- Page 1:

Please note The text in this file h

- Page 4 and 5:

Swinburne University of Technology

- Page 6:

Sections General University Informa

- Page 9 and 10:

A Coat ofArms A proud history Ll Th

- Page 12:

General enquiries: 9215 7000 The Li

- Page 15 and 16:

UNION STREET SHOPS PRIVATE HWSES CA

- Page 17 and 18:

P UNIMRSIN COUNCIL J Membership as

- Page 19 and 20:

g Corporate Services 3 Facilities a

- Page 21 and 22:

Swinburne University of Technology

- Page 23 and 24:

Swinburne University of Technology

- Page 25 and 26:

University Services 0 f Access Educ

- Page 27 and 28:

2 Lilydale campus 5 Richard O'Brien

- Page 29 and 30:

family status, impairment, religiou

- Page 31 and 32:

synthesizer and screen enlarger is

- Page 33 and 34:

9 Health Service (Hawthorn) Coordin

- Page 35 and 36:

expectation that it will better ref

- Page 37 and 38:

includes lawn-mowers, mulchers, whi

- Page 39 and 40:

committee format to plan and prepar

- Page 42 and 43:

~~ -~ Swinburne Centres Research Ce

- Page 44 and 45:

COTAR promoted and facilitates tech

- Page 46 and 47:

Centre for Innovation and Enterpris

- Page 48 and 49:

Centre for Social Research Chair Jo

- Page 50:

Undergraduate Courses: General Info

- Page 53 and 54:

Undergraduate courses Division of S

- Page 55 and 56:

Undergraduate courses Swinburne at

- Page 57 and 58:

Bachelor of Engineering BEng Chemic

- Page 59 and 60:

Detailed information on the extent

- Page 61 and 62:

(cooperative) format are considered

- Page 63 and 64:

5 3 - Prizes and Scholarships Divis

- Page 65 and 66:

scholarship for up to two years for

- Page 68:

Business, Humanities & Social Scien

- Page 71 and 72:

D.G. Vinen, DipEdwon), BEcwon), MAd

- Page 73 and 74:

$ School of Social and Behavioural

- Page 75 and 76:

fails fifty per cent or more of the

- Page 77 and 78:

@ NO61 Certificate in Commercial Ra

- Page 79 and 80:

Plus four electives chosen from the

- Page 81 and 82:

Subiects offered Stage 1 Core subje

- Page 83 and 84:

information. It should be noted tha

- Page 85 and 86:

AH201 Mind, Language and Thought AH

- Page 87 and 88:

society, economy and government in

- Page 89 and 90:

~055 Bachelor of Business The Bache

- Page 91 and 92:

Stage one (core subject) BLllO Lega

- Page 93 and 94:

Manufacturing Management The manufa

- Page 95 and 96:

A further two subjects from other d

- Page 97 and 98:

A065 Vietnamese AV103 Vietnamese 1A

- Page 99 and 100:

Duration The Bachelor of Arts(Honou

- Page 102:

Science, Engineering and Design Und

- Page 106 and 107:

School of Civil Engineering and Bui

- Page 108 and 109:

Industrial Research Institute Swinb

- Page 110 and 111:

The policy of the Divisional Board

- Page 112 and 113:

If a student elects not to sit for

- Page 114 and 115:

who would benefit from transfer to

- Page 116 and 117:

helping meet society's needs, such

- Page 118 and 119:

Student workload and credit point s

- Page 120 and 121:

Associate Diploma of Applied Scienc

- Page 122 and 123:

semesters), with the option of an a

- Page 124 and 125:

ES200 Object-Oriented Software Deve

- Page 126 and 127:

SM484 Experimental Design and Multi

- Page 128 and 129:

computer software covering programm

- Page 130 and 131:

Counselling 8.5 SP631 Neurophysiolo

- Page 132 and 133:

2031 Bachelor of Applied Science/ E

- Page 134 and 135:

ID403 ID404 ID405 Year 3 Semester 1

- Page 136 and 137:

C050 Bachelor of Engineering (Civil

- Page 138 and 139:

SK280 Software Design 10 SM233 Engi

- Page 140 and 141:

1990 syllabus (Students currently e

- Page 142 and 143:

Course strudure (proposed) 1997 Ful

- Page 144 and 145:

2044 Bachelor of Software Engineeri

- Page 146 and 147:

Course structure (1990 syllabus) Th

- Page 148:

Application procedure Refer to page

- Page 152 and 153:

Deputy Vice-Chancellor To be appoin

- Page 154 and 155:

Leave of Absence will be eligible f

- Page 156 and 157:

and the Internet, from their homes.

