Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

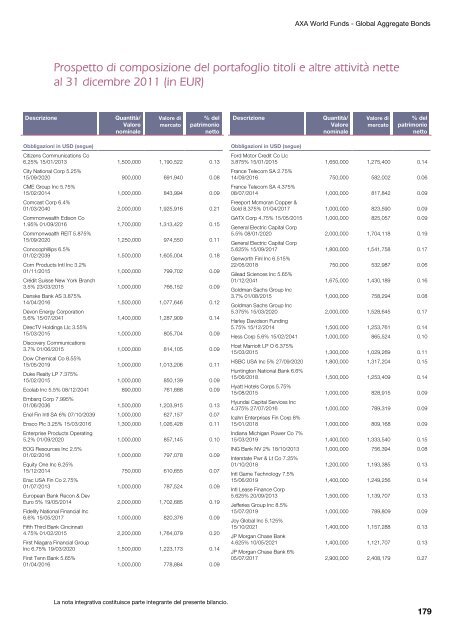

AXA World Funds - Global Aggregate Bonds<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in EUR)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Obbligazioni in USD (segue)<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Citizens Communications Co<br />

6.25% 15/01/2013<br />

City National Corp 5.25%<br />

1,500,000 1,190,522 0.13<br />

15/09/2020<br />

CME Group Inc 5.75%<br />

900,000 691,940 0.08<br />

15/02/2014<br />

Comcast Corp 6.4%<br />

1,000,000 843,994 0.09<br />

01/03/2040<br />

Commonwealth E<strong>di</strong>son Co<br />

2,000,000 1,925,916 0.21<br />

1.95% 01/09/2016<br />

Commonwealth REIT 5.875%<br />

1,700,000 1,313,422 0.15<br />

15/09/2020<br />

Conocophillips 6.5%<br />

1,250,000 974,550 0.11<br />

01/02/2039<br />

Corn Products Intl Inc 3.2%<br />

1,500,000 1,605,004 0.18<br />

01/11/2015<br />

Cré<strong>di</strong>t Suisse New York Branch<br />

1,000,000 799,702 0.09<br />

3.5% 23/03/2015<br />

Danske Bank AS 3.875%<br />

1,000,000 766,152 0.09<br />

14/04/2016<br />

Devon Energy Corporation<br />

1,500,000 1,077,646 0.12<br />

5.6% 15/07/2041<br />

DirecTV Hol<strong>di</strong>ngs Llc 3.55%<br />

1,400,000 1,287,909 0.14<br />

15/03/2015<br />

Discovery Communications<br />

1,000,000 805,704 0.09<br />

3.7% 01/06/2015<br />

Dow Chemical Co 8.55%<br />

1,000,000 814,105 0.09<br />

15/05/2019<br />

Duke Realty LP 7.375%<br />

1,000,000 1,013,206 0.11<br />

15/02/2015 1,000,000 850,139 0.09<br />

Ecolab Inc 5.5% 08/12/2041<br />

Embarq Corp 7.995%<br />

890,000 761,688 0.09<br />

01/06/2036 1,500,000 1,203,915 0.13<br />

Enel Fin Intl SA 6% 07/10/2039 1,000,000 627,157 0.07<br />

Ensco Plc 3.25% 15/03/2016<br />

Enterprise Products Operating<br />

1,300,000 1,026,428 0.11<br />

5.2% 01/09/2020<br />

EOG Resources Inc 2.5%<br />

1,000,000 857,145 0.10<br />

01/02/2016<br />

Equity One Inc 6.25%<br />

1,000,000 797,078 0.09<br />

15/12/2014<br />

Erac USA Fin Co 2.75%<br />

750,000 610,655 0.07<br />

01/07/2013<br />

European Bank Recon & Dev<br />

1,000,000 787,524 0.09<br />

Euro 5% 19/05/2014<br />

Fi<strong>del</strong>ity National Financial Inc<br />

2,000,000 1,702,685 0.19<br />

6.6% 15/05/2017<br />

Fifth Third Bank Cincinnati<br />

1,000,000 820,376 0.09<br />

4.75% 01/02/2015<br />

First Niagara Financial Group<br />

2,200,000 1,764,079 0.20<br />

Inc 6.75% 19/03/2020<br />

First Tenn Bank 5.65%<br />

1,500,000 1,223,173 0.14<br />

01/04/2016 1,000,000 778,884 0.09<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Obbligazioni in USD (segue)<br />

