<br />

2,789,000 2,901,466 0.49<br />

25/08/2014 2,363,000 2,020,790 0.34<br />

Natexis 1.838% 26/01/2017<br />

Nomura Europe Fin NV 5.125%<br />

6,600,000 6,478,131 1.09<br />

09/12/2014<br />

Nordea Bank AB 3%<br />

2,865,000 2,929,720 0.49<br />

06/08/2012<br />

Nordea Bank AB 4%<br />

5,155,000 5,196,652 0.87<br />

29/03/2021 2,778,000 2,357,286 0.40<br />

Pfizer Inc 3.625% 03/06/2013<br />

Philip Morris Intl Inc 5.75%<br />

2,600,000 2,683,356 0.45<br />

24/03/2016 5,000,000 5,782,000 0.97<br />

PPR SA 8.625% 03/04/2014<br />

RCI Banque SA 3.25%<br />

999,000 1,123,765 0.19<br />

17/01/2014<br />

RCI Banque SA Emtn 5.625%<br />

3,000,000 2,944,365 0.49<br />

05/10/2015<br />

Sanofi Aventis 3.125%<br />

5,609,000 5,654,040 0.95<br />

10/10/2014<br />

Santander Intl Debt SAU Emtn<br />

3,990,000 4,165,999 0.70<br />

3.381% 01/12/2015<br />

SES SA Emtn 4.625%<br />

2,300,000 2,156,687 0.36<br />

09/03/2020<br />

Societe Des Autoroutes<br />

Paris-Rhin-Rhone 5%<br />

4,000,000 4,152,540 0.70<br />

12/01/2017<br />

Société Générale 3.75%<br />

4,000,000 4,066,000 0.68<br />

21/08/2014<br />

Societe Generale 4.75%<br />

4,250,000 4,237,292 0.71<br />

02/03/2021<br />

Société Générale Accept NV<br />

3,300,000 3,183,890 0.53<br />

5.25% 28/03/2013<br />

Standard Chartered Plc<br />

4,000,000 4,081,440 0.68<br />

3.625% 15/12/2015<br />

Telecom Italia SpA 7.875%<br />

3,621,000 3,677,687 0.62<br />

22/01/2014<br />

Telenor ASA 4.125%<br />

3,500,000 3,661,245 0.61<br />

26/03/2020<br />

TransCapitalInvest 5.381%<br />

2,780,000 2,997,882 0.50<br />

27/06/2012<br />

Unicre<strong>di</strong>t Bank Austria AG Emtn<br />

2,500,000 2,531,662 0.42<br />

1.875% 27/09/2013<br />

Veolia Environnement 4.375%<br />

7,100,000 7,082,605 1.19<br />

16/01/2017<br />

Verizon Wireless Capital 8.75%<br />

2,200,000 2,306,766 0.39<br />

18/12/2015 2,400,000 3,013,452 0.51<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Obbligazioni in EUR (segue)<br />

Volkswagen Intl Fin NV 7%<br />

09/02/2016<br />

WPP Group Plc Emtn 6.625%<br />

3,000,000 3,505,875 0.59<br />

12/05/2016<br />

Xstrata Fin Canada Ltd Emtn<br />

3,500,000 3,908,275 0.66<br />

5.25% 13/06/2017 2,770,000 2,965,396 0.50<br />

311,005,345 52.22<br />

Titoli governativi e sovranazionali in EUR<br />

Belgium (Kingdom of) 4%<br />

28/03/2018<br />

Caisse d'Amortissement de la<br />

20,000,000 20,557,001 3.44<br />

Dette Sociale 4.5% 04/09/2013<br />

Caisse d'Amortissement de la<br />

Dette Sociale Emtn 3.625%<br />

6,000,000 6,301,800 1.06<br />

25/04/2016<br />

Germany (Fed Rep) 06 3.75%<br />

11,000,000 11,560,100 1.94<br />

04/01/2017<br />

Germany (Fed Rep) 4%<br />

40,000,000 45,674,001 7.65<br />

04/07/2016<br />

Italy Buoni Poliennali Del Tesoro<br />

8,000,000 9,166,400 1.54<br />

3.75% 01/08/2016<br />

Netherlands Government Bond<br />

18,000,000 16,457,400 2.76<br />

5.5% 15/01/2028<br />

Republic of Austria 4.65%<br />

13,000,000 17,971,200 3.01<br />

15/01/2018<br />

Republic of Finland 4.375%<br />

9,500,000 10,655,912 1.79<br />

04/07/2019<br />

Republic of France 3.75%<br />

15,500,000 17,881,962 3.00<br />

25/04/2017<br />

Republic of France 5%<br />

25,000,000 27,017,501 4.52<br />

25/10/2016<br />

Republic of Italy 4.5%<br />

9,000,000 10,252,800 1.72<br />

01/02/2018<br />

Republic of Italy 4.75%<br />

24,000,000 21,910,801 3.67<br />

01/08/2023<br />

Spain Government Bond 4.65%<br />

6,600,000 5,458,860 0.92<br />

30/07/2025 10,600,000 9,624,270 1.61<br />

230,490,008 38.63<br />

TOTALE VALORI MOBILIARI AMMESSI ALLA<br />

QUOTAZIONE UFFICIALE DI UNA BORSA<br />

VALORI O NEGOZIATI SU UN ALTRO<br />

MERCATO REGOLAMENTATO<br />

541,495,353 90.85<br />

147