- Page 158 and 159:

In Stage three, subjects can be tak

- Page 160 and 161:

LBC303 Strategic Cost Management LB

- Page 162 and 163:

shown in entries for all psychology

- Page 164 and 165:

CONTENTS Postgraduate Courses: Gene

- Page 166 and 167:

Postg rad uate courses Division of

- Page 168 and 169:

Postgraduate courses Division of Sc

- Page 170 and 171:

Degree of Master Master of Applied

- Page 172:

Business, Humanities & Social Scien

- Page 175 and 176:

The course may be run 'in-house' fo

- Page 177 and 178:

to provide an entry to postgraduate

- Page 179 and 180:

to prepare students for entry level

- Page 181 and 182:

C entrepreneurs, but also to 'entre

- Page 183 and 184:

equired to complete appropriate sub

- Page 185 and 186:

considerable relevant experience an

- Page 187 and 188:

The program includes the following

- Page 189 and 190:

Master degrees NO91 Master of Arts

- Page 191 and 192:

language subjects and overall high

- Page 193 and 194:

Term 3 (10 weeks) BB804 Management

- Page 195 and 196:

Location Normally these classes wil

- Page 197 and 198:

i! m a n c 0 A090 Master of Busines

- Page 199 and 200:

entrepreneurial theory) and a secon

- Page 202 and 203:

Postgraduate course descriptions Gr

- Page 204 and 205:

Graduate Diplomas Z084 Graduate Dip

- Page 206 and 207:

the Graduate Certificate in Social

- Page 208 and 209:

M081 Graduate Diploma in Maintenanc

- Page 210 and 211:

Semester 2 SC737 Research Skills, P

- Page 212 and 213:

Students are not normally permitted

- Page 214 and 215:

Z190 zi80 zi 70 Master of Engineeri

- Page 216:

Course structure (1 993 syllabus) C

- Page 219 and 220:

A4106 Advanced ltalian 1 A 6 hours

- Page 221 and 222:

AA309 Italian 3X AA375 Industry Bas

- Page 223 and 224:

