sectoral economic costs and benefits of ghg mitigation - IPCC

sectoral economic costs and benefits of ghg mitigation - IPCC

sectoral economic costs and benefits of ghg mitigation - IPCC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fossil Fuels<br />

<strong>of</strong> the first Kyoto commitment period. It is assumed that non-conventional sources will begin to<br />

supplement conventional sources in order to meet dem<strong>and</strong> – <strong>and</strong> non-conventional reserves are<br />

certainly anticipated to exist in sufficient quantities to supply dem<strong>and</strong> growth. However,<br />

production <strong>and</strong> consumption <strong>of</strong> non-convention fuels are significantly more carbon-intensive<br />

than conventional fuels. If governments choose to impose broadly based carbon charges as a<br />

means <strong>of</strong> limiting overall emissions, development <strong>of</strong> non-conventional sources would certainly<br />

be deferred (even more so if governments preferentially imposed charge on new investment in<br />

non-conventional oil). Under such a scenario, the overall dem<strong>and</strong> for conventional supplies<br />

would be expected to rise even more rapidly – <strong>and</strong> volumes from Middle-East exporting<br />

countries could remain high through the next several decades 1 .<br />

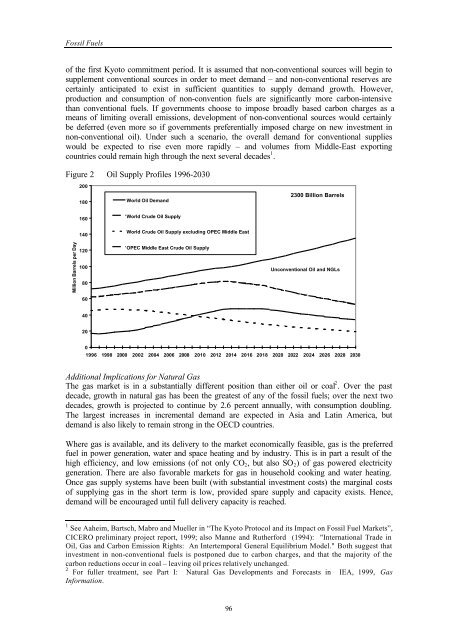

Figure 2 Oil Supply Pr<strong>of</strong>iles 1996-2030<br />

200<br />

180<br />

World Oil Dem<strong>and</strong><br />

2300 Billion Barrels<br />

160<br />

World Crude Oil Supply<br />

140<br />

World Crude Oil Supply excluding OPEC Middle East<br />

Million Barrels per Day<br />

120<br />

100<br />

80<br />

OPEC Middle East Crude Oil Supply<br />

Unconventional Oil <strong>and</strong> NGLs<br />

60<br />

40<br />

20<br />

0<br />

1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 2024 2026 2028 2030<br />

Additional Implications for Natural Gas<br />

The gas market is in a substantially different position than either oil or coal 2 . Over the past<br />

decade, growth in natural gas has been the greatest <strong>of</strong> any <strong>of</strong> the fossil fuels; over the next two<br />

decades, growth is projected to continue by 2.6 percent annually, with consumption doubling.<br />

The largest increases in incremental dem<strong>and</strong> are expected in Asia <strong>and</strong> Latin America, but<br />

dem<strong>and</strong> is also likely to remain strong in the OECD countries.<br />

Where gas is available, <strong>and</strong> its delivery to the market <strong>economic</strong>ally feasible, gas is the preferred<br />

fuel in power generation, water <strong>and</strong> space heating <strong>and</strong> by industry. This is in part a result <strong>of</strong> the<br />

high efficiency, <strong>and</strong> low emissions (<strong>of</strong> not only CO 2 , but also SO 2 ) <strong>of</strong> gas powered electricity<br />

generation. There are also favorable markets for gas in household cooking <strong>and</strong> water heating.<br />

Once gas supply systems have been built (with substantial investment <strong>costs</strong>) the marginal <strong>costs</strong><br />

<strong>of</strong> supplying gas in the short term is low, provided spare supply <strong>and</strong> capacity exists. Hence,<br />

dem<strong>and</strong> will be encouraged until full delivery capacity is reached.<br />

1 See Aaheim, Bartsch, Mabro <strong>and</strong> Mueller in “The Kyoto Protocol <strong>and</strong> its Impact on Fossil Fuel Markets”,<br />

CICERO preliminary project report, 1999; also Manne <strong>and</strong> Rutherford (1994): "International Trade in<br />

Oil, Gas <strong>and</strong> Carbon Emission Rights: An Intertemporal General Equilibrium Model." Both suggest that<br />

investment in non-conventional fuels is postponed due to carbon charges, <strong>and</strong> that the majority <strong>of</strong> the<br />

carbon reductions occur in coal – leaving oil prices relatively unchanged.<br />

2 For fuller treatment, see Part I: Natural Gas Developments <strong>and</strong> Forecasts in IEA, 1999, Gas<br />

Information.<br />

96