Untitled - University of New Orleans

Untitled - University of New Orleans

Untitled - University of New Orleans

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

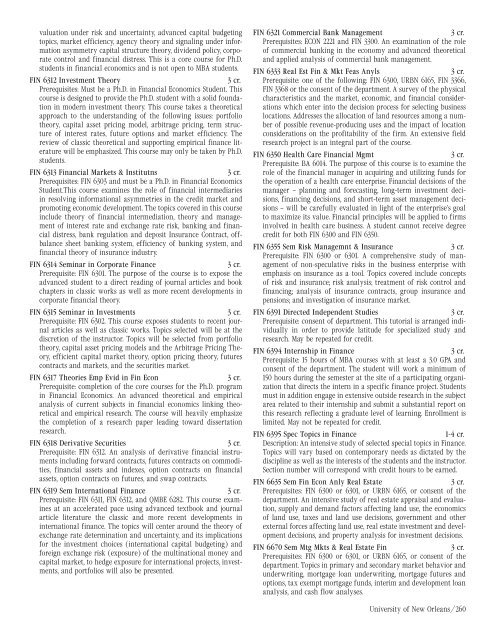

valuation under risk and uncertainty, advanced capital budgeting<br />

topics, market efficiency, agency theory and signaling under information<br />

asymmetry capital structure theory, dividend policy, corporate<br />

control and financial distress. This is a core course for Ph.D.<br />

students in financial economics and is not open to MBA students.<br />

FIN 6312 Investment Theory<br />

3 cr.<br />

Prerequisites: Must be a Ph.D. in Financial Economics Student. This<br />

course is designed to provide the Ph.D. student with a solid foundation<br />

in modern investment theory. This course takes a theoretical<br />

approach to the understanding <strong>of</strong> the following issues: portfolio<br />

theory, capital asset pricing model, arbitrage pricing, term structure<br />

<strong>of</strong> interest rates, future options and market efficiency. The<br />

review <strong>of</strong> classic theoretical and supporting empirical finance literature<br />

will be emphasized. This course may only be taken by Ph.D.<br />

students.<br />

FIN 6313 Financial Markets & Institutns<br />

3 cr.<br />

Prerequisites: FIN 6303 and must be a Ph.D. in Financial Economics<br />

Student.This course examines the role <strong>of</strong> financial intermediaries<br />

in resolving informational asymmetries in the credit market and<br />

promoting economic development. The topics covered in this course<br />

include theory <strong>of</strong> financial intermediation, theory and management<br />

<strong>of</strong> interest rate and exchange rate risk, banking and financial<br />

distress, bank regulation and deposit Insurance Contract, <strong>of</strong>fbalance<br />

sheet banking system, efficiency <strong>of</strong> banking system, and<br />

financial theory <strong>of</strong> insurance industry.<br />

FIN 6314 Seminar in Corporate Finance<br />

3 cr.<br />

Prerequisite: FIN 6301. The purpose <strong>of</strong> the course is to expose the<br />

advanced student to a direct reading <strong>of</strong> journal articles and book<br />

chapters in classic works as well as more recent developments in<br />

corporate financial theory.<br />

FIN 6315 Seminar in Investments<br />

3 cr.<br />

Prerequisite: FIN 6302. This course exposes students to recent journal<br />

articles as well as classic works. Topics selected will be at the<br />

discretion <strong>of</strong> the instructor. Topics will be selected from portfolio<br />

theory, capital asset pricing models and the Arbitrage Pricing Theory,<br />

efficient capital market theory, option pricing theory, futures<br />

contracts and markets, and the securities market.<br />

FIN 6317 Theories Emp Evid in Fin Econ<br />

3 cr.<br />

Prerequisite: completion <strong>of</strong> the core courses for the Ph.D. program<br />

in Financial Economics. An advanced theoretical and empirical<br />

analysis <strong>of</strong> current subjects in financial economics linking theoretical<br />

and empirical research. The course will heavily emphasize<br />

the completion <strong>of</strong> a research paper leading toward dissertation<br />

research.<br />

FIN 6318 Derivative Securities<br />

3 cr.<br />

Prerequisite: FIN 6312. An analysis <strong>of</strong> derivative financial instruments<br />

including forward contracts, futures contracts on commodities,<br />

financial assets and indexes, option contracts on financial<br />

assets, option contracts on futures, and swap contracts.<br />

FIN 6319 Sem International Finance<br />

3 cr.<br />

Prerequisite: FIN 6311, FIN 6312, and QMBE 6282. This course examines<br />

at an accelerated pace using advanced textbook and journal<br />

article literature the classic and more recent developments in<br />

international finance. The topics will center around the theory <strong>of</strong><br />

exchange rate determination and uncertainty, and its implications<br />

for the investment choices (international capital budgeting) and<br />

foreign exchange risk (exposure) <strong>of</strong> the multinational money and<br />

capital market, to hedge exposure for international projects, investments,<br />

and portfolios will also be presented.<br />

FIN 6321 Commercial Bank Management<br />

3 cr.<br />

Prerequisites: ECON 2221 and FIN 3300. An examination <strong>of</strong> the role<br />