Ford Motor Cre<strong>di</strong>t Co Llc<br />

3.875% 15/01/2015<br />

France Telecom SA 2.75%<br />

1,650,000 1,275,400 0.14<br />

14/09/2016<br />

France Telecom SA 4.375%<br />

750,000 582,002 0.06<br />

08/07/2014<br />

Freeport Mcmoran Copper &<br />

1,000,000 817,842 0.09<br />

Gold 8.375% 01/04/2017 1,000,000 823,590 0.09<br />

GATX Corp 4.75% 15/05/2015<br />

General Electric Capital Corp<br />

1,000,000 825,057 0.09<br />

5.5% 08/01/2020<br />

General Electric Capital Corp<br />

2,000,000 1,704,118 0.19<br />

5.625% 15/09/2017<br />

Genworth Finl Inc 6.515%<br />

1,800,000 1,541,758 0.17<br />

22/05/2018<br />

Gilead Sciences Inc 5.65%<br />

750,000 532,987 0.06<br />

01/12/2041<br />

Goldman Sachs Group Inc<br />

1,675,000 1,430,189 0.16<br />

3.7% 01/08/2015<br />

Goldman Sachs Group Inc<br />

1,000,000 758,294 0.08<br />

5.375% 15/03/2020<br />

Harley Davidson Fun<strong>di</strong>ng<br />

2,000,000 1,528,645 0.17<br />

5.75% 15/12/2014 1,500,000 1,253,761 0.14<br />

Hess Corp 5.6% 15/02/2041<br />

Host Marriott LP O 6.375%<br />

1,000,000 865,524 0.10<br />

15/03/2015 1,300,000 1,029,269 0.11<br />

HSBC USA Inc 5% 27/09/2020<br />

Huntington National Bank 6.6%<br />

1,800,000 1,317,204 0.15<br />

15/06/2018<br />

Hyatt Hotels Corps 5.75%<br />

1,500,000 1,253,409 0.14<br />

15/08/2015<br />

Hyundai Capital Services Inc<br />

1,000,000 828,915 0.09<br />

4.375% 27/07/2016<br />

Icahn Enterprises Fin Corp 8%<br />

1,000,000 789,319 0.09<br />

15/01/2018<br />

In<strong>di</strong>ana Michigan Power Co 7%<br />

1,000,000 809,168 0.09<br />

15/03/2019 1,400,000 1,333,540 0.15<br />

ING Bank NV 2% 18/10/2013<br />

Interstate Pwr & Lt Co 7.25%<br />

1,000,000 756,394 0.08<br />

01/10/2018<br />

Intl Game Technology 7.5%<br />

1,200,000 1,193,385 0.13<br />

15/06/2019<br />

Intl Lease Finance Corp<br />

1,400,000 1,249,256 0.14<br />

5.625% 20/09/2013<br />

Jefferies Group Inc 8.5%<br />

1,500,000 1,139,707 0.13<br />

15/07/2019<br />

Joy Global Inc 5.125%<br />

1,000,000 789,809 0.09<br />

15/10/2021<br />

JP Morgan Chase Bank<br />

1,400,000 1,157,288 0.13<br />

4.625% 10/05/2021<br />

JP Morgan Chase Bank 6%<br />

1,400,000 1,121,707 0.13<br />

05/07/2017 2,900,000 2,408,179 0.27<br />

179