Untitled - University of New Orleans

Untitled - University of New Orleans

Untitled - University of New Orleans

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

systems concepts.<br />

• Students will demonstrate a pr<strong>of</strong>iciency in governmental accounting<br />

concepts.<br />

• Graduates will demonstrate the effective use <strong>of</strong> computers and information<br />

technology.<br />

• Graduates will demonstrate a pr<strong>of</strong>iciency in conducting auditing,<br />

financial accounting, and tax research.<br />

• The Department will <strong>of</strong>fer an academic program that is flexible for<br />

our students, given our resources.<br />

Accreditation<br />

In addition to college-wide accreditation, the Bachelor <strong>of</strong> Science<br />

in Accounting and the Master <strong>of</strong> Science in Accounting programs are<br />

separately accredited by AACSB International.<br />

Admissions Requirements<br />

College <strong>of</strong> Business Administration students are eligible to declare a<br />

major in accounting if they have thirty semester hours earned and an<br />

overall average <strong>of</strong> 2.2 or higher on all work taken prior to declaring<br />

an accounting major.<br />

The Department <strong>of</strong> Accounting ordinarily requires 15 hours <strong>of</strong><br />

accounting courses to be taken in residence at UNO in order to receive<br />

an undergraduate degree in accounting. The accounting faculty<br />

strongly urges students with less than a 3.0 GPA not to take more than<br />

six hours <strong>of</strong> accounting per semester.<br />

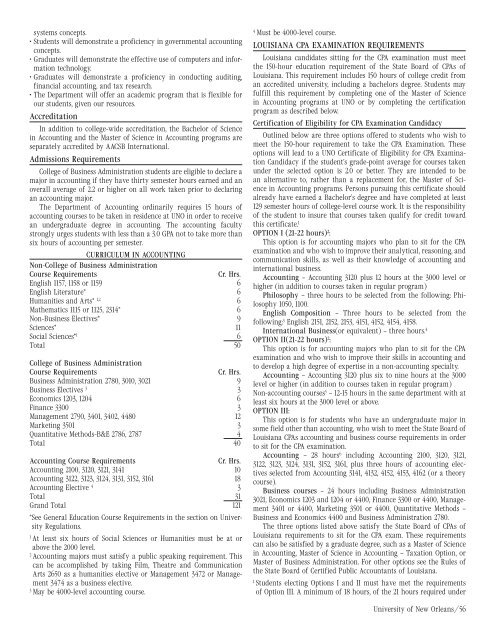

CURRICULUM IN ACCOUNTING<br />

Non-College <strong>of</strong> Business Administration<br />

Course Requirements<br />

Cr. Hrs.<br />

English 1157, 1158 or 1159 6<br />

English Literature* 6<br />

Humanities and Arts* 1,2 6<br />

Mathematics 1115 or 1125, 2314* 6<br />

Non-Business Electives* 9<br />

Sciences* 11<br />

Social Sciences* 1 6<br />

Total 50<br />

College <strong>of</strong> Business Administration<br />

Course Requirements<br />

Cr. Hrs.<br />

Business Administration 2780, 3010, 3021 9<br />

Business Electives 3 3<br />

Economics 1203, 1204 6<br />

Finance 3300 3<br />

Management 2790, 3401, 3402, 4480 12<br />

Marketing 3501 3<br />

Quantitative Methods-B&E 2786, 2787 4<br />

Total 40<br />

Accounting Course Requirements<br />

Cr. Hrs.<br />

Accounting 2100, 3120, 3121, 3141 10<br />

Accounting 3122, 3123, 3124, 3131, 3152, 3161 18<br />

Accounting Elective 4 3<br />

Total 31<br />

Grand Total 121<br />

*See General Education Course Requirements in the section on <strong>University</strong><br />

Regulations.<br />

1<br />

At <br />

least six hours <strong>of</strong> Social Sciences or Humanities must be at or<br />

above the 2000 level.<br />

2<br />

Accounting majors must satisfy a public speaking requirement. This<br />

can be accomplished by taking Film, Theatre and Communication<br />

Arts 2650 as a humanities elective or Management 3472 or Management<br />

3474 as a business elective.<br />

3<br />

May be 4000-level accounting course.<br />

4<br />

Must be 4000-level course.<br />

LOUISIANA CPA EXAMINATION REQUIREMENTS<br />

Louisiana candidates sitting for the CPA examination must meet<br />

the 150-hour education requirement <strong>of</strong> the State Board <strong>of</strong> CPAs <strong>of</strong><br />