AD1 02/ Australian Society, the Eco

- Page 225 and 226: AD208 Negotiation and Change Manage

- Page 227 and 228: *AH205 Social Philosophy, Politics

- Page 229 and 230: AH31 0 Approaches to Culture 3 hour

- Page 231 and 232: Textbooks Japanese Section, T, Dial

- Page 233 and 234: A304 Japanese 3D 6 hours per week H

- Page 235 and 236: tn A1404 Japanese Business and Indu

- Page 237 and 238: AK103 Korean 1A AK206 Korean 2B 6 h

- Page 239 and 240: Recommended reading Dong-a's Nm Con

- Page 241 and 242: Library, 1979 Buell, L. Literary Tr

- Page 243 and 244: ALM310 Electronic Writing 3 hours p

- Page 245 and 246: VI C -. broadcasting service. Recom

- Page 247 and 248: Cook, P. (ed.) The Cinema Book. Lon

- Page 249 and 250: indigenous people will be canvassed

- Page 251 and 252: AP112 Australian Identities 3 hours

- Page 253 and 254: interest and pressure groups. The a

- Page 255 and 256: v, C _q Objedives and Content The s

- Page 257 and 258: AS403 Research Report 3 hoursper we

- Page 259 and 260: AV103 Vietnamese 1 A 6 hours per we

- Page 261 and 262: Recommended reading Best, J.B. Cogn

- Page 263 and 264: empirical research question, design

- Page 265 and 266: AY513 Research Colloquium 3 hourspe

- Page 267 and 268: AY612 Second Supervised Pradicum -

- Page 269 and 270: towards business that encourages an

- Page 271 and 272: BB809 Strategic Project - Master of

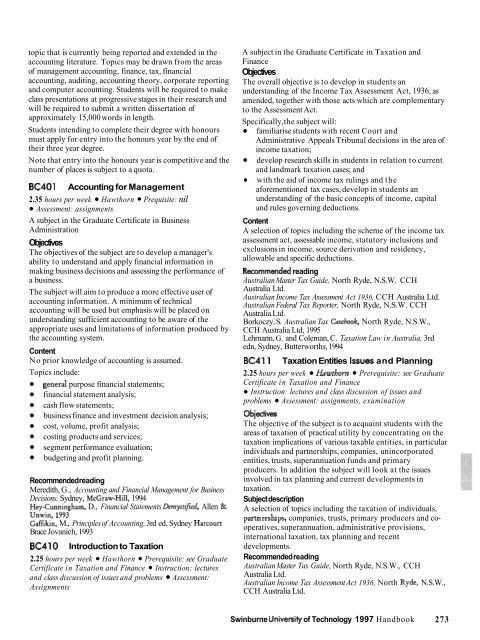

- Page 273 and 274: Recommended reading Gul, F.A., Teoh

- Page 275: particular, companies, unincorporat

- Page 279 and 280: Recommended reading Emmanuel, C. an

- Page 281 and 282: BE331 Public Finance 3 hours per we

- Page 283 and 284: institutions provided that they sho

- Page 285 and 286: -. 0- systematically develop compet

- Page 287 and 288: The subject will: examine the rapid

- Page 289 and 290: Recommended reading Morgan, G. Imag

- Page 291 and 292: and organisational - context; to de

- Page 293 and 294: influences its operations. To explo

- Page 295 and 296: acceptance and rejection of goods,

- Page 297 and 298: m an understanding of the law appli

- Page 299 and 300: Creighton, W.B., Ford, W. and Mitch

- Page 301 and 302: A case study with a strongly practi

- Page 303 and 304: BM338 Asian Pacific Business Pradic

- Page 305 and 306: BM602 Strategic Management 12.5 cre

- Page 307 and 308: under the Pathways project. Formal

- Page 309 and 310: SPSS for Windows software to anlays

- Page 311 and 312: subject students will make extensiv

- Page 313 and 314: -. 0- BS2540 Legal Procedure and Ev

- Page 315 and 316: Textbooks Eden, P., Entity Relation

- Page 317 and 318: Content The following topics are in

- Page 319 and 320: the design of good quality entry fo

- Page 321 and 322: BT502 Current Issues in lnformation

- Page 323 and 324: BT564 Business Programming 2A 12.5

- Page 325 and 326: the organisational role of end user

- Page 327 and 328:

Content A series of topics selected

- Page 329 and 330:

Recommended Reading Halpin, T.A., C

- Page 331 and 332:

CE102 Engineering Design6 ,:, J ,L

- Page 333 and 334:

CE216 Structural Mechanics 1 k [bid

- Page 335 and 336:

n h{ &? ch 1 CE277 Temporary Strudu

- Page 337 and 338:

Timber design: simple beam and colu

- Page 339 and 340:

"7 CE416 Structural Engineering (El

- Page 341 and 342:

Recommended reading Austroads. Rura

- Page 343 and 344:

and without drop panels; long colum

- Page 345 and 346:

CE505 Investigation Project 12.5 cr

- Page 347 and 348:

interaction; interaction of lightly

- Page 349 and 350:

-. & g wastes; bioremediation; meth

- Page 351 and 352:

Finance Budgets management reportin

- Page 353 and 354:

2 CE693 Introduction to Contract La

- Page 355 and 356:

CE792 Health and Safety in construc

- Page 357 and 358:

problem solving and decision making

- Page 359 and 360:

Englewood Ciffs, N.J. Prentice Hall

- Page 361 and 362:

Conctpts and Implementation. Englew

- Page 363 and 364:

AC Machine Transients: Space phasor

- Page 365 and 366:

microcomputers; the logical and ele

- Page 367 and 368:

i Content The student chooses a par

- Page 369 and 370:

Obiectives and content EF618 Manage

- Page 371 and 372:

Objectives and Content A course foc

- Page 373 and 374:

On completion of the subject studen

- Page 375 and 376:

V) -. Obiectives and content - ~8 C

- Page 377 and 378:

linkage between established theory

- Page 379 and 380:

Content Software costing, schedulin

- Page 381 and 382:

grammar; FIRST and FOLLOW sets; the

- Page 383 and 384:

ES518 Computer Graphics and Virtual

- Page 385 and 386:

ES609 Soft Computing Obiedives . 10

- Page 387 and 388:

implementations; trees; heaps and p

- Page 389 and 390:

spoken English in order to assist t

- Page 391 and 392:

metals and nonmetals; organic and i

- Page 393 and 394:

ID301 Industrial Design 3 12.5 cred

- Page 395 and 396:

Content Advanced engineering drawin

- Page 397 and 398:

culture, taste, style, the vernacul

- Page 399 and 400:

Introduction to business support sy

- Page 401 and 402:

skills of organisation behaviour an

- Page 403 and 404:

various ways in which the total cor

- Page 405 and 406:

IT906 Human-Computer Interaction (H

- Page 407 and 408:

LBC200 Computer Accounting Systems

- Page 409 and 410:

Specifically, the course will: fami

- Page 411 and 412:

appreciation of macroeconomic conce

- Page 413 and 414:

Latimer, P., Australian Business La

- Page 415 and 416:

Content i- to explore the meaning,

- Page 417 and 418:

C cr Topics covered: information sy

- Page 419 and 420:

