Untitled - University of New Orleans

Untitled - University of New Orleans

Untitled - University of New Orleans

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

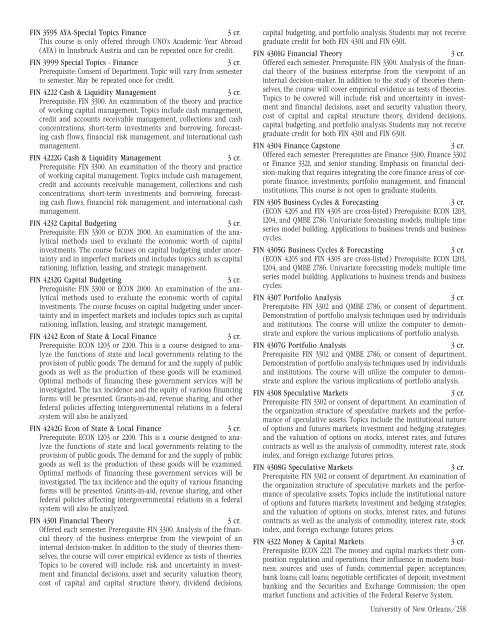

FIN 3595 AYA-Special Topics Finance<br />

3 cr.<br />

This course is only <strong>of</strong>fered through UNO’s Academic Year Abroad<br />

(AYA) in Innsbruck Austria and can be repeated once for credit.<br />

FIN 3999 Special Topics - Finance<br />

3 cr.<br />

Prerequisite: Consent <strong>of</strong> Department. Topic will vary from semester<br />

to semester. May be repeated once for credit.<br />

FIN 4222 Cash & Liquidity Management<br />

3 cr.<br />

Prerequisite: FIN 3300. An examination <strong>of</strong> the theory and practice<br />

<strong>of</strong> working capital management. Topics include cash management,<br />

credit and accounts receivable management, collections and cash<br />

concentrations, short-term investments and borrowing, forecasting<br />

cash flows, financial risk management, and international cash<br />

management.<br />

FIN 4222G Cash & Liquidity Management<br />

3 cr.<br />

Prerequisite: FIN 3300. An examination <strong>of</strong> the theory and practice<br />

<strong>of</strong> working capital management. Topics include cash management,<br />

credit and accounts receivable management, collections and cash<br />

concentrations, short-term investments and borrowing, forecasting<br />

cash flows, financial risk management, and international cash<br />

management.<br />

FIN 4232 Capital Budgeting<br />

3 cr.<br />

Prerequisite: FIN 3300 or ECON 2000. An examination <strong>of</strong> the analytical<br />

methods used to evaluate the economic worth <strong>of</strong> capital<br />

investments. The course focuses on capital budgeting under uncertainty<br />

and in imperfect markets and includes topics such as capital<br />

rationing, inflation, leasing, and strategic management.<br />

FIN 4232G Capital Budgeting<br />

3 cr.<br />

Prerequisite: FIN 3300 or ECON 2000. An examination <strong>of</strong> the analytical<br />

methods used to evaluate the economic worth <strong>of</strong> capital<br />

investments. The course focuses on capital budgeting under uncertainty<br />

and in imperfect markets and includes topics such as capital<br />

rationing, inflation, leasing, and strategic management.<br />

FIN 4242 Econ <strong>of</strong> State & Local Finance<br />

3 cr.<br />

Prerequisite: ECON 1203 or 2200. This is a course designed to analyze<br />

the functions <strong>of</strong> state and local governments relating to the<br />

provision <strong>of</strong> public goods. The demand for and the supply <strong>of</strong> public<br />

goods as well as the production <strong>of</strong> these goods will be examined.<br />

Optimal methods <strong>of</strong> financing these government services will be<br />

investigated. The tax incidence and the equity <strong>of</strong> various financing<br />

forms will be presented. Grants-in-aid, revenue sharing, and other<br />

federal policies affecting intergovernmental relations in a federal<br />

system will also be analyzed.<br />

FIN 4242G Econ <strong>of</strong> State & Local Finance<br />

3 cr.<br />

Prerequisite: ECON 1203 or 2200. This is a course designed to analyze<br />

the functions <strong>of</strong> state and local governments relating to the<br />

provision <strong>of</strong> public goods. The demand for and the supply <strong>of</strong> public<br />

goods as well as the production <strong>of</strong> these goods will be examined.<br />

Optimal methods <strong>of</strong> financing these government services will be<br />

investigated. The tax incidence and the equity <strong>of</strong> various financing<br />

forms will be presented. Grants-in-aid, revenue sharing, and other<br />

federal policies affecting intergovernmental relations in a federal<br />

system will also be analyzed.<br />

FIN 4301 Financial Theory<br />

3 cr.<br />

Offered each semester. Prerequisite: FIN 3300. Analysis <strong>of</strong> the financial<br />

theory <strong>of</strong> the business enterprise from the viewpoint <strong>of</strong> an<br />

internal decision-maker. In addition to the study <strong>of</strong> theories themselves,<br />

the course will cover empirical evidence as tests <strong>of</strong> theories.<br />

