Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

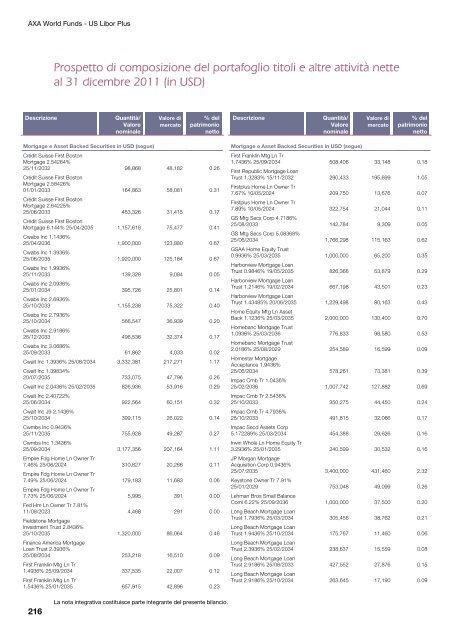

AXA World Funds - US Libor Plus<br />

216<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in USD)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Mortgage e Asset Backed Securities in USD (segue)<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Cré<strong>di</strong>t Suisse First Boston<br />

Mortgage 2.54264%<br />

25/11/2032<br />

Cré<strong>di</strong>t Suisse First Boston<br />

Mortgage 2.58426%<br />

98,868 48,182 0.26<br />

01/01/2033<br />

Cré<strong>di</strong>t Suisse First Boston<br />

Mortgage 2.64225%<br />

164,863 58,081 0.31<br />

25/06/2033<br />

Cré<strong>di</strong>t Suisse First Boston<br />

453,326 31,415 0.17<br />

Mortgage 6.144% 25/04/2035<br />

Cwabs Inc 1.1436%<br />

1,157,618 75,477 0.41<br />

25/04/2036<br />

Cwabs Inc 1.3936%<br />

1,900,000 123,880 0.67<br />

25/06/2035<br />

Cwabs Inc 1.9936%<br />

1,920,000 125,184 0.67<br />

25/11/2033<br />

Cwabs Inc 2.0936%<br />

139,328 9,084 0.05<br />

25/01/2034<br />

Cwabs Inc 2.6936%<br />

395,726 25,801 0.14<br />

25/10/2033<br />

Cwabs Inc 2.7936%<br />

1,155,238 75,322 0.40<br />

25/10/2034<br />

Cwabs Inc 2.9186%<br />

566,547 36,939 0.20<br />

25/12/2033<br />

Cwabs Inc 3.0686%<br />

496,536 32,374 0.17<br />

25/09/2033 61,862 4,033 0.02<br />

Cwalt Inc 1.3936% 25/08/2034<br />

Cwalt Inc 1.39834%<br />

3,332,381 217,271 1.17<br />

20/07/2035 733,075 47,796 0.26<br />

Cwalt Inc 2.0436% 25/02/2035<br />

Cwalt Inc 2.40722%<br />

826,936 53,916 0.29<br />

25/06/2034<br />

Cwalt Inc J9 2.1436%<br />

922,564 60,151 0.32<br />

25/10/2034<br />

Cwmbs Inc 0.9436%<br />

399,115 26,022 0.14<br />

25/11/2035<br />

Cwmbs Inc 1.3436%<br />

755,928 49,287 0.27<br />

25/09/2034<br />

Empire Fdg Home Ln Owner Tr<br />

3,177,356 207,164 1.11<br />

7.46% 25/06/2024<br />

Empire Fdg Home Ln Owner Tr<br />

310,827 20,266 0.11<br />

7.49% 25/06/2024<br />

Empire Fdg Home Ln Owner Tr<br />

179,183 11,683 0.06<br />

7.73% 25/06/2024<br />

Fed Hm Ln Owner Tr 7.81%<br />

5,995 391 0.00<br />

11/09/2023<br />

Fieldstone Mortgage<br />

Investment Trust 2.8436%<br />

4,468 291 0.00<br />

25/10/2035<br />

Finance America Mortgage<br />

Loan Trust 2.3936%<br />

1,320,000 86,064 0.46<br />

25/08/2034<br />

First Franklin Mtg Ln Tr<br />

253,218 16,510 0.09<br />

1.4936% 25/09/2034<br />

First Franklin Mtg Ln Tr<br />

337,535 22,007 0.12<br />

1.5436% 25/01/2035 657,915 42,896 0.23<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Mortgage e Asset Backed Securities in USD (segue)<br />

