Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

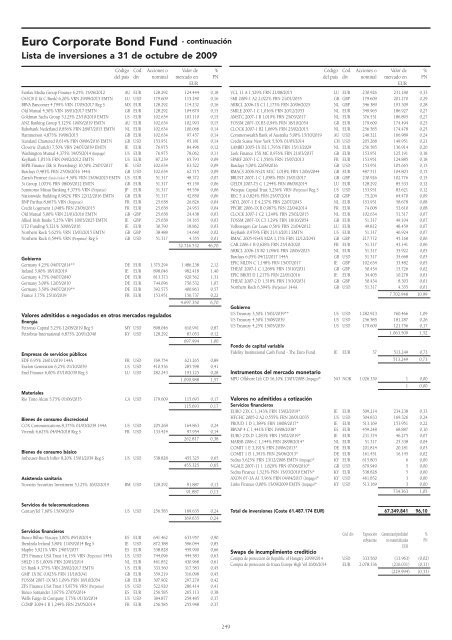

Euro Corporate Bond Fund - continuación<br />

Lista de inversiones a 31 de octubre de 2009<br />

Código Cód. Acciones o Valor de %<br />

del país div nominal mercado en PN<br />

EUR<br />

Fairfax Media Group Finance 6,25% 15/06/2012 AU EUR 128.292 124.444 0,18<br />

Or-ICB (I & C Bank) 6,20% VRN 29/09/2015 EMTN LU USD 179.609 115.240 0,16<br />

BBVA Bancomer 4,799% VRN 17/05/2017 Reg S MX EUR 128.292 114.232 0,16<br />

Old Mutual 4,50% VRN 18/01/2017 EMTN GB EUR 128.292 104.879 0,15<br />

Goldman Sachs Group 5,125% 23/10/2019 EMTN US EUR 102.634 103.110 0,15<br />

ANZ Banking Group 5,125% 10/09/2019 EMTN AU EUR 102.634 102.993 0,15<br />

Rabobank Nederland 0,856% FRN 28/07/2015 EMTN NL EUR 102.634 100.068 0,14<br />

Hammerson 4,875% 19/06/2015 GB EUR 102.634 97.457 0,14<br />

Standard Chartered 0,614% FRN 09/06/2016 EMTN GB USD 153.951 95.181 0,14<br />

Cloverie (Zurich) 7,50% VRN 24/07/2039 EMTN IE EUR 76.975 84.496 0,12<br />

Washington Mutual 4,375% 19/05/2014 (Impago) US EUR 76.975 78.062 0,11<br />

KeyBank 1,053% FRN 09/02/2012 EMTN US EUR 87.239 65.793 0,09<br />

BSPB Finance (Bk St Petersburg) 10,50% 25/07/2017 IE USD 102.634 63.322 0,09<br />

Barclays 0,483% FRN 27/06/2016 144A GB USD 102.634 62.715 0,09<br />

Zurich Finance (Estados Unidos) 4,50% VRN 15/06/2025 EMTN US EUR 51.317 48.372 0,07<br />

3i Group 1,003% FRN 08/06/2012 EMTN GB EUR 51.317 45.159 0,06<br />

Sumitomo Mitsui Banking 4,375% VRN (Perpetuo) JP EUR 51.317 44.556 0,06<br />

Nationwide Building 0,982% FRN 22/12/2016 EMTN GB EUR 51.317 42.850 0,06<br />

BNP Paribas 8,667% VRN (Perpetuo) FR EUR 25.658 26.826 0,04<br />

Credit Logement 1,048% FRN 23/06/2015 FR EUR 25.658 24.953 0,04<br />

Old Mutual 5,00% VRN 21/01/2016 EMTN GB GBP 25.658 24.438 0,03<br />

Allied Irish Banks 5,25% VRN 10/03/2025 EMTN IE GBP 25.658 19.165 0,03<br />

UT2 Funding 5,321% 30/06/2016 IE EUR 30.790 18.862 0,03<br />

Northern Rock 5,625% VRN 13/01/2015 EMTN GB GBP 38.488 14.640 0,02<br />

Northern Rock 6,594% VRN (Perpetuo) Reg S GB USD 51.317 4.355 0,01<br />

32.726.532 46,70<br />

Gobierno<br />

Germany 4,25% 04/07/2014** DE EUR 1.375.294 1.486.238 2,12<br />

Ireland 5,90% 18/10/2019 IE EUR 898.046 982.418 1,40<br />

Germany 4,75% 04/07/2040 DE EUR 813.373 920.562 1,31<br />

Germany 3,00% 12/03/2010 DE EUR 744.096 750.532 1,07<br />

Germany 3,50% 04/07/2019** DE EUR 392.575 400.863 0,57<br />

France 3,75% 25/10/2019 FR EUR 153.951 156.737 0,22<br />

4.697.350 6,70<br />

Valores admitidos o negociados en otros mercados regulados<br />

Energía<br />

Petronas Capital 5,25% 12/08/2019 Reg S MY USD 898.046 610.941 0,87<br />

Petrobras International 6,875% 20/01/2040 KY USD 128.292 87.053 0,12<br />

697.994 1,00<br />

Empresas de servicios públicos<br />

EDF 6,95% 26/01/2039 144A FR USD 769.754 621.265 0,89<br />

Exelon Generation 6,25% 01/10/2039 US USD 410.536 285.598 0,41<br />

Enel Finance 6,00% 07/10/2039 Reg S LU USD 282.243 193.125 0,28<br />

1.099.988 1,57<br />

Materiales<br />

Rio Tinto Alcan 5,75% 01/06/2035 CA USD 179.609 115.693 0,17<br />

115.693 0,17<br />

Bienes de consumo discrecional<br />

COX Communications 8,375% 01/03/2039 144A US USD 205.268 164.863 0,24<br />

Vivendi 6,625% 04/04/2018 Reg S FR USD 133.424 97.954 0,14<br />

262.817 0,38<br />

Bienes de consumo básico<br />

Anheuser-Busch InBev 8,20% 15/01/2039 Reg S US USD 538.828 455.325 0,65<br />

455.325 0,65<br />

Asistencia sanitaria<br />

Novartis Securities Investment 5,125% 10/02/2019 BM USD 128.292 91.887 0,13<br />

91.887 0,13<br />

Servicios de telecomunicaciones<br />

CenturyTel 7,60% 15/09/2039 US USD 256.585 169.635 0,24<br />

169.635 0,24<br />

Código Cód. Acciones o Valor de %<br />

del país div nominal mercado en PN<br />