Topics to be covered will include: risk and uncertainty in investment<br />

and financial decisions, asset and security valuation theory,<br />

cost <strong>of</strong> capital and capital structure theory, dividend decisions,<br />

capital budgeting, and portfolio analysis. Students may not receive<br />

graduate credit for both FIN 4301 and FIN 6301.<br />

FIN 4301G Financial Theory<br />

3 cr.<br />

Offered each semester. Prerequisite: FIN 3300. Analysis <strong>of</strong> the financial<br />

theory <strong>of</strong> the business enterprise from the viewpoint <strong>of</strong> an<br />

internal decision-maker. In addition to the study <strong>of</strong> theories themselves,<br />

the course will cover empirical evidence as tests <strong>of</strong> theories.<br />

Topics to be covered will include: risk and uncertainty in investment<br />

and financial decisions, asset and security valuation theory,<br />

cost <strong>of</strong> capital and capital structure theory, dividend decisions,<br />

capital budgeting, and portfolio analysis. Students may not receive<br />

graduate credit for both FIN 4301 and FIN 6301.<br />

FIN 4304 Finance Capstone<br />

3 cr.<br />

Offered each semester. Prerequisites are Finance 3300, Finance 3302<br />

or Finance 3321, and senior standing. Emphasis on financial decision-making<br />

that requires integrating the core finance areas <strong>of</strong> corporate<br />

finance, investments, portfolio management, and financial<br />

institutions. This course is not open to graduate students.<br />

FIN 4305 Business Cycles & Forecasting<br />

3 cr.<br />

(ECON 4205 and FIN 4305 are cross-listed) Prerequisite: ECON 1203,<br />

1204, and QMBE 2786. Univariate forecasting models; multiple time<br />

series model building. Applications to business trends and business<br />

cycles.<br />

FIN 4305G Business Cycles & Forecasting<br />

3 cr.<br />

(ECON 4205 and FIN 4305 are cross-listed) Prerequisite: ECON 1203,<br />

1204, and QMBE 2786. Univariate forecasting models; multiple time<br />

series model building. Applications to business trends and business<br />

cycles.<br />

FIN 4307 Portfolio Analysis<br />

3 cr.<br />

Prerequisite: FIN 3302 and QMBE 2786, or consent <strong>of</strong> department.<br />

Demonstration <strong>of</strong> portfolio analysis techniques used by individuals<br />

and institutions. The course will utilize the computer to demonstrate<br />

and explore the various implications <strong>of</strong> portfolio analysis.<br />

FIN 4307G Portfolio Analysis<br />

3 cr.<br />

Prerequisite: FIN 3302 and QMBE 2786, or consent <strong>of</strong> department.<br />

Demonstration <strong>of</strong> portfolio analysis techniques used by individuals<br />

and institutions. The course will utilize the computer to demonstrate<br />

and explore the various implications <strong>of</strong> portfolio analysis.<br />

FIN 4308 Speculative Markets<br />

3 cr.<br />

Prerequisite: FIN 3302 or consent <strong>of</strong> department. An examination <strong>of</strong><br />

the organization structure <strong>of</strong> speculative markets and the performance<br />

<strong>of</strong> speculative assets. Topics include the institutional nature<br />

<strong>of</strong> options and futures markets; investment and hedging strategies;<br />

and the valuation <strong>of</strong> options on stocks, interest rates, and futures<br />

contracts as well as the analysis <strong>of</strong> commodity, interest rate, stock<br />

index, and foreign exchange futures prices.<br />

FIN 4308G Speculative Markets<br />

3 cr.<br />

Prerequisite: FIN 3302 or consent <strong>of</strong> department. An examination <strong>of</strong><br />

the organization structure <strong>of</strong> speculative markets and the performance<br />

<strong>of</strong> speculative assets. Topics include the institutional nature<br />

<strong>of</strong> options and futures markets; investment and hedging strategies;<br />

and the valuation <strong>of</strong> options on stocks, interest rates, and futures<br />

contracts as well as the analysis <strong>of</strong> commodity, interest rate, stock<br />

index, and foreign exchange futures prices.<br />

FIN 4322 Money & Capital Markets<br />

3 cr.<br />

Prerequisite: ECON 2221. The money and capital markets their composition<br />

regulation and operations; their influence in modern business;<br />

sources and uses <strong>of</strong> funds; commercial paper; acceptances;<br />

bank loans; call loans; negotiable certificates <strong>of</strong> deposit; investment<br />

banking and the Securities and Exchange Commission; the open<br />

market functions and activities <strong>of</strong> the Federal Reserve System.<br />

<strong>University</strong> <strong>of</strong> <strong>New</strong> <strong>Orleans</strong>/258