Louisiana. This requirement includes 150 hours <strong>of</strong> college credit from<br />

an accredited university, including a bachelors degree. Students may<br />

fulfill this requirement by completing one <strong>of</strong> the Master <strong>of</strong> Science<br />

in Accounting programs at UNO or by completing the certification<br />

program as described below.<br />

Certification <strong>of</strong> Eligibility for CPA Examination Candidacy<br />

Outlined below are three options <strong>of</strong>fered to students who wish to<br />

meet the 150-hour requirement to take the CPA Examination. These<br />

options will lead to a UNO Certificate <strong>of</strong> Eligibility for CPA Examination<br />

Candidacy if the student’s grade-point average for courses taken<br />

under the selected option is 2.0 or better. They are intended to be<br />

an alternative to, rather than a replacement for, the Master <strong>of</strong> Science<br />

in Accounting programs. Persons pursuing this certificate should<br />

already have earned a Bachelor’s degree and have completed at least<br />

129 semester hours <strong>of</strong> college-level course work. It is the responsibility<br />

<strong>of</strong> the student to insure that courses taken qualify for credit toward<br />

this certificate. 1<br />

OPTION I (21-22 hours) 2 :<br />

This option is for accounting majors who plan to sit for the CPA<br />

examination and who wish to improve their analytical, reasoning, and<br />

communication skills, as well as their knowledge <strong>of</strong> accounting and<br />

international business.<br />

Accounting – Accounting 3120 plus 12 hours at the 3000 level or<br />

higher (in addition to courses taken in regular program)<br />

Philosophy – three hours to be selected from the following: Philosophy<br />

1050, 1100.<br />

English Composition – Three hours to be selected from the<br />

following: 3 English 2151, 2152, 2153, 4151, 4152, 4154, 4158.<br />

International Business(or equivalent) – three hours. 4<br />

OPTION II(21-22 hours) 2 :<br />

This option is for accounting majors who plan to sit for the CPA<br />

examination and who wish to improve their skills in accounting and<br />

to develop a high degree <strong>of</strong> expertise in a non-accounting specialty.<br />

Accounting – Accounting 3120 plus six to nine hours at the 3000<br />

level or higher (in addition to courses taken in regular program)<br />

Non-accounting courses 5 – 12-15 hours in the same department with at<br />

least six hours at the 3000 level or above.<br />

OPTION III:<br />

This option is for students who have an undergraduate major in<br />

some field other than accounting, who wish to meet the State Board <strong>of</strong><br />

Louisiana CPAs accounting and business course requirements in order<br />

to sit for the CPA examination.<br />

Accounting – 28 hours 6 including Accounting 2100, 3120, 3121,<br />

3122, 3123, 3124, 3131, 3152, 3161, plus three hours <strong>of</strong> accounting electives<br />

selected from Accounting 3141, 4132, 4152, 4153, 4162 (or a theory<br />

course).<br />

Business courses – 24 hours including Business Administration<br />

3021, Economics 1203 and 1204 or 4400, Finance 3300 or 4400, Management<br />

3401 or 4400, Marketing 3501 or 4400, Quantitative Methods –<br />

Business and Economics 4400 and Business Administration 2780.<br />

The three options listed above satisfy the State Board <strong>of</strong> CPAs <strong>of</strong><br />

Louisiana requirements to sit for the CPA exam. These requirements<br />

can also be satisfied by a graduate degree, such as a Master <strong>of</strong> Science<br />

in Accounting, Master <strong>of</strong> Science in Accounting – Taxation Option, or<br />

Master <strong>of</strong> Business Administration. For other options see the Rules <strong>of</strong><br />

the State Board <strong>of</strong> Certified Public Accountants <strong>of</strong> Louisiana.<br />

1<br />

Students electing Options I and II must have met the requirements<br />

<strong>of</strong> Option III. A minimum <strong>of</strong> 18 hours, <strong>of</strong> the 21 hours required under<br />

<strong>University</strong> <strong>of</strong> <strong>New</strong> <strong>Orleans</strong>/56