Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

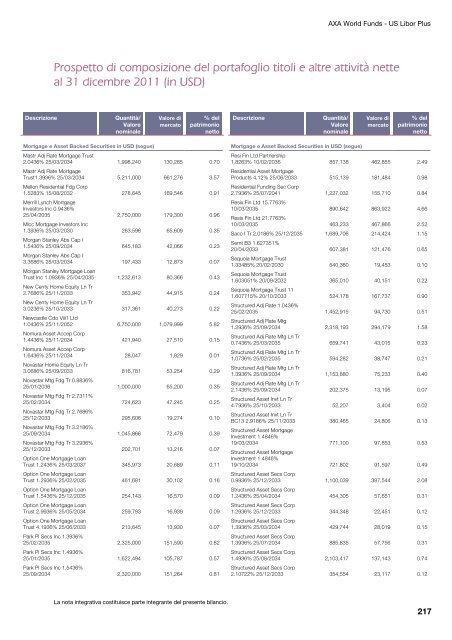

AXA World Funds - US Libor Plus<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in USD)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Mortgage e Asset Backed Securities in USD (segue)<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Mastr Adj Rate Mortgage Trust<br />

2.0436% 25/03/2034<br />

Mastr Adj Rate Mortgage<br />

1,998,240 130,285 0.70<br />

Trust1.3936% 25/03/2034<br />

Mellon Residential Fdg Corp<br />

5,211,000 661,276 3.57<br />

1.5283% 15/08/2032<br />

Merrill Lynch Mortgage<br />

Investors Inc 0.9436%<br />

278,645 169,546 0.91<br />

25/04/2035<br />

Mlcc Mortgage Investors Inc<br />

2,750,000 179,300 0.96<br />

1.3936% 25/03/2030<br />

Morgan Stanley Abs Cap I<br />

263,596 65,609 0.35<br />

1.5436% 25/09/2034<br />

Morgan Stanley Abs Cap I<br />

645,183 42,066 0.23<br />

3.3686% 25/03/2034<br />

Morgan Stanley Mortgage Loan<br />

197,433 12,873 0.07<br />

Trust Inc 1.0936% 25/04/2035<br />

New Centy Home Equity Ln Tr<br />

1,232,613 80,366 0.43<br />

2.7686% 25/11/2033<br />

New Centy Home Equity Ln Tr<br />

353,942 44,915 0.24<br />

3.0236% 25/10/2033<br />

Newcastle Cdo Viii1 Ltd<br />

317,361 40,273 0.22<br />

1.0436% 25/11/2052<br />

Nomura Asset Accep Corp<br />

6,750,000 1,079,999 5.82<br />

1.4436% 25/11/2034<br />

Nomura Asset Accep Corp<br />

421,940 27,510 0.15<br />

1.6436% 25/11/2034<br />

Novastar Home Equity Ln Tr<br />

28,047 1,829 0.01<br />

3.0686% 25/09/2033<br />

Novastar Mtg Fdg Tr 0.8836%<br />

816,781 53,254 0.29<br />

25/01/2036<br />

Novastar Mtg Fdg Tr 2.7311%<br />

1,000,000 65,200 0.35<br />

25/02/2034<br />

Novastar Mtg Fdg Tr 2.7686%<br />

724,623 47,245 0.25<br />

25/12/2033<br />

Novastar Mtg Fdg Tr 3.2186%<br />

295,606 19,274 0.10<br />

25/09/2034<br />

Novastar Mtg Fdg Tr 3.2936%<br />

1,045,866 72,479 0.39<br />

25/12/2033<br />

Option One Mortgage Loan<br />

202,701 13,216 0.07<br />

Trust 1.2436% 25/03/2037<br />

Option One Mortgage Loan<br />

345,973 20,689 0.11<br />

Trust 1.2936% 25/02/2035<br />

Option One Mortgage Loan<br />

461,681 30,102 0.16<br />

Trust 1.5436% 25/12/2035<br />

Option One Mortgage Loan<br />

254,143 16,570 0.09<br />

Trust 2.9936% 25/05/2034<br />

Option One Mortgage Loan<br />

259,793 16,939 0.09<br />

Trust 4.1936% 25/06/2033<br />

Park Pl Secs Inc 1.3936%<br />

213,645 13,930 0.07<br />

25/02/2035<br />

Park Pl Secs Inc 1.4936%<br />

2,325,000 151,590 0.82<br />

