- Page 1: TENDER NO VOLUME PSER:SCT:DPL-C1154

- Page 5 and 6: VOLUME-IF (SUP) TENDER NO - PSER:SC

- Page 7 and 8: VOLUME-IF (SUP) TENDER NO - PSER:SC

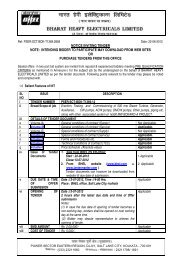

- Page 9 and 10: TENDER NO VOLUME PSER:SCT:DPL-C1154

- Page 11 and 12: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 13 and 14: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 15 and 16: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 17 and 18: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 19 and 20: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 21 and 22: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 23 and 24: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 25 and 26: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 27 and 28: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 29 and 30: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 31 and 32: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 33 and 34: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 35 and 36: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 37 and 38: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 39 and 40: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 41 and 42: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 43 and 44: VOLUME-IF (SER) TENDER NO - PSER:SC

- Page 45 and 46: THE DURGAPUR PROJECTS LIMITED DURGA

- Page 47 and 48: SPECIFICATION NO. PE-TS-360-620-C00

- Page 49 and 50: TITLE: SCOPE OF WORK SPECIFICATION

- Page 51 and 52: TITLE: SCOPE OF WORK SPECIFICATION

- Page 53 and 54:

TITLE: PROJECT INFORMATION SPECIFIC

- Page 55:

TITLE: PROJECT INFORMATION SPECIFIC

- Page 60 and 61:

TITLE: TECHNICAL SPECIFICATION FOR

- Page 62 and 63:

TITLE: TECHNICAL SPECIFICATION FOR

- Page 64 and 65:

iv) TITLE: TECHNICAL SPECIFICATION

- Page 66 and 67:

TITLE: SPECIFIC TECHNICAL REQUIREME

- Page 68 and 69:

TITLE: SPECIFICATION NO. PE-TS-360-

- Page 70 and 71:

TITLE: SPECIFICATION NO. PE-TS-360-

- Page 72 and 73:

SPECIFIC TECHNICAL REQUIREMENT SPEC

- Page 74 and 75:

PEM-6666-0 TITLE SPECIFICATION NO.

- Page 76 and 77:

PEM-6666-0 TITLE SPECIFICATION NO.

- Page 78 and 79:

PEM-6666-0 TITLE SPECIFICATION NO.

- Page 80 and 81:

PEM-6666-0 TITLE SPECIFICATION NO.

- Page 82 and 83:

PEM-6666-0 TITLE SPECIFICATION NO.

- Page 84 and 85:

PEM-6666-0 TITLE SPECIFICATION NO.

- Page 86 and 87:

PEM-6666-0 TITLE SPECIFICATION NO.

- Page 88 and 89:

PEM-6666-0 TITLE SPECIFICATION NO.

- Page 90 and 91:

PEM-6666-0 TITLE SPECIFICATION NO.

- Page 92 and 93:

PEM-6666-0 TITLE SPECIFICATION NO.

- Page 94 and 95:

Title Spec. No.: PE-TS-360-620-C001

- Page 96 and 97:

Title Spec. No.: PE-TS-360-620-C001

- Page 98 and 99:

Title Spec. No.: PE-TS-360-620-C001

- Page 100 and 101:

Title Spec. No.: PE-TS-360-620-C001

- Page 102 and 103:

Title Spec. No.: PE-TS-360-620-C001

- Page 104 and 105:

TITLE: 1X250 MW EXTENSION UNIT-8 AT

- Page 106 and 107:

DCPL-K4A02 VOLUME : II TECHNICAL SP

- Page 108 and 109:

DCPL-K4A02 VOLUME : II-D/2 TECHNICA

- Page 110 and 111:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 112 and 113:

DCPL-K4A02 VOLUME: II-D/2 SECTION-I

- Page 114 and 115:

DCPL-K4A02 2.5.1 General All materi

- Page 116 and 117:

DCPL-K4A02 g) Excavation, filling a

- Page 118 and 119:

DCPL-K4A02 c) Hard Rock 3.6.0 Earth

- Page 120 and 121:

DCPL-K4A02 Specific permission of E

- Page 122 and 123:

DCPL-K4A02 a magazine. Explosive in

- Page 124 and 125:

DCPL-K4A02 Only such quantities of

- Page 126 and 127:

DCPL-K4A02 3.8.0 Earthwork in Filli

- Page 128 and 129:

DCPL-K4A02 including dumpers, dozer

- Page 130 and 131:

DCPL-K4A02 e) Minimum two tests per

- Page 132 and 133:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 134 and 135:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 136 and 137:

