Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Prospetto di composizione del portafoglio titoli e altre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

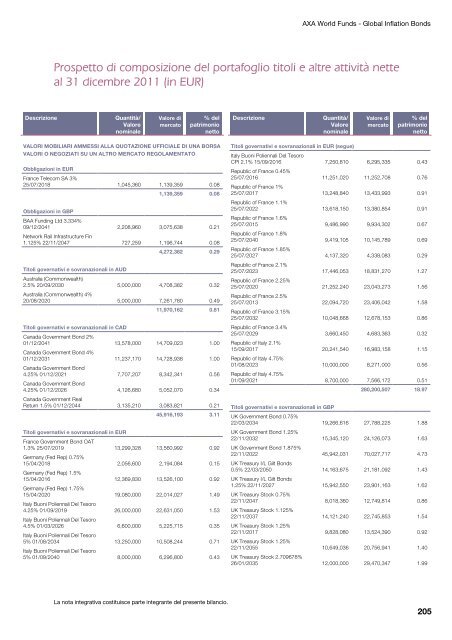

AXA World Funds - Global Inflation Bonds<br />

<strong>Prospetto</strong> <strong>di</strong> <strong>composizione</strong> <strong>del</strong> <strong>portafoglio</strong> <strong>titoli</strong> e <strong>altre</strong> attività nette<br />

al 31 <strong>di</strong>cembre 2011 (in EUR)<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

VALORI MOBILIARI AMMESSI ALLA QUOTAZIONE UFFICIALE DI UNA BORSA<br />

VALORI O NEGOZIATI SU UN ALTRO MERCATO REGOLAMENTATO<br />

Obbligazioni in EUR<br />

France Telecom SA 3%<br />

25/07/2018 1,045,360 1,139,359 0.08<br />

1,139,359 0.08<br />

Obbligazioni in GBP<br />

BAA Fun<strong>di</strong>ng Ltd 3.334%<br />

09/12/2041<br />

Network Rail Infrastructure Fin<br />

2,208,960 3,075,638 0.21<br />

1.125% 22/11/2047 727,259 1,196,744 0.08<br />

4,272,382 0.29<br />

Titoli governativi e sovranazionali in AUD<br />

Australia (Commonwealth)<br />

2.5% 20/09/2030<br />

Australia (Commonwealth) 4%<br />

5,000,000 4,708,382 0.32<br />

20/08/2020 5,000,000 7,261,780 0.49<br />

11,970,162 0.81<br />

Titoli governativi e sovranazionali in CAD<br />

Canada Government Bond 2%<br />

01/12/2041<br />

Canada Government Bond 4%<br />

13,578,000 14,709,023 1.00<br />

01/12/2031<br />

Canada Government Bond<br />

11,237,170 14,728,938 1.00<br />

4.25% 01/12/2021<br />

Canada Government Bond<br />

7,707,207 8,342,341 0.56<br />

4.25% 01/12/2026<br />

Canada Government Real<br />

4,126,680 5,052,070 0.34<br />

Return 1.5% 01/12/2044 3,135,210 3,083,821 0.21<br />

45,916,193 3.11<br />

Titoli governativi e sovranazionali in EUR<br />

France Government Bond OAT<br />

1.3% 25/07/2019<br />

Germany (Fed Rep) 0.75%<br />

13,299,328 13,560,992 0.92<br />

15/04/2018<br />

Germany (Fed Rep) 1.5%<br />

2,056,600 2,194,084 0.15<br />

15/04/2016<br />

Germany (Fed Rep) 1.75%<br />

12,369,830 13,526,100 0.92<br />

15/04/2020<br />

Italy Buoni Poliennali Del Tesoro<br />

19,080,000 22,014,027 1.49<br />

4.25% 01/09/2019<br />

Italy Buoni Poliennali Del Tesoro<br />

26,000,000 22,631,050 1.53<br />

4.5% 01/03/2026<br />

Italy Buoni Poliennali Del Tesoro<br />

6,600,000 5,225,715 0.35<br />

5% 01/08/2034<br />

Italy Buoni Poliennali Del Tesoro<br />

13,250,000 10,508,244 0.71<br />

5% 01/09/2040 8,000,000 6,296,800 0.43<br />

La nota integrativa costituisce parte integrante <strong>del</strong> presente bilancio.<br />

Descrizione Quantità/<br />

Valore<br />

nominale<br />

Valore <strong>di</strong><br />

mercato<br />

% <strong>del</strong><br />

patrimonio<br />

netto<br />

Titoli governativi e sovranazionali in EUR (segue)<br />

Italy Buoni Poliennali Del Tesoro<br />

CPI 2.1% 15/09/2016<br />

Republic of France 0.45%<br />

7,250,810 6,295,335 0.43<br />

25/07/2016<br />

Republic of France 1%<br />

11,251,020 11,252,708 0.76<br />

25/07/2017<br />

Republic of France 1.1%<br />

13,248,840 13,433,993 0.91<br />

25/07/2022<br />

Republic of France 1.6%<br />

13,618,150 13,380,854 0.91<br />

25/07/2015<br />

Republic of France 1.8%<br />

9,486,990 9,934,302 0.67<br />

25/07/2040<br />

Republic of France 1.85%<br />

9,419,105 10,145,789 0.69<br />

25/07/2027<br />

Republic of France 2.1%<br />

4,137,320 4,338,083 0.29<br />

25/07/2023<br />

Republic of France 2.25%<br />

17,446,053 18,831,270 1.27<br />

25/07/2020<br />

Republic of France 2.5%<br />

21,252,240 23,043,273 1.56<br />

25/07/2013<br />

Republic of France 3.15%<br />

22,094,720 23,406,042 1.58<br />

25/07/2032<br />

Republic of France 3.4%<br />

10,048,668 12,678,153 0.86<br />

25/07/2029<br />

Republic of Italy 2.1%<br />

3,660,450 4,683,363 0.32<br />

15/09/2017<br />

Republic of Italy 4.75%<br />

20,241,540 16,983,158 1.15<br />

01/08/2023<br />

Republic of Italy 4.75%<br />

10,000,000 8,271,000 0.56<br />

01/09/2021 8,700,000 7,566,172 0.51<br />

280,200,507 18.97<br />

Titoli governativi e sovranazionali in GBP<br />

UK Government Bond 0.75%<br />

22/03/2034<br />

UK Government Bond 1.25%<br />

19,266,616 27,788,225 1.88<br />

22/11/2032<br />

UK Government Bond 1.875%<br />

15,345,120 24,126,073 1.63<br />

22/11/2022<br />

UK Treasury I/L Gilt Bonds<br />

45,942,031 70,027,717 4.73<br />

0.5% 22/03/2050<br />

UK Treasury I/L Gilt Bonds<br />

14,163,675 21,181,092 1.43<br />

1.25% 22/11/2027<br />

UK Treasury Stock 0.75%<br />

15,942,550 23,901,163 1.62<br />

22/11/2047<br />

UK Treasury Stock 1.125%<br />

8,018,360 12,749,814 0.86<br />

22/11/2037<br />

UK Treasury Stock 1.25%<br />

14,121,240 22,745,853 1.54<br />

22/11/2017<br />

UK Treasury Stock 1.25%<br />

9,828,080 13,524,390 0.92<br />

22/11/2055<br />

UK Treasury Stock 2.709678%<br />

10,649,036 20,756,941 1.40<br />

26/01/2035 12,000,000 29,470,347 1.99<br />

205