LCS305 Database Structures and Algo

- Page 421 and 422:

EM200 Popular Culture 3 hours per w

- Page 423 and 424:

Content Information society: concep

- Page 425 and 426:

9' LSY 100 Psychology 100 4 hours p

- Page 427 and 428:

psychotherapeutic counselling; to p

- Page 429 and 430:

-. Recommended reading CASA Aeronau

- Page 431 and 432:

MF23 1 Aircraft General Knowledge 2

- Page 433 and 434:

?' MF330 Ground School , fl o d y Y

- Page 435 and 436:

concepts of strength, toughness, an

- Page 437 and 438:

, \r,,i,.O~~~k MM245 Thermodynamics

- Page 439 and 440:

MM295 Measurement and Control syste

- Page 441 and 442:

., -. "3 - valving for pressure, di

- Page 443 and 444:

Macroeconomics of cost, profit marg

- Page 445 and 446:

This topic provides basic understan

- Page 447 and 448:

Prenter, P.M., Splines and Variatio

- Page 449 and 450:

- -. mathematics structures used in

- Page 451 and 452:

-. " Kinematics and kinetics of spa

- Page 453 and 454:

easoning. ~ ~ 5 Keactor 5 6 Design

- Page 455 and 456:

management attitudes, scope of prob

- Page 457 and 458:

V) c _q Calendering and coating. Ma

- Page 459 and 460:

Interfacing elements - analog circu

- Page 461 and 462:

-. u Recommended reading De Jonghe,

- Page 463 and 464:

to specifically study the operation

- Page 465 and 466:

electrical systems. Recommended rea

- Page 467 and 468:

Lees, F.P., Loss Prevention in the

- Page 469 and 470:

MP711 Mass Transfer 9 credit points

- Page 471 and 472:

SA508 Industry Based Learning 50 cr

- Page 473 and 474:

environmental aspects. Corrosion an

- Page 475 and 476:

SC318 Microbiology 7.5 credit point

- Page 477 and 478:

p g 0 b jectives To study water che

- Page 479 and 480:

V) -. photochemical reactions; indu

- Page 481 and 482:

SC609 Health Promotion 10 credit po

- Page 483 and 484:

SC717 Basic Surface Science 7.5 cre

- Page 485 and 486:

SC740 Chemistry of Surface Coatings

- Page 487 and 488:

SC753 Thin Films and Foams 7.5 cred

- Page 489 and 490:

SCE203 Industrial Process Engineeri

- Page 491 and 492:

Content Review of fundamental conce

- Page 493 and 494:

Analogies among momentum, heat, and

- Page 495 and 496:

SCE502 Reactor Design 10 credit poi

- Page 497 and 498:

v, engineering activities and an un

- Page 499 and 500:

Content This subject provides preli

- Page 501 and 502:

, independent Schrodinger equations

- Page 503 and 504:

Content Transients in single time c

- Page 505 and 506:

SE230 Cardiovascular Biophysics 10

- Page 507 and 508:

methods for analogue and digital tr

- Page 509 and 510:

SK280 Sohare Development 10 credit

- Page 511 and 512:

To reinforce and develop mathematic

- Page 513 and 514:

SM366 Engineering Mathematics Recom

- Page 515 and 516:

Collins, 1994 Kolb, D.A., Rubin I.M

- Page 517 and 518:

SM588 Industrial Applications of Op

- Page 519 and 520:

-. g appropriate packages such as L

- Page 521 and 522:

for screening, prevalent and incide

- Page 523 and 524:

5 -. ;i- SM3415 Mathematical Method

- Page 525 and 526:

-. 8 SP235 Instrumental Science 10

- Page 527 and 528:

SP525 Applied Biophysics A 8 credit

- Page 529 and 530:

Image construction methods real-tim

- Page 531 and 532:

SP602 Special Project 4 credit poin

- Page 533 and 534:

-. u Philosophy's of mind: Topics i

- Page 535 and 536:

an awareness of the types and natur

- Page 537 and 538:

SQ403 Computer Science Team Project

- Page 539 and 540:

SQ523 Industry based Learning liO c

- Page 541 and 542:

V) -. and sdb; shell programming (d

- Page 544:

Index

- Page 547 and 548:

Environmental Health 121 European S

- Page 549 and 550:

Certificate in Commercial Radio 74

- Page 551 and 552:

Open Systems 200 Risk Management 20

- Page 553 and 554:

Mathematicsand Computer Science, Ba

- Page 555 and 556:

Master of Engineering (by coursewor

- Page 557 and 558:

Notes

- Page 559 and 560:

Notes

- Page 561 and 562:

Notes

- Page 563:

Notes