First Franklin Mtg Ln Tr<br />

1.7436% 25/09/2034<br />

First Republic Mortgage Loan<br />

508,406 33,148 0.18<br />

Trust 1.3283% 15/11/2032<br />

Firstplus Home Ln Owner Tr<br />

290,433 195,699 1.05<br />

7.67% 10/05/2024<br />

Firstplus Home Ln Owner Tr<br />

209,750 13,676 0.07<br />

7.89% 10/05/2024<br />

GS Mtg Secs Corp 4.7186%<br />

322,754 21,044 0.11<br />

25/08/2033<br />

GS Mtg Secs Corp 5.08368%<br />

142,784 9,309 0.05<br />

25/06/2034<br />

GSAA Home Equity Trust<br />

1,766,298 115,163 0.62<br />

0.9936% 25/03/2035<br />

Harborview Mortgage Loan<br />

1,000,000 65,200 0.35<br />

Trust 0.9846% 19/05/2035<br />

Harborview Mortgage Loan<br />

826,366 53,879 0.29<br />

Trust 1.2146% 19/02/2034<br />

Harborview Mortgage Loan<br />

667,198 43,501 0.23<br />

Trust 1.43485% 20/06/2035<br />

Home Equity Mtg Ln Asset<br />

1,229,498 80,163 0.43<br />

Back 1.1236% 25/03/2035<br />

Homebanc Mortgage Trust<br />

2,000,000 130,400 0.70<br />

1.0936% 25/03/2036<br />

Homebanc Mortgage Trust<br />

776,833 98,580 0.53<br />

2.0186% 25/08/2029<br />

Homestar Mortgage<br />

Acceptance 1.9436%<br />

254,589 16,599 0.09<br />

25/06/2034<br />

Impac Cmb Tr 1.0436%<br />

578,261 73,381 0.39<br />

25/02/2036<br />

Impac Cmb Tr 2.5436%<br />

1,007,742 127,882 0.69<br />

25/10/2033<br />

Impac Cmb Tr 4.7936%<br />

350,275 44,450 0.24<br />

25/10/2033<br />

Impac Secd Assets Corp<br />

491,815 32,066 0.17<br />

5.172289% 25/03/2034<br />

Irwin Whole Ln Home Equity Tr<br />

454,388 29,626 0.16<br />

3.2936% 25/01/2035<br />

JP Morgan Mortgage<br />

Acquisition Corp 0.9436%<br />

240,599 30,532 0.16<br />

25/07/2035<br />

Keystone Owner Tr 7.91%<br />

3,400,000 431,460 2.32<br />

25/01/2029<br />

Lehman Bros Small Balance<br />

753,048 49,099 0.26<br />

Coml 6.22% 25/09/2036<br />

Long Beach Mortgage Loan<br />

1,000,000 37,500 0.20<br />

Trust 1.7936% 25/03/2034<br />

Long Beach Mortgage Loan<br />

305,456 38,762 0.21<br />

Trust 1.9436% 25/10/2034<br />

Long Beach Mortgage Loan<br />

175,767 11,460 0.06<br />

Trust 2.3936% 25/02/2034<br />

Long Beach Mortgage Loan<br />

238,637 15,559 0.08<br />

Trust 2.9186% 25/08/2033<br />

Long Beach Mortgage Loan<br />

427,552 27,876 0.15<br />

Trust 2.9186% 25/10/2034 263,645 17,190 0.09