1997 Swinburne Higher Education Handbook

1997 Swinburne Higher Education Handbook

1997 Swinburne Higher Education Handbook

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Australian Federal Tax Reporter, North Ryde, N.S.W., CCH<br />

Australia Ltd.<br />

Lehmann, G. and Coleman, C. Taxation Law in Australia, 3rd<br />

edn, Sydney: Butterworths, 1994<br />

Barkoczy, S. Australian Tax Casebook, North Ryde, N.S.W.,<br />

CCH Australia, 1995<br />

O'Grady, G.W. and O'Rourke, K.J. Ryan's Manual of the Law of<br />

Income Tax in Australia. 7th ed, North Ryde: Law Book<br />

Company, 1989<br />

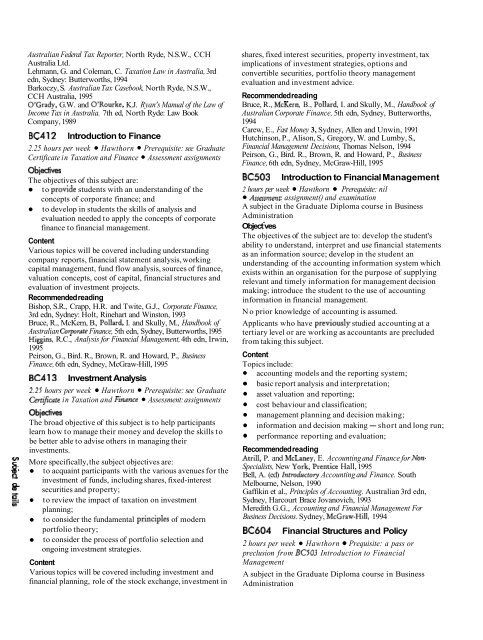

BC412 lntroduction to Finance<br />

2.25 hours per week Hawthorn Prerequisite: see Graduate<br />

Certificate in Taxation and Finance Assessment assignments<br />

Objectives<br />

The objectives of this subject are:<br />

to provide students with an understanding of the<br />

concepts of corporate finance; and<br />

to develop in students the skills of analysis and<br />

evaluation needed to apply the concepts of corporate<br />

finance to financial management.<br />

Content<br />

Various topics will be covered including understanding<br />

company reports, financial statement analysis, working<br />

capital management, fund flow analysis, sources of finance,<br />

valuation concepts, cost of capital, financial structures and<br />

evaluation of investment projects.<br />

Recommended reading<br />

Bishop, S.R., Crapp, H.R. and Twite, G.J., Corporate Finance,<br />

3rd edn, Sydney: Holt, Rinehart and Winston, 1993<br />

Bruce, R., McKern, B., Pollard, I. and Skully, M., <strong>Handbook</strong> of<br />

Australian Corporate Finance, 5th edn, Sydney, Butterworths, 1995<br />

Higgins, R.C., Analysis for Financial Management, 4th edn, Irwin,<br />

1995<br />

Peirson, G., Bird. R., Brown, R. and Howard, P., Business<br />

Finance, 6th edn, Sydney, McGraw-Hill, 1995<br />

BC413 Investment Analysis<br />

2.25 hours per week Hawthorn Prerequisite: see Graduate<br />

Cert$cate in Taxation and Finunce Assessment: assignments<br />

Obiectives<br />

The broad objective of this subject is to help participants<br />

learn how to manage their money and develop the skills to<br />

be better able to advise others in managing their<br />

investments.<br />

V)<br />

c More specifically, the subject objectives are:<br />

-. to acquaint participants with the various avenues for the<br />

B investment of funds, including shares, fixed-interest<br />

P<br />

(D securities and property;<br />

$ to review the impact of taxation on investment<br />

planning;<br />

to consider the fundamental ~rinci~les of modern<br />

portfolio theory;<br />

to consider the process of portfolio selection and<br />

ongoing investment strategies.<br />

Content<br />

Various topics will be covered including investment and<br />

financial planning, role of the stock exchange, investment in<br />

shares, fixed interest securities, property investment, tax<br />

implications of investment strategies, options and<br />

convertible securities, portfolio theory management<br />

evaluation and investment advice.<br />

Recommended reading<br />

Bruce, R., McKern, B., Pollard, I. and Skully, M., <strong>Handbook</strong> of<br />

Australian Corporate Finance, 5th edn, Sydney, Butterworths,<br />

1994<br />

Carew, E., Fast Money 3, Sydney, Allen and Unwin, 1991<br />

Hutchinson, P., Alison, S., Gregory, W. and Lumby, S.,<br />

Financial Management Decisions, Thomas Nelson, 1994<br />

Peirson, G., Bird. R., Brown, R. and Howard, P., Business<br />

Finance, 6th edn, Sydney, McGraw-Hill, 1995<br />

BC503 Introduction to Financial Management<br />

2 hours per week Hawthorn Prerequisite: nil<br />

Assessment assignment() and examination<br />

A subject in the Graduate Diploma course in Business<br />

Administration<br />

i<br />

Objectves<br />

The objectives of the subject are to: develop the student's<br />

ability to understand, interpret and use financial statements<br />

as an information source; develop in the student an<br />

understanding of the accounting information system which<br />

exists within an organisation for the purpose of supplying<br />

relevant and timely information for management decision<br />

making; introduce the student to the use of accounting<br />

information in financial management.<br />

No prior knowledge of accounting is assumed.<br />

Applicants who have previously studied accounting at a<br />

tertiary level or are working as accountants are precluded<br />

from taking this subject.<br />

Content<br />

Topics include:<br />

accounting models and the reporting system;<br />

basic report analysis and interpretation;<br />

asset valuation and reporting;<br />

cost behaviour and classification;<br />

management planning and decision making;<br />

information and decision making - short and long run;<br />

performance reporting and evaluation;<br />

Recommended reading<br />

Atrill, P. and McLaney, E. Accounting and Finance for Non-<br />

Specialists, New York, Prentice Hall, 1995<br />

Bell, A. (ed) Introductory Accounting and Finance. South<br />

Melbourne, Nelson, 1990<br />

Gaffikin et al., Principles of Accounting. Australian 3rd edn,<br />

Sydney, Harcourt Brace Jovanovich, 1993<br />

Meredith G.G., Accounting and Financial Management For<br />

Business Decisions. Sydney, McGraw-Hill, 1994<br />

BC604 Financial Structures and Policy<br />

2 hours per week Hawthorn Prequisite: a pass or<br />

preclusion from BC503 Introduction to Financial<br />

Management<br />

A subject in the Graduate Diploma course in Business<br />

Administration