Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

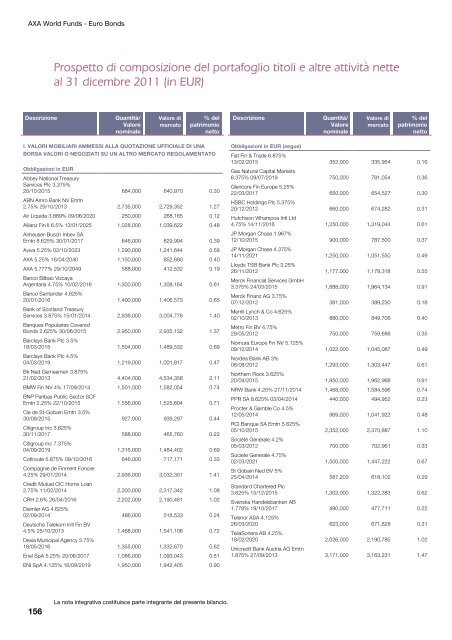

AXA World Funds - Euro Bonds<br />

156<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in EUR)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

I. VALORI MOBILIARI AMMESSI ALLA QUOTAZIONE UFFICIALE DI UNA<br />

BORSA VALORI O NEGOZIATI SU UN ALTRO MERCATO REGOLAMENTATO<br />

Obbligazioni in EUR<br />

Abbey National Treasury<br />

Services Plc 3.375%<br />

20/10/2015<br />

ABN Amro Bank NV Emtn<br />

684,000 640,970 0.30<br />

2.75% 29/10/2013 2,735,000 2,729,352 1.27<br />

Air Liquide 3.889% 09/06/2020 250,000 268,165 0.12<br />

Allianz Fin II 6.5% 13/01/2025<br />

Anheuser-Busch Inbev SA<br />

1,028,000 1,039,622 0.48<br />

Emtn 8.625% 30/01/2017 646,000 829,994 0.39<br />

Aviva 5.25% 02/10/2023 1,290,000 1,241,644 0.58<br />

AXA 5.25% 16/04/2040 1,150,000 852,690 0.40<br />

AXA 5.777% 29/10/2049<br />

Banco Bilbao Vizcaya<br />

588,000 412,532 0.19<br />

Argentaria 4.75% 10/02/2016<br />

Banco Santander 4.625%<br />

1,300,000 1,308,164 0.61<br />

20/01/2016<br />

Bank of Scotland Treasury<br />

1,400,000 1,406,573 0.65<br />

Services 3.875% 15/01/2014<br />

Banques Populaires Covered<br />

2,936,000 3,004,776 1.40<br />

Bonds 2.625% 30/06/2015<br />

Barclays Bank Plc 3.5%<br />

2,950,000 2,935,132 1.37<br />

18/03/2015<br />

Barclays Bank Plc 4.5%<br />

1,504,000 1,489,532 0.69<br />

04/03/2019<br />

Bk Ned Gemeenten 3.875%<br />

1,219,000 1,001,817 0.47<br />

21/02/2013 4,404,000 4,534,358 2.11<br />

BMW Fin NV 4% 17/09/2014<br />

BNP Paribas Public Sector SCF<br />

1,501,000 1,582,054 0.74<br />

Emtn 2.25% 22/10/2015<br />

Cie de St-Gobain Emtn 3.5%<br />

1,556,000 1,525,604 0.71<br />

30/09/2015<br />

Citigroup Inc 3.625%<br />

927,000 939,297 0.44<br />

30/11/2017<br />

Citigroup Inc 7.375%<br />

588,000 465,760 0.22<br />

04/09/2019 1,316,000 1,484,402 0.69<br />

Cofiroute 5.875% 09/10/2016<br />

Compagnie de Finment Foncier<br />

646,000 717,171 0.33<br />

4.25% 29/01/2014<br />

Cre<strong>di</strong>t Mutuel CIC Home Loan<br />

2,936,000 3,032,301 1.41<br />

2.75% 11/02/2014 2,300,000 2,317,342 1.08<br />

CRH 2.6% 26/04/2016<br />

Daimler AG 4.625%<br />

2,202,009 2,190,481 1.02<br />

02/09/2014<br />

Deutsche Telekom Intl Fin BV<br />

486,000 518,533 0.24<br />

4.5% 25/10/2013<br />

Dexia Municipal Agency 3.75%<br />

1,468,000 1,541,106 0.72<br />

18/05/2016 1,355,000 1,332,670 0.62<br />

Enel SpA 5.25% 20/06/2017 1,086,000 1,093,043 0.51<br />

ENI SpA 4.125% 16/09/2019 1,950,000 1,942,405 0.90<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Obbligazioni in EUR (segue)<br />

Fiat Fin & Trade 6.875%<br />

13/02/2015<br />

Gas Natural Capital Markets<br />

352,000 335,954 0.16<br />

6.375% 09/07/2019<br />

Glencore Fin Europe 5.25%<br />

750,000 781,054 0.36<br />

22/03/2017<br />

HSBC Hol<strong>di</strong>ngs Plc 5.375%<br />

650,000 654,527 0.30<br />

20/12/2012<br />

Hutchison Whampoa Intl Ltd<br />

660,000 674,282 0.31<br />

4.75% 14/11/2016<br />

JP Morgan Chase 1.967%<br />

1,250,000 1,319,044 0.61<br />

12/10/2015<br />

JP Morgan Chase 4.375%<br />

900,000 787,500 0.37<br />

14/11/2021<br />

Lloyds TSB Bank Plc 3.25%<br />

1,250,000 1,051,550 0.49<br />

26/11/2012<br />

Merck Financial Services GmbH<br />

1,177,000 1,178,318 0.55<br />

3.375% 24/03/2015<br />

Merck Finanz AG 3.75%<br />

1,888,000 1,964,134 0.91<br />

07/12/2012<br />

Merrill Lynch & Co 4.625%<br />

381,000 389,230 0.18<br />

02/10/2013<br />

Metro Fin BV 4.75%<br />

880,000 849,706 0.40<br />

29/05/2012<br />

Nomura Europe Fin NV 5.125%<br />

750,000 759,686 0.35<br />

09/12/2014<br />

Nordea Bank AB 3%<br />

1,022,000 1,045,087 0.49<br />

06/08/2012<br />

Northern Rock 3.625%<br />

1,293,000 1,303,447 0.61<br />

20/04/2015 1,950,000 1,962,968 0.91<br />

NRW Bank 4.25% 27/11/2014 1,468,000 1,584,596 0.74<br />

PPR SA 8.625% 03/04/2014<br />

Procter & Gamble Co 4.5%<br />

440,000 494,952 0.23<br />

12/05/2014<br />

RCI Banque SA Emtn 5.625%<br />

969,000 1,041,922 0.48<br />

05/10/2015<br />

Société Générale 4.2%<br />

2,352,000 2,370,887 1.10<br />

05/03/2012<br />

Societe Generale 4.75%<br />

700,000 702,961 0.33<br />

02/03/2021<br />

St Gobain Ned BV 5%<br />

1,500,000 1,447,222 0.67<br />

25/04/2014<br />

Standard Chartered Plc<br />

587,203 618,102 0.29<br />

3.625% 15/12/2015<br />

Svenska Han<strong>del</strong>sbanken AB<br />

1,302,000 1,322,383 0.62<br />

1.778% 19/10/2017<br />

Telenor ASA 4.125%<br />

490,000 477,711 0.22<br />

26/03/2020<br />

TeliaSonera AB 4.25%<br />

623,000 671,828 0.31<br />

18/02/2020<br />

Unicre<strong>di</strong>t Bank Austria AG Emtn<br />

2,026,000 2,190,785 1.02<br />

1.875% 27/09/2013 3,171,000 3,163,231 1.47