<strong>of</strong> commercial banking in the economy and advanced theoretical<br />

and applied analysis <strong>of</strong> commercial bank management.<br />

FIN 6333 Real Est Fin & Mkt Feas Anyls<br />

3 cr.<br />

Prerequisite: one <strong>of</strong> the following: FIN 6300, URBN 6165, FIN 3366,<br />

FIN 3368 or the consent <strong>of</strong> the department. A survey <strong>of</strong> the physical<br />

characteristics and the market, economic, and financial considerations<br />

which enter into the decision process for selecting business<br />

locations. Addresses the allocation <strong>of</strong> land resources among a number<br />

<strong>of</strong> possible revenue-producing uses and the impact <strong>of</strong> location<br />

considerations on the pr<strong>of</strong>itability <strong>of</strong> the firm. An extensive field<br />

research project is an integral part <strong>of</strong> the course.<br />

FIN 6350 Health Care Financial Mgmt<br />

3 cr.<br />

Prerequisite: BA 6014. The purpose <strong>of</strong> this course is to examine the<br />

role <strong>of</strong> the financial manager in acquiring and utilizing funds for<br />

the operation <strong>of</strong> a health care enterprise. Financial decisions <strong>of</strong> the<br />

manager – planning and forecasting, long-term investment decisions,<br />

financing decisions, and short-term asset management decisions<br />

– will be carefully evaluated in light <strong>of</strong> the enterprise’s goal<br />

to maximize its value. Financial principles will be applied to firms<br />

involved in health care business. A student cannot receive degree<br />

credit for both FIN 6300 and FIN 6350.<br />

FIN 6355 Sem Risk Managemnt & Insurance<br />

3 cr.<br />

Prerequisite: FIN 6300 or 6301. A comprehensive study <strong>of</strong> management<br />

<strong>of</strong> non-speculative risks in the business enterprise with<br />

emphasis on insurance as a tool. Topics covered include concepts<br />

<strong>of</strong> risk and insurance; risk analysis; treatment <strong>of</strong> risk control and<br />

financing; analysis <strong>of</strong> insurance contracts, group insurance and<br />

pensions; and investigation <strong>of</strong> insurance market.<br />

FIN 6391 Directed Independent Studies<br />

3 cr.<br />

Prerequisite: consent <strong>of</strong> department. This tutorial is arranged individually<br />

in order to provide latitude for specialized study and<br />

research. May be repeated for credit.<br />

FIN 6394 Internship in Finance<br />

3 cr.<br />

Prerequisite: 15 hours <strong>of</strong> MBA courses with at least a 3.0 GPA and<br />

consent <strong>of</strong> the department. The student will work a minimum <strong>of</strong><br />

150 hours during the semester at the site <strong>of</strong> a participating organization<br />

that directs the intern in a specific finance project. Students<br />

must in addition engage in extensive outside research in the subject<br />

area related to their internship and submit a substantial report on<br />

this research reflecting a graduate level <strong>of</strong> learning. Enrollment is<br />

limited. May not be repeated for credit.<br />

FIN 6395 Spec Topics in Finance<br />

1-4 cr.<br />

Description: An intensive study <strong>of</strong> selected special topics in Finance.<br />

Topics will vary based on contemporary needs as dictated by the<br />

discipline as well as the interests <strong>of</strong> the students and the instructor.<br />

Section number will correspond with credit hours to be earned.<br />

FIN 6635 Sem Fin Econ Anly Real Estate<br />

3 cr.<br />

Prerequisites: FIN 6300 or 6301, or URBN 6165, or consent <strong>of</strong> the<br />

department. An intensive study <strong>of</strong> real estate appraisal and evaluation,<br />

supply and demand factors affecting land use, the economics<br />

<strong>of</strong> land use, taxes and land use decisions, government and other<br />

external forces affecting land use, real estate investment and development<br />

decisions, and property analysis for investment decisions.<br />

FIN 6670 Sem Mtg Mkts & Real Estate Fin<br />

3 cr.<br />

Prerequisites: FIN 6300 or 6301, or URBN 6165, or consent <strong>of</strong> the<br />

department. Topics in primary and secondary market behavior and<br />

underwriting, mortgage loan underwriting, mortgage futures and<br />

options, tax exempt mortgage funds, interim and development loan<br />

analysis, and cash flow analyses.<br />

<strong>University</strong> <strong>of</strong> <strong>New</strong> <strong>Orleans</strong>/260