DCPL-K4A02 Borrow material required

- Page 138 and 139:

DCPL-K4A02 a) Ordinary Soil This sh

- Page 140 and 141:

DCPL-K4A02 All loose boulders, semi

- Page 142 and 143:

DCPL-K4A02 Two lightning conductors

- Page 144 and 145:

3.5.5 Disposal DCPL-K4A02 300 metre

- Page 146 and 147:

DCPL-K4A02 the responsibility of th

- Page 148 and 149:

DCPL-K4A02 3.7.3 Plinth Filling Sin

- Page 150 and 151:

DCPL-K4A02 The degree of compaction

- Page 152 and 153:

DCPL-K4A02 CONTENT CLAUSE NO. DESCR

- Page 154 and 155:

DCPL-K4A02 d) Submit for approval s

- Page 156 and 157:

DCPL-K4A02 v) Joint sealing strips

- Page 158 and 159:

2.5.3 Aggregates i) Sulphate Resist

- Page 160 and 161:

DCPL-K4A02 e) Water proofing admixt

- Page 162 and 163:

DCPL-K4A02 e) Formwork : Material,

- Page 164 and 165:

DCPL-K4A02 Structural concrete shal

- Page 166 and 167:

DCPL-K4A02 WORKABILITY WATER/CEME N

- Page 168 and 169:

3.8 Workability DCPL-K4A02 Whenever

- Page 170 and 171:

DCPL-K4A02 are in the drum. When ab

- Page 172 and 173:

DCPL-K4A02 or handled in a manner w

- Page 174 and 175:

DCPL-K4A02 3.13.2 Cold Joint Where

- Page 176 and 177:

DCPL-K4A02 3.14.2 Finishing Unforme

- Page 178 and 179:

DCPL-K4A02 used as reinforcement as

- Page 180 and 181:

DCPL-K4A02 3.17 Cold Weather Concre

- Page 182 and 183:

3.20.3 Design DCPL-K4A02 They shall

- Page 184 and 185:

DCPL-K4A02 TABLE - IV SCHEDULE OF R

- Page 186 and 187:

DCPL-K4A02 required grain texture o

- Page 188 and 189:

DCPL-K4A02 Joint sealing strips may

- Page 190 and 191:

DCPL-K4A02 3.23.4 Joint Sealing Com

- Page 192 and 193:

DCPL-K4A02 plumbing shall be done a

- Page 194 and 195:

DCPL-K4A02 N/Super" or approved equ

- Page 196 and 197:

DCPL-K4A02 Alternatively, the overl

- Page 198 and 199:

DCPL-K4A02 4.5.1 Air Entraining Age

- Page 200 and 201:

DCPL-K4A02 any other standard pract

- Page 202 and 203:

DCPL-K4A02 IS : 3370 - Indian Stand

- Page 204 and 205:

DCPL-K4A02 IS : 8043 - Indian stand

- Page 206 and 207:

DCPL-K4A02 CONTENTS CLAUSE NO. DESC

- Page 208 and 209:

DCPL-K4A02 g) Prepare and furnish d

- Page 210 and 211:

DCPL-K4A02 IS : 1852 - Rolling and

- Page 212 and 213:

2.5.2 Steel 2.5.3 Electrodes DCPL-K

- Page 214 and 215:

2.6.2 Steel 2.6.3 Electrodes DCPL-K

- Page 216 and 217:

DCPL-K4A02 The sequence of submissi

- Page 218 and 219:

DCPL-K4A02 To determine the effecti

- Page 220 and 221:

DCPL-K4A02 3.3.4 Welding Sequence I

- Page 222 and 223:

DCPL-K4A02 3.8.0 Bearing Plates Pro

- Page 224 and 225:

3.14.3 Procedure DCPL-K4A02 All mem

- Page 226 and 227:

4.2.4 Welding DCPL-K4A02 to commenc

- Page 228 and 229:

4.5.2 Marking DCPL-K4A02 the Owner

- Page 230 and 231:

DCPL-K4A02 The Contractor shall quo

- Page 232 and 233:

DCPL-K4A02 VOLUME: II-D/2 SECTION-V

- Page 234 and 235:

DCPL-K4A02 VOLUME: II-G/2 SECTION-V

- Page 236 and 237:

2.5.0 Material 2.5.1 General DCPL-K

- Page 238 and 239:

DCPL-K4A02 3.1.3 Temporary bracing

- Page 240 and 241:

NOTE : DCPL-K4A02 When torque wrenc

- Page 242 and 243:

DCPL-K4A02 No grouting shall be car

- Page 244 and 245:

DCPL-K4A02 4.1.2 Strength Test The

- Page 246 and 247:

DCPL-K4A02 difference allowed betwe

- Page 248 and 249:

DCPL-K4A02 arrangement and location

- Page 251 and 252:

DCPL-K4A02 CONTENTS CLAUSE NO. DESC

- Page 253 and 254:

DCPL-K4A02 All work under this spec

- Page 255 and 256:

DCPL-K4A02 TABLE -I PERMITTED TOLER

- Page 257 and 258:

DCPL-K4A02 3.0 EXECUTION 3.1.0 Shou

- Page 259 and 260:

DCPL-K4A02 The fraction of material

- Page 261 and 262:

DCPL-K4A02 3.4.2.3 Grading Requirem

- Page 263 and 264:

3.4.3.4 Rolling DCPL-K4A02 The coar

- Page 265 and 266:

3.5.0 Tack Coat 3.5.1 Description 3

- Page 267 and 268:

DCPL-K4A02 4.75 mm - 10-30 2.36 mm

- Page 269 and 270:

3.6.3.6 Rolling DCPL-K4A02 the full

- Page 271 and 272:

DCPL-K4A02 TABLE-IX : QUANTITIES OF

- Page 273 and 274:

DCPL-K4A02 3.7.3.6 Seal Coat 3.8.0

- Page 275 and 276:

DCPL-K4A02 As soon as sufficient le

- Page 277 and 278:

DCPL-K4A02 Contractor. After laying

- Page 279 and 280:

3.14.2 Stone Masonry DCPL-K4A02 hou

- Page 281 and 282:

DCPL-K4A02 Masonry and finish to ma

- Page 283 and 284:

DCPL-K4A02 CONTENT CLAUSE NO. DESCR

- Page 285 and 286:

DCPL-K4A02 2.3.0 Masonry 2.3.1 Gene

- Page 287 and 288:

DCPL-K4A02 Location of joints shall

- Page 289 and 290:

DCPL-K4A02 VOLUME : II-D /2 SECTION

- Page 291 and 292:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 293 and 294:

DCPL-K4A02 Wherever punning is indi

- Page 295 and 296:

DCPL-K4A02 2.5.0 Lime Punning For p

- Page 297 and 298:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 299 and 300:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 301 and 302:

2.1.0 In Situ Finishes DCPL-K4A02 u

- Page 303 and 304:

DCPL-K4A02 2.1.3 Terrazo Finish : I

- Page 305 and 306:

2.1.4 Granolithic Finish DCPL-K4A02

- Page 307 and 308:

DCPL-K4A02 The Patent Stone finish,

- Page 309 and 310:

DCPL-K4A02 Bitumen mastic shall con

- Page 311 and 312:

DCPL-K4A02 dusted over it or a ceme

- Page 313 and 314:

DCPL-K4A02 d) Laying Same as clause

- Page 315 and 316:

DCPL-K4A02 insoluble in water and r

- Page 317 and 318:

DCPL-K4A02 e) Polishing, Finishing

- Page 319 and 320:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 321 and 322:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 323 and 324:

DCPL-K4A02 VOLUME : II-D /2 SECTION

- Page 325 and 326:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 327 and 328:

DCPL-K4A02 All carpentry work after

- Page 329 and 330:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 331 and 332:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 333 and 334:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 335 and 336:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 337 and 338:

Doors shall be mortised, reinforced

- Page 339 and 340:

DCPL-K4A02 2.2.3 Aluminium Structur

- Page 341 and 342:

DCPL-K4A02 3.0.0 ACCEPTANCE CRITERI

- Page 343 and 344:

4.0.0 INFORMATION TO BE SUBMITTED D

- Page 345 and 346:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 347 and 348:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 349 and 350:

DCPL-K4A02 3.0.0 ACCEPTANCE CRITERI

- Page 351 and 352:

DCPL-K4A02 CONTENT CLAUSE NO. DESCR

- Page 353 and 354:

DCPL-K4A02 reinforced to prevent sa

- Page 355 and 356:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 357 and 358:

DCPL-K4A02 VOLUME : II-G/2 SECTION-

- Page 359 and 360:

DCPL-K4A02 2.2.6 Drifting 2.2.7 Gro

- Page 361 and 362:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 363 and 364:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 365 and 366:

2.0.2 Storage DCPL-K4A02 Shall be m

- Page 367 and 368:

DCPL-K4A02 drying. Application of p

- Page 369 and 370:

2.2.10 French Polish DCPL-K4A02 the

- Page 371 and 372:

DCPL-K4A02 IS:1477 : Code of Practi

- Page 373 and 374:

DCPL-K4A02 CONTENT CLAUSE NO. DESCR

- Page 375 and 376:

DCPL-K4A02 2.3.0 Insulation The con

- Page 377 and 378:

DCPL-K4A02 It shall consist of poly

- Page 379 and 380:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 381 and 382:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 383 and 384:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 385 and 386:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 387 and 388:

DCPL-K4A02 2.1.2 Back Flow In addit

- Page 389 and 390:

DCPL-K4A02 d) Lead 2.1.7 Painting c

- Page 391 and 392:

DCPL-K4A02 Open end of each pipe sh

- Page 393 and 394:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 395 and 396:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 397 and 398:

DCPL-K4A02 All pipes shall be laid

- Page 399 and 400:

DCPL-K4A02 2.3.10 Jointing Jointing

- Page 401 and 402:

2.5.1 Water closet 2.5.2 Urinals DC

- Page 403 and 404:

DCPL-K4A02 a soak pit for absorptio

- Page 405 and 406:

DCPL-K4A02 through the joints, the

- Page 407 and 408:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 409 and 410:

DCPL-K4A02 VOLUME : II-D/2 SECTION-

- Page 411 and 412:

DCPL-K4A02 The Contractor shall giv

- Page 414 and 415:

DCPL-K9A01 CONTENT d.AUSENO. DESCRI

- Page 416 and 417:

DCPL-K9A01 f) Prepare and submit fo

- Page 418 and 419:

DCPL-K9AOl 15:1554 cables. 15:1566

- Page 420 and 421:

DCPL·K9A01 15:4687 Gland packing a

- Page 422 and 423:

DCPl-K9AOl 2.5.7 steel Rue a) All m

- Page 424 and 425:

DCPL-K9A01 ii) iii) Iv) Minimum she

- Page 426 and 427:

DCPL·K9A01 relevant IS Specificati

- Page 428 and 429:

DCPL-K9AOI slreng1h of the concrete

- Page 430 and 431:

DCPL-K9A01 Vibration shall begin as

- Page 432 and 433:

Ii) Design of scaffolding and stagi

- Page 434 and 435:

OCPL·K9AOl rounded aggregates offe

- Page 436 and 437:

OCPL-K9A01 For movement of personne

- Page 438 and 439:

OCPL-K9AOl 3.4.0 3.4.1 steel Flues

- Page 440 and 441:

3.5.2 Cement Paint OCPL-K9AOl and i

- Page 442 and 443:

DCPl-K9A01 under adverse conditions

- Page 444 and 445:

DCPl·K9AOl 3.9.0 Interi1allllumina

- Page 446 and 447:

DCPL·K9A01 3.12.3 lighting fixture

- Page 448 and 449:

DCPL·K9A01 4.0.0 TESTING AND ACCEP

- Page 450 and 451:

5:2.2 Samples 5,2.3 Deslfin Mix OCP

- Page 452:

VOLUME : II-D/2 ANNEXURE B

- Page 455 and 456:

OCPL·K9A01 VOLUME: II-D/2 SECTIO

- Page 457 and 458:

DCPL·K9A01 2.01.02 2.01.03 2.01.04

- Page 459 and 460:

f· DCPl-K9A01 4.02.03 All ~nd lap

- Page 461 and 462:

TITLE SPECIFICATION NO. PES-509-02A

- Page 463 and 464:

TITLE SPECIFICATION NO. PES-509-02A

- Page 465 and 466:

TITLE SPECIFICATION NO. PES-509-02A

- Page 494 and 495:

TITLE: LIGHTING NOTES AND DETAILS S

- Page 520 and 521:

. S. NO. 1 COMPONENT / OPERATION 2

- Page 522 and 523:

. S. NO. 1 COMPONENT / OPERATION 2

- Page 524 and 525:

TITLE: SPECIFIC TECHNICAL REQUIREME

- Page 526 and 527:

Clause No. POWER AND CONTROL CABLES

- Page 528 and 529:

. . 44 S. NO. 1 COMPONENT / OPERATI

- Page 530 and 531:

. . S. NO. 1 COMPONENT / OPERATION

- Page 532 and 533:

. . S. NO. 1 COMPONENT / OPERATION

- Page 542:

TITLE: LIGHTING DISTRIBUTION BOARD

- Page 546 and 547:

TITLE: LIGHTING DISTRIBUTION BOARD

- Page 548 and 549:

Positive Negative TITLE: LIGHTING D

- Page 550 and 551:

TITLE: LIGHTING DISTRIBUTION BOARD

- Page 552 and 553:

TITLE: LIGHTING DISTRIBUTION BOARD

- Page 554 and 555:

TITLE: LIGHTING DISTRIBUTION BOARD

- Page 556 and 557:

TITLE: LIGHTING DISTRIBUTION BOARD

- Page 558 and 559:

TITLE: LIGHTING DISTRIBUTION BOARD