Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

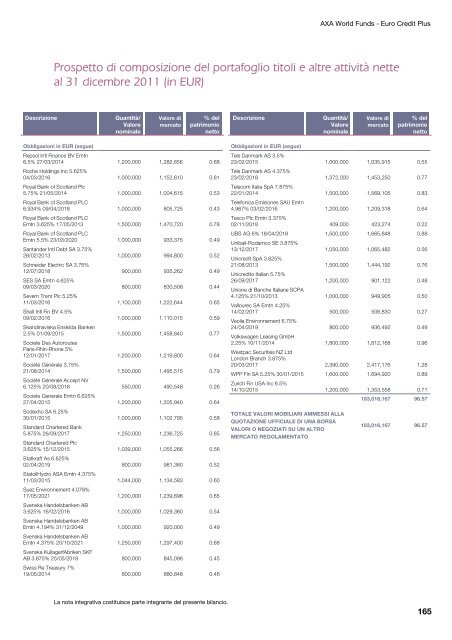

AXA World Funds - Euro Cre<strong>di</strong>t Plus<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in EUR)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Obbligazioni in EUR (segue)<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Repsol Intl Finance BV Emtn<br />

6.5% 27/03/2014<br />

Roche Hol<strong>di</strong>ngs Inc 5.625%<br />

1,200,000 1,282,656 0.68<br />

04/03/2016<br />

Royal Bank of Scotland Plc<br />

1,000,000 1,152,610 0.61<br />

5.75% 21/05/2014<br />

Royal Bank of Scotland PLC<br />

1,000,000 1,004,615 0.53<br />

6.934% 09/04/2018<br />

Royal Bank of Scotland PLC<br />

1,000,000 805,725 0.43<br />

Emtn 3.625% 17/05/2013<br />

Royal Bank of Scotland PLC<br />

1,500,000 1,470,720 0.78<br />

Emtn 5.5% 23/03/2020<br />

Santander Intl Debt SA 3.75%<br />

1,000,000 933,375 0.49<br />

28/02/2013<br />

Schneider Electric SA 3.75%<br />

1,000,000 994,800 0.52<br />

12/07/2018<br />

SES SA Emtn 4.625%<br />

900,000 935,262 0.49<br />

09/03/2020<br />

Severn Trent Plc 5.25%<br />

800,000 830,508 0.44<br />

11/03/2016<br />

Shell Intl Fin BV 4.5%<br />

1,100,000 1,222,644 0.65<br />

09/02/2016<br />

Skan<strong>di</strong>naviska Enskilda Banken<br />

1,000,000 1,110,015 0.59<br />

2.5% 01/09/2015<br />

Societe Des Autoroutes<br />

Paris-Rhin-Rhone 5%<br />

1,500,000 1,458,840 0.77<br />

12/01/2017<br />

Société Générale 3.75%<br />

1,200,000 1,219,800 0.64<br />

21/08/2014<br />

Société Générale Accept NV<br />

1,500,000 1,495,515 0.79<br />

6.125% 20/08/2018<br />

Societe Generale Emtn 6.625%<br />

550,000 490,548 0.26<br />

27/04/2015<br />

Sodexho SA 6.25%<br />

1,200,000 1,205,940 0.64<br />

30/01/2015<br />

Standard Chartered Bank<br />

1,000,000 1,102,795 0.58<br />

5.875% 26/09/2017<br />

Standard Chartered Plc<br />

1,250,000 1,236,725 0.65<br />

3.625% 15/12/2015<br />

Statkraft As 6.625%<br />

1,039,000 1,055,266 0.56<br />

02/04/2019<br />

StatoilHydro ASA Emtn 4.375%<br />

800,000 981,380 0.52<br />

11/03/2015<br />

Suez Environnement 4.078%<br />

1,044,000 1,134,583 0.60<br />

17/05/2021<br />

Svenska Han<strong>del</strong>sbanken AB<br />

1,200,000 1,239,696 0.65<br />

3.625% 16/02/2016<br />

Svenska Han<strong>del</strong>sbanken AB<br />

1,000,000 1,029,380 0.54<br />

Emtn 4.194% 31/12/2049<br />

Svenska Han<strong>del</strong>sbanken AB<br />

1,000,000 920,000 0.49<br />

Emtn 4.375% 20/10/2021<br />

Svenska KullagerfAbriken SKF<br />

1,250,000 1,297,400 0.68<br />

AB 3.875% 25/05/2018<br />

Swiss Re Treasury 7%<br />

800,000 845,096 0.45<br />

19/05/2014 800,000 880,848 0.46<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Obbligazioni in EUR (segue)<br />

Tele Danmark AS 3.5%<br />

23/02/2015<br />

Tele Danmark AS 4.375%<br />

1,000,000 1,035,915 0.55<br />

23/02/2018<br />

Telecom Italia SpA 7.875%<br />

1,372,000 1,453,250 0.77<br />

22/01/2014<br />

Telefonica Emisiones SAU Emtn<br />

1,500,000 1,569,105 0.83<br />

4.967% 03/02/2016<br />

Tesco Plc Emtn 3.375%<br />

1,200,000 1,209,318 0.64<br />

02/11/2018 409,000 423,274 0.22<br />

UBS AG 6% 18/04/2018<br />

Unibail-Rodamco SE 3.875%<br />

1,500,000 1,665,848 0.88<br />

13/12/2017<br />

Unicre<strong>di</strong>t SpA 3.625%<br />

1,050,000 1,065,482 0.56<br />

21/08/2013<br />

Unicre<strong>di</strong>to Italian 5.75%<br />

1,500,000 1,444,192 0.76<br />

26/09/2017<br />

Unione <strong>di</strong> Banche Italiane SCPA<br />

1,200,000 901,122 0.48<br />

4.125% 21/10/2013<br />

Vallourec SA Emtn 4.25%<br />

1,000,000 949,905 0.50<br />

14/02/2017<br />

Veolia Environnement 6.75%<br />

500,000 508,830 0.27<br />

24/04/2019<br />

Volkswagen Leasing GmbH<br />

800,000 936,492 0.49<br />

2.25% 10/11/2014<br />

Westpac Securities NZ Ltd<br />

London Branch 3.875%<br />

1,800,000 1,812,168 0.96<br />

20/03/2017 2,390,000 2,417,176 1.28<br />

WPP Fin SA 5.25% 30/01/2015<br />

Zurich Fin USA Inc 6.5%<br />

1,600,000 1,694,920 0.89<br />

14/10/2015 1,200,000 1,353,558 0.71<br />

183,016,167 96.57<br />

TOTALE VALORI MOBILIARI AMMESSI ALLA<br />

QUOTAZIONE UFFICIALE DI UNA BORSA<br />

VALORI O NEGOZIATI SU UN ALTRO<br />

MERCATO REGOLAMENTATO<br />

183,016,167 96.57<br />

165