1997 Swinburne Higher Education Handbook

1997 Swinburne Higher Education Handbook

1997 Swinburne Higher Education Handbook

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

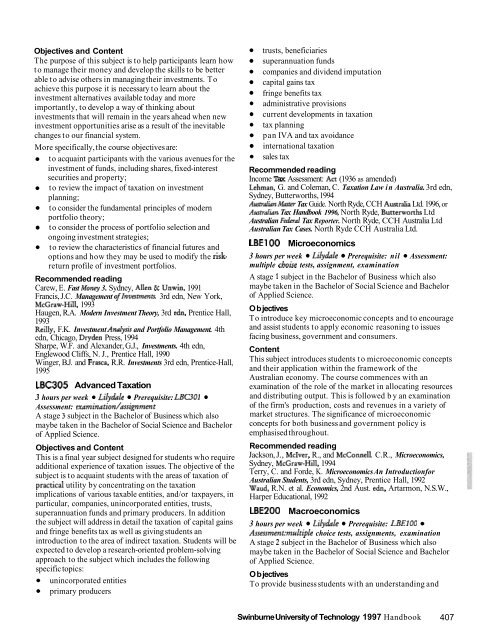

Objectives and Content<br />

The purpose of this subject is to help participants learn how<br />

to manage their money and develop the skills to be better<br />

able to advise others in managing their investments. To<br />

achieve this purpose it is necessary to learn about the<br />

investment alternatives available today and more<br />

importantly, to develop a way of thinking about<br />

investments that will remain in the years ahead when new<br />

investment opportunities arise as a result of the inevitable<br />

changes to our financial system.<br />

More specifically, the course objectives are:<br />

to acquaint participants with the various avenues for the<br />

investment of funds, including shares, fixed-interest<br />

securities and -property;<br />

- -<br />

to review the impact of taxation on investment<br />

planning;<br />

to consider the fundamental principles of modern<br />

portfolio theory;<br />

to consider the process of portfolio selection and<br />

ongoing investment strategies;<br />

to review the characteristics of financial futures and<br />

options and how they may be used to modify the riskreturn<br />

profile of investment portfolios.<br />

Recommended reading<br />

Carew, E. Fast Moy 3. Sydney, Allen & Unwin, 1991<br />

Francis, J.C. Management oflnvestments. 3rd edn, New York,<br />

McGraw-Hill, 1993<br />

Haugen, R.A. Modern Investment Theory, 3rd edn, Prentice Hall,<br />

1993<br />

Reilly, F.K. Investment Adysis and Portfolio Management. 4th<br />

edn, Chicago, Dryden Press, 1994<br />

Sharpe, W.F. and Alexander, G.J., Investments. 4th edn,<br />

Englewood Cliffs, N. J., Prentice Hall, 1990<br />

Winger, B.J. and Frasca, R.R. Investments 3rd edn, Prentice-Hall,<br />

1995<br />

LBC305 Advanced Taxation<br />

3 hours per week Lilydale Prerequisite: LBC301<br />

Assessment: examination/assignment<br />

A stage 3 subject in the Bachelor of Business which also<br />

maybe taken in the Bachelor of Social Science and Bachelor<br />

of Applied Science.<br />

Objectives and Content<br />

This is a final year subject designed for students who require<br />

additional experience of taxation issues. The objective of the<br />

subject is to acquaint students with the areas of taxation of<br />

practical utility by concentrating on the taxation<br />

implications of various taxable entities, and/or taxpayers, in<br />

particular, companies, unincorporated entities, trusts,<br />

superannuation funds and primary producers. In addition<br />

the subject will address in detail the taxation of capital gains<br />

and fringe benefits tax as well as giving students an<br />

introduction to the area of indirect taxation. Students will be<br />

expected to develop a research-oriented problem-solving<br />

approach to the subject which includes the following<br />

specific topics:<br />

unincorporated entities<br />

primary producers<br />

trusts, beneficiaries<br />

superannuation funds<br />

companies and dividend imputation<br />

capital gains tax<br />

fringe benefits tax<br />

administrative provisions<br />

current developments in taxation<br />

tax planning<br />

pan IVA and tax avoidance<br />

international taxation<br />

sales tax<br />

Recommended reading<br />

Income Tax Assessment: Act (1936 as amended)<br />

Lehman, G. and Coleman, C. Taxation Law in Australia. 3rd edn,<br />

Sydney, Butterworths, 1994<br />

AtrmalianIl.ttste/ Tax Guide. North Ryde, CCH Australia Ltd. 1996, or<br />

Australian Tax <strong>Handbook</strong> 1996, North Ryde, Butterworths Ltd<br />

Australian Federal Tax Reporter. North Ryde, CCH Australia Ltd<br />

Australian Tax Cases. North Ryde CCH Australia Ltd.<br />

LBEl 00 Microeconomics<br />

3 hours per week Lilydale Prerequisite: nil Assessment:<br />

multiple choise tests, assignment, examination<br />

A stage 1 subject in the Bachelor of Business which also<br />

maybe taken in the Bachelor of Social Science and Bachelor<br />

of Applied Science.<br />

Ob jectives<br />

To introduce key microeconomic concepts and to encourage<br />

and assist students to apply economic reasoning to issues<br />

facing business, government and consumers.<br />

Content<br />

This subject introduces students to microeconomic concepts<br />

and their application within the framework of the<br />

Australian economy. The course commences with an<br />

examination of the role of the market in allocating resources<br />

and distributing output. This is followed by an examination<br />

of the firm's production, costs and revenues in a variety of<br />

market structures. The significance of microeconomic<br />

concepts for both business and government policy is<br />

emphasised throughout.<br />

Recommended reading<br />

Jackson, J., McIver, R., and McConnell, C.R., Microeconomics,<br />

Sydney, McGraw-Hill, 1994<br />

Terry, C. and Forde, K. Microeconomics An Introductionfor<br />

Australian Students, 3rd edn, Sydney, Prentice Hall, 1992<br />

Waud, R.N. et al. Economics, 2nd Aust. edn, Artarmon, N.S.W.,<br />

Harper <strong>Education</strong>al, 1992<br />

LBE200 Macroeconomics<br />

3 hours per week Lilydale Prerequisite: LBElOO<br />

Assessment:multiple choice tests, assignments, examination<br />

A stage 2 subject in the Bachelor of Business which also<br />

maybe taken in the Bachelor of Social Science and Bachelor<br />

of Applied Science.<br />

Ob jectives<br />

To provide business students with an understanding and<br />

<strong>Swinburne</strong> University of Technology <strong>1997</strong> <strong>Handbook</strong> 407