Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

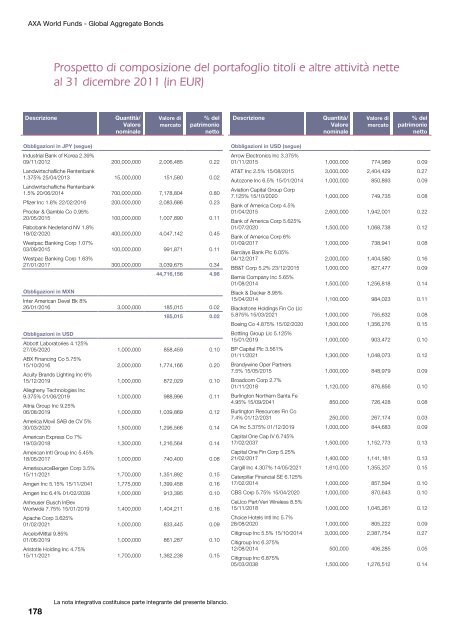

AXA World Funds - Global Aggregate Bonds<br />

178<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in EUR)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Obbligazioni in JPY (segue)<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Industrial Bank of Korea 2.39%<br />

09/11/2012<br />

Landwirtschafliche Rentenbank<br />

200,000,000 2,006,485 0.22<br />

1.375% 25/04/2013<br />

Landwirtschafliche Rentenbank<br />

15,000,000 151,580 0.02<br />

1.5% 20/06/2014 700,000,000 7,178,804 0.80<br />

Pfizer Inc 1.8% 22/02/2016<br />

Procter & Gamble Co 0.95%<br />

200,000,000 2,083,686 0.23<br />

20/05/2015<br />

Rabobank Nederland NV 1.8%<br />

100,000,000 1,007,890 0.11<br />

18/02/2020<br />

Westpac Banking Corp 1.07%<br />

400,000,000 4,047,142 0.45<br />

03/09/2015<br />

Westpac Banking Corp 1.63%<br />

100,000,000 991,871 0.11<br />

27/01/2017 300,000,000 3,039,675 0.34<br />

44,716,156 4.98<br />

Obbligazioni in MXN<br />

Inter American Devel Bk 8%<br />

26/01/2016 3,000,000 185,015 0.02<br />

185,015 0.02<br />

Obbligazioni in USD<br />

Abbott Laboratories 4.125%<br />

27/05/2020<br />

ABX Financing Co 5.75%<br />

1,000,000 858,459 0.10<br />

15/10/2016<br />

Acuity Brands Lighting Inc 6%<br />

2,000,000 1,774,166 0.20<br />

15/12/2019<br />

Allegheny Technologies Inc<br />

1,000,000 872,029 0.10<br />

9.375% 01/06/2019<br />

Altria Group Inc 9.25%<br />

1,000,000 988,996 0.11<br />

06/08/2019<br />

America Movil SAB de CV 5%<br />

1,000,000 1,039,869 0.12<br />

30/03/2020<br />

American Express Co 7%<br />

1,500,000 1,296,566 0.14<br />

19/03/2018<br />

American Intl Group Inc 5.45%<br />

1,300,000 1,216,564 0.14<br />

18/05/2017<br />

AmerisourceBergen Corp 3.5%<br />

1,000,000 740,400 0.08<br />

15/11/2021 1,700,000 1,351,892 0.15<br />

Amgen Inc 5.15% 15/11/2041 1,775,000 1,399,458 0.16<br />

Amgen Inc 6.4% 01/02/2039<br />

Anheuser Busch InBev<br />

1,000,000 913,395 0.10<br />

Worlwide 7.75% 15/01/2019<br />

Apache Corp 3.625%<br />

1,400,000 1,404,211 0.16<br />

01/02/2021<br />

ArcelorMittal 9.85%<br />

1,000,000 833,445 0.09<br />

01/06/2019<br />

Aristotle Hol<strong>di</strong>ng Inc 4.75%<br />

1,000,000 861,287 0.10<br />

15/11/2021 1,700,000 1,362,238 0.15<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Obbligazioni in USD (segue)<br />

Arrow Electronics Inc 3.375%<br />

01/11/2015 1,000,000 774,989 0.09<br />

AT&T Inc 2.5% 15/08/2015 3,000,000 2,404,429 0.27<br />

Autozone Inc 6.5% 15/01/2014<br />

Aviation Capital Group Corp<br />

1,000,000 850,893 0.09<br />

7.125% 15/10/2020<br />

Bank of America Corp 4.5%<br />

1,000,000 749,735 0.08<br />

01/04/2015<br />

Bank of America Corp 5.625%<br />

2,600,000 1,942,001 0.22<br />

01/07/2020<br />

Bank of America Corp 6%<br />

1,500,000 1,068,738 0.12<br />

01/09/2017<br />

Barclays Bank Plc 6.05%<br />

1,000,000 738,941 0.08<br />

04/12/2017 2,000,000 1,404,580 0.16<br />

BB&T Corp 5.2% 23/12/2015<br />

Bemis Company Inc 5.65%<br />

1,000,000 827,477 0.09<br />

01/08/2014<br />

Black & Decker 8.95%<br />

1,500,000 1,256,818 0.14<br />

15/04/2014<br />

Blackstone Hol<strong>di</strong>ngs Fin Co Llc<br />

1,100,000 984,023 0.11<br />

5.875% 15/03/2021 1,000,000 755,632 0.08<br />

Boeing Co 4.875% 15/02/2020<br />

Bottling Group Llc 5.125%<br />

1,500,000 1,356,276 0.15<br />

15/01/2019<br />

BP Capital Plc 3.561%<br />

1,000,000 903,472 0.10<br />

01/11/2021<br />

Brandywine Oper Partners<br />

1,300,000 1,048,073 0.12<br />

7.5% 15/05/2015<br />

Broadcom Corp 2.7%<br />

1,000,000 848,979 0.09<br />

01/11/2018<br />

Burlington Northern Santa Fe<br />

1,120,000 876,856 0.10<br />

4.95% 15/09/2041<br />

Burlington Resources Fin Co<br />

850,000 726,428 0.08<br />

7.4% 01/12/2031 250,000 267,174 0.03<br />

CA Inc 5.375% 01/12/2019<br />

Capital One Cap IV 6.745%<br />

1,000,000 844,683 0.09<br />

17/02/2037<br />

Capital One Fin Corp 5.25%<br />

1,500,000 1,152,773 0.13<br />

21/02/2017 1,400,000 1,141,181 0.13<br />

Cargill Inc 4.307% 14/05/2021<br />

Caterpillar Financial SE 6.125%<br />

1,610,000 1,355,207 0.15<br />

17/02/2014 1,000,000 857,594 0.10<br />

CBS Corp 5.75% 15/04/2020<br />

CeLlco Part/Veri Wireless 8.5%<br />

1,000,000 870,643 0.10<br />

15/11/2018<br />

Choice Hotels Intl Inc 5.7%<br />

1,000,000 1,045,261 0.12<br />

28/08/2020 1,000,000 805,222 0.09<br />

Citigroup Inc 5.5% 15/10/2014<br />

Citigroup Inc 6.375%<br />

3,000,000 2,387,754 0.27<br />

12/08/2014<br />

Citigroup Inc 6.875%<br />

500,000 406,285 0.05<br />

05/03/2038 1,500,000 1,276,512 0.14