Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

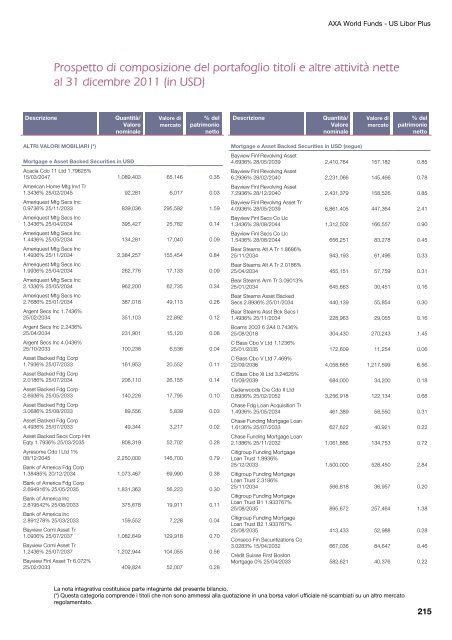

AXA World Funds - US Libor Plus<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in USD)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

ALTRI VALORI MOBILIARI (*)<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Mortgage e Asset Backed Securities in USD<br />

Acacia Cdo 11 Ltd 1.79625%<br />

15/03/2047<br />

American Home Mtg Invt Tr<br />

1,089,403 65,146 0.35<br />

1.3436% 25/02/2045<br />

Ameriquest Mtg Secs Inc<br />

92,281 6,017 0.03<br />

0.9736% 25/11/2033<br />

Ameriquest Mtg Secs Inc<br />

839,036 295,592 1.59<br />

1.3436% 25/04/2034<br />

Ameriquest Mtg Secs Inc<br />

395,427 25,782 0.14<br />

1.4436% 25/05/2034<br />

Ameriquest Mtg Secs Inc<br />

134,281 17,040 0.09<br />

1.4936% 25/11/2034<br />

Ameriquest Mtg Secs Inc<br />

2,384,257 155,454 0.84<br />

1.9936% 25/04/2034<br />

Ameriquest Mtg Secs Inc<br />

262,776 17,133 0.09<br />

2.1336% 25/05/2034<br />

Ameriquest Mtg Secs Inc<br />

962,200 62,735 0.34<br />

2.7686% 25/01/2034<br />

Argent Secs Inc 1.7436%<br />

387,018 49,113 0.26<br />

25/02/2034<br />

Argent Secs Inc 2.2436%<br />

351,103 22,892 0.12<br />

25/04/2034<br />

Argent Secs Inc 4.0436%<br />

231,901 15,120 0.08<br />

25/10/2033<br />

Asset Backed Fdg Corp<br />

100,238 6,536 0.04<br />

1.7936% 25/07/2033<br />

Asset Backed Fdg Corp<br />

161,953 20,552 0.11<br />

2.0186% 25/07/2034<br />

Asset Backed Fdg Corp<br />

206,110 26,155 0.14<br />

2.6936% 25/05/2033<br />

Asset Backed Fdg Corp<br />

140,228 17,795 0.10<br />

3.0686% 25/08/2033<br />

Asset Backed Fdg Corp<br />

89,556 5,839 0.03<br />

4.4936% 25/07/2033<br />

Asset Backed Secs Corp Hm<br />

49,344 3,217 0.02<br />

Eqty 1.7936% 25/03/2035<br />

Ayresome Cdo I Ltd 1%<br />

808,319 52,702 0.28<br />

08/12/2045<br />

Bank of America Fdg Corp<br />

2,250,000 146,700 0.79<br />

1.38485% 20/12/2034<br />

Bank of America Fdg Corp<br />

1,073,467 69,990 0.38<br />

2.694916% 25/05/2035<br />

Bank of America Inc<br />

1,831,363 56,223 0.30<br />

2.819542% 25/08/2033<br />

Bank of America Inc<br />

375,678 19,911 0.11<br />

2.891278% 25/03/2033<br />

Bayview Coml Asset Tr<br />

159,552 7,228 0.04<br />

1.0936% 25/07/2037<br />

Bayview Coml Asset Tr<br />

1,082,649 129,918 0.70<br />

1.2436% 25/07/2037<br />

Bayview Finl Asset Tr 6.072%<br />

1,202,944 104,055 0.56<br />

25/02/2033 409,824 52,007 0.28<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

(*) Questa categoria comprende i <strong>titoli</strong> che non sono ammessi alla quotazione in una borsa valori ufficiale né scambiati su un altro mercato<br />

regolamentato.<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Mortgage e Asset Backed Securities in USD (segue)<br />

Bayview Finl Revolving Asset<br />

4.6936% 28/05/2039<br />

Bayview Finl Revolving Asset<br />

2,410,764 157,182 0.85<br />

6.2936% 28/02/2040<br />

Bayview Finl Revolving Asset<br />

2,231,066 145,466 0.78<br />

7.2936% 28/12/2040<br />

Bayview Finl Revolvng Asset Tr<br />

2,431,379 158,526 0.85<br />

4.0936% 28/05/2039<br />

Bayview Finl Secs Co Llc<br />

6,861,405 447,364 2.41<br />

1.3436% 28/08/2044<br />

Bayview Finl Secs Co Llc<br />

1,312,502 166,557 0.90<br />

1.5436% 28/08/2044<br />

Bear Stearns Alt A Tr 1.8686%<br />

656,251 83,278 0.45<br />

25/11/2034<br />

Bear Stearns Alt A Tr 2.0186%<br />

943,193 61,496 0.33<br />

25/04/2034<br />

Bear Stearns Arm Tr 3.09013%<br />

455,151 57,759 0.31<br />

25/01/2034<br />

Bear Stearns Asset Backed<br />

645,663 30,451 0.16<br />

Secs 2.8936% 25/01/2034<br />

Bear Stearns Asst Bck Secs I<br />

440,139 55,854 0.30<br />

1.4936% 25/11/2034<br />

Boams 2003 6 2A4 0.7436%<br />

228,963 29,055 0.16<br />

25/08/2018<br />

C Bass Cbo V Ltd 1.1236%<br />

304,430 270,243 1.45<br />

25/01/2035<br />

C Bass Cbo V Ltd 7.469%<br />

172,609 11,254 0.06<br />

22/09/2036<br />

C Bass Cbo XI Ltd 3.24625%<br />

4,058,665 1,217,599 6.56<br />

15/09/2039<br />

Cederwoods Cre Cdo II Ltd<br />

684,000 34,200 0.18<br />

0.8936% 25/02/2052<br />

Chase Fdg Loan Acquisition Tr<br />

3,256,918 122,134 0.66<br />

1.4936% 25/05/2034<br />

Chase Fun<strong>di</strong>ng Mortgage Loan<br />

461,389 58,550 0.31<br />

1.6136% 25/07/2033<br />

Chase Fun<strong>di</strong>ng Mortgage Loan<br />

627,622 40,921 0.22<br />

2.1386% 25/11/2032<br />

Citigroup Fun<strong>di</strong>ng Mortgage<br />

Loan Trust 1.8936%<br />

1,061,886 134,753 0.72<br />

25/12/2033<br />

Citigroup Fun<strong>di</strong>ng Mortgage<br />

Loan Trust 2.3186%<br />

1,500,000 528,450 2.84<br />

25/11/2034<br />

Citigroup Fun<strong>di</strong>ng Mortgage<br />

Loan Trust B1 1.933767%<br />

566,818 36,957 0.20<br />

25/08/2035<br />

Citigroup Fun<strong>di</strong>ng Mortgage<br />

Loan Trust B2 1.933767%<br />

895,672 257,464 1.38<br />

25/08/2035<br />

Conseco Fin Securitizations Co<br />

413,433 52,988 0.28<br />

3.0283% 15/04/2032<br />

Cré<strong>di</strong>t Suisse First Boston<br />

667,036 84,647 0.46<br />

Mortgage 0% 25/04/2033 582,621 40,376 0.22<br />

215