25/01/2035<br />

Park Pl Secs Inc 1.5436%<br />

1,622,494 105,787 0.57<br />

25/09/2034 2,320,000 151,264 0.81<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Mortgage e Asset Backed Securities in USD (segue)<br />

Resi Fin Ltd Partnership<br />

1.8263% 10/02/2036<br />

Residential Asset Mortgage<br />

857,138 462,855 2.49<br />

Products 4.12% 25/06/2033<br />

Residential Fun<strong>di</strong>ng Sec Corp<br />

515,139 181,484 0.98<br />

2.7936% 25/07/2041<br />

Resix Fin Ltd 15.7763%<br />

1,227,032 155,710 0.84<br />

10/03/2035<br />

Resix Fin Ltd 21.7763%<br />

890,642 863,922 4.66<br />

10/03/2035 463,233 467,866 2.52<br />

Saco I Tr 2.0186% 25/12/2035<br />

Semt B3 1.627351%<br />

1,689,706 214,424 1.15<br />

20/04/2033<br />

Sequoia Mortgage Trust<br />

607,381 121,476 0.65<br />

1.33485% 20/02/2030<br />

Sequoia Mortgage Trust<br />

540,360 19,453 0.10<br />

1.603051% 20/09/2032<br />

Sequoia Mortgage Trust 11<br />

365,010 40,151 0.22<br />

1.607715% 20/10/2033<br />

Structured Adj Rate 1.0436%<br />

524,178 167,737 0.90<br />

25/02/2035<br />

Structured Adj Rate Mtg<br />

1,452,915 94,730 0.51<br />

1.2936% 25/09/2034<br />

Structured Adj Rate Mtg Ln Tr<br />

2,318,193 294,179 1.58<br />

0.7436% 25/03/2035<br />

Structured Adj Rate Mtg Ln Tr<br />

659,741 43,015 0.23<br />

1.0736% 25/02/2035<br />

Structured Adj Rate Mtg Ln Tr<br />

594,282 38,747 0.21<br />

1.3936% 25/09/2034<br />

Structured Adj Rate Mtg Ln Tr<br />

1,153,880 75,233 0.40<br />

2.1436% 25/09/2034<br />

Structured Asset Invt Ln Tr<br />

202,375 13,195 0.07<br />

4.7936% 25/10/2033<br />

Structured Asset Invt Ln Tr<br />

52,207 3,404 0.02<br />

BC13 2.9186% 25/11/2033<br />

Structured Asset Mortgage<br />

Investment 1.4846%<br />

380,465 24,806 0.13<br />

19/03/2034<br />

Structured Asset Mortgage<br />

Investment 1.4846%<br />

771,100 97,853 0.53<br />

19/10/2034<br />

Structured Asset Secs Corp<br />

721,802 91,597 0.49<br />

0.9936% 25/12/2033<br />

Structured Asset Secs Corp<br />

1,100,039 387,544 2.08<br />

1.2436% 25/04/2034<br />

Structured Asset Secs Corp<br />

454,305 57,651 0.31<br />

1.2936% 25/12/2033<br />

Structured Asset Secs Corp<br />

344,348 22,451 0.12<br />

1.3936% 25/03/2034<br />

Structured Asset Secs Corp<br />

429,744 28,019 0.15<br />

1.3936% 25/07/2034<br />

Structured Asset Secs Corp<br />

885,835 57,756 0.31<br />

1.4936% 25/08/2034<br />

Structured Asset Secs Corp<br />

2,103,417 137,143 0.74<br />

2.10722% 25/12/2033 354,554 23,117 0.12<br />

217