sectoral economic costs and benefits of ghg mitigation - IPCC

sectoral economic costs and benefits of ghg mitigation - IPCC

sectoral economic costs and benefits of ghg mitigation - IPCC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fossil Fuels<br />

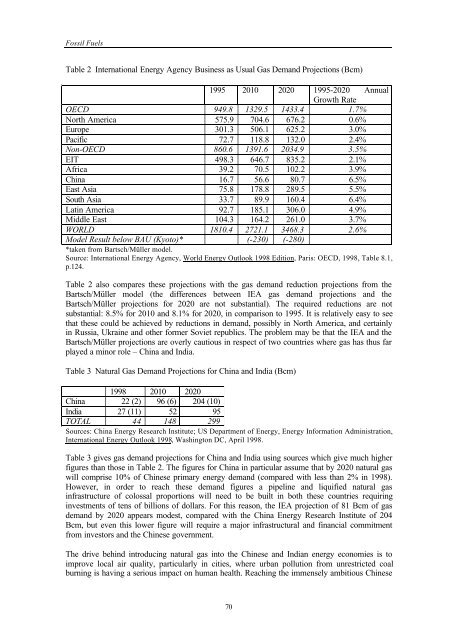

Table 2 International Energy Agency Business as Usual Gas Dem<strong>and</strong> Projections (Bcm)<br />

1995 2010 2020 1995-2020 Annual<br />

Growth Rate<br />

OECD 949.8 1329.5 1433.4 1.7%<br />

North America 575.9 704.6 676.2 0.6%<br />

Europe 301.3 506.1 625.2 3.0%<br />

Pacific 72.7 118.8 132.0 2.4%<br />

Non-OECD 860.6 1391.6 2034.9 3.5%<br />

EIT 498.3 646.7 835.2 2.1%<br />

Africa 39.2 70.5 102.2 3.9%<br />

China 16.7 56.6 80.7 6.5%<br />

East Asia 75.8 178.8 289.5 5.5%<br />

South Asia 33.7 89.9 160.4 6.4%<br />

Latin America 92.7 185.1 306.0 4.9%<br />

Middle East 104.3 164.2 261.0 3.7%<br />

WORLD 1810.4 2721.1 3468.3 2.6%<br />

Model Result below BAU (Kyoto)* (-230) (-280)<br />

*taken from Bartsch/Müller model.<br />

Source: International Energy Agency, World Energy Outlook 1998 Edition, Paris: OECD, 1998, Table 8.1,<br />

p.124.<br />

Table 2 also compares these projections with the gas dem<strong>and</strong> reduction projections from the<br />

Bartsch/Müller model (the differences between IEA gas dem<strong>and</strong> projections <strong>and</strong> the<br />

Bartsch/Müller projections for 2020 are not substantial). The required reductions are not<br />

substantial: 8.5% for 2010 <strong>and</strong> 8.1% for 2020, in comparison to 1995. It is relatively easy to see<br />

that these could be achieved by reductions in dem<strong>and</strong>, possibly in North America, <strong>and</strong> certainly<br />

in Russia, Ukraine <strong>and</strong> other former Soviet republics. The problem may be that the IEA <strong>and</strong> the<br />

Bartsch/Müller projections are overly cautious in respect <strong>of</strong> two countries where gas has thus far<br />

played a minor role – China <strong>and</strong> India.<br />

Table 3 Natural Gas Dem<strong>and</strong> Projections for China <strong>and</strong> India (Bcm)<br />

1998 2010 2020<br />

China 22 (2) 96 (6) 204 (10)<br />

India 27 (11) 52 95<br />

TOTAL 44 148 299<br />

Sources: China Energy Research Institute; US Department <strong>of</strong> Energy, Energy Information Administration,<br />

International Energy Outlook 1998, Washington DC, April 1998.<br />

Table 3 gives gas dem<strong>and</strong> projections for China <strong>and</strong> India using sources which give much higher<br />

figures than those in Table 2. The figures for China in particular assume that by 2020 natural gas<br />

will comprise 10% <strong>of</strong> Chinese primary energy dem<strong>and</strong> (compared with less than 2% in 1998).<br />

However, in order to reach these dem<strong>and</strong> figures a pipeline <strong>and</strong> liquified natural gas<br />

infrastructure <strong>of</strong> colossal proportions will need to be built in both these countries requiring<br />

investments <strong>of</strong> tens <strong>of</strong> billions <strong>of</strong> dollars. For this reason, the IEA projection <strong>of</strong> 81 Bcm <strong>of</strong> gas<br />

dem<strong>and</strong> by 2020 appears modest, compared with the China Energy Research Institute <strong>of</strong> 204<br />

Bcm, but even this lower figure will require a major infrastructural <strong>and</strong> financial commitment<br />

from investors <strong>and</strong> the Chinese government.<br />

The drive behind introducing natural gas into the Chinese <strong>and</strong> Indian energy economies is to<br />

improve local air quality, particularly in cities, where urban pollution from unrestricted coal<br />

burning is having a serious impact on human health. Reaching the immensely ambitious Chinese<br />

70