1997 Swinburne Higher Education Handbook

1997 Swinburne Higher Education Handbook

1997 Swinburne Higher Education Handbook

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Specifically, the course will:<br />

familiarise students with recent court and<br />

Administrative Appeals Tribunal decisions in the area of<br />

income taxation;<br />

develop research skills in students in relation to current<br />

and landmark taxation cases;<br />

introduce students to the com~lexities of taxation in<br />

relation to various taxable entities;<br />

with the aid of income tax rulings and the<br />

aforementioned tax cases, develop in students an<br />

understanding of the basic concepts of income, capital,<br />

and the rules governing deductions;<br />

It is recommended these students also complete LBL305<br />

Advanced Taxation.<br />

Content<br />

Tonics covered include the nature of assessable income.<br />

specific income types, source residency and derivation,<br />

eligible termination payments, capital gains tax, fringe<br />

benefits tax, allowable deductions and the provisions<br />

relating to companies, partnerships, and individuals.<br />

Recommended reading<br />

Australian Income Tax Assessment: Act 1936, North Ryde,<br />

N.S.W., CCH Australia Ltd.<br />

Australian Master Tax Guide. North Ryde, NS. U%, CCH Australia<br />

Ltd.<br />

Barkoczy, S., Australian Tax Casebook, North Ryde, N.S.W.,<br />

CCH Australia Ltd., 1993<br />

Australian Federal Tax Reponer. CCH Australia Ltd.<br />

Lehmann, G. and Coleman, C. Taxation Law in Australia. 3rd<br />

edn, Sydney, Butterworths, 1994<br />

O'Grady, G.W. and O'Rouke, K.J. Ryan's Manual of the Law of<br />

Income Tax in Australia. 7th edn, Sydney, Law Book Company,<br />

1989<br />

Topical Tax Cases for Australians. Nonh Ryde, N.S.W., CCH<br />

Australia Ltd., 1991<br />

Australian Tax <strong>Handbook</strong>. Sydney, Butterworths<br />

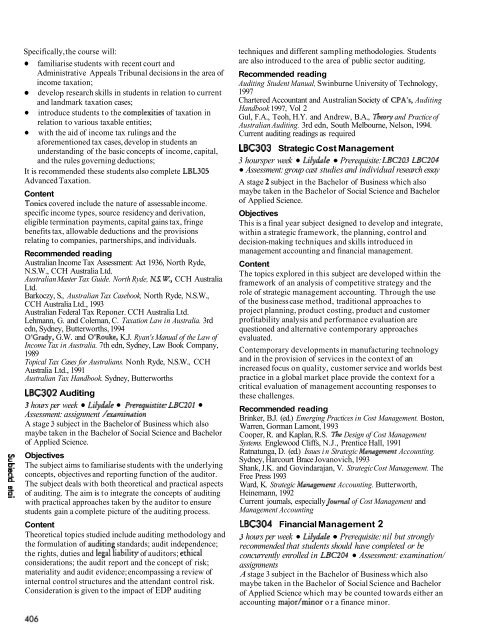

LBC302 Auditing<br />

3 hours per week Lilydale Prerequistite: LBC2Ol<br />

Assessment: assignment /examination<br />

A stage 3 subject in the Bachelor of Business which also<br />

maybe taken in the Bachelor of Social Science and Bachelor<br />

of Applied Science.<br />

p Objectives<br />

E The subject aims to familiarise students with the underlying<br />

concepts, objectives and reporting function of the auditor.<br />

Q<br />

The subject deals with both theoretical and practical aspects<br />

3. of auditing. The aim is to integrate the concepts of auditing<br />

with practical approaches taken by the auditor to ensure<br />

students gain a complete picture of the auditing process.<br />

Content<br />

Theoretical topics studied include auditing methodology and<br />

the formulation of auditina standards; audit independence;<br />

the rights, duties and legalliability of auditors; eihical<br />

considerations; the audit report and the concept of risk;<br />

materiality and audit evidence; encompassing a review of<br />

internal control structures and the attendant control risk.<br />

Consideration is given to the impact of EDP auditing<br />

techniques and different sampling methodologies. Students<br />

are also introduced to the area of public sector auditing.<br />

Recommended reading<br />

Auditing Student Manual, <strong>Swinburne</strong> University of Technology,<br />

<strong>1997</strong><br />

Chartered Accountant and Australian Society of CPA's, Auditing<br />

<strong>Handbook</strong> <strong>1997</strong>, Vol 2<br />

Gul, F.A., Teoh, H.Y. and Andrew, B.A., Tbeory and Practice of<br />

Australian Auditing. 3rd edn, South Melbourne, Nelson, 1994.<br />

Current auditing readings as required<br />

LBC303 Strategic Cost Management<br />

3 hoursper week Lilydale Prerequisite: LBC203 LBC204<br />

Assessment: group cast studies and individual research essay<br />

A stage 2 subject in the Bachelor of Business which also<br />

maybe taken in the Bachelor of Social Science and Bachelor<br />

of Applied Science.<br />

Objectives<br />

This is a final year subject designed to develop and integrate,<br />

within a strategic framework, the planning, control and<br />

decision-making techniques and skills introduced in<br />

management accounting and financial management.<br />

Content<br />

The topics explored in this subject are developed within the<br />

framework of an analysis of competitive strategy and the<br />

role of strategic management accounting. Through the use<br />

of the business case method, traditional approaches to<br />

project planning, product costing, product and customer<br />

profitability analysis and performance evaluation are<br />

questioned and alternative contemporary approaches<br />

evaluated.<br />

Contemporary developments in manufacturing technology<br />

and in the provision of services in the context of an<br />

increased focus on quality, customer service and worlds best<br />

practice in a global market place provide the context for a<br />

critical evaluation of management accounting responses to<br />

these challenges.<br />

Recommended reading<br />

Brinker, B.J. (ed.) Emerging Practices in Cost Management. Boston,<br />

Warren, Gorman Lamont, 1993<br />

Cooper, R. and Kaplan, R.S. Tbe Design of Cost Management<br />

Systems. Englewood Cliffs, N.J., Prentice Hall, 1991<br />

Ratnatunga, D. (ed.) Issues in Strategic Management Accounting.<br />

Sydney, Harcourt Brace Jovanovich, 1993<br />

Shank, J.K. and Govindarajan, V. Strategic Cost Management. The<br />

Free Press 1993<br />

Ward, K. Strategic Management Accounting. Butterworth,<br />

Heinemann, 1992<br />

Current journals, especially Journal of Cost Management and<br />

Management Accounting<br />

LBC304 Financial Management 2<br />

3 hours per week Lilydale Prerequisite: nil but strongly<br />

recommended that students should have completed or be<br />

concurrently enrolled in LBC204 Assessment: examination/<br />

assignments<br />

A stage 3 subject in the Bachelor of Business which also<br />

maybe taken in the Bachelor of Social Science and Bachelor<br />

of Applied Science which may be counted towards either an<br />

accounting major/minor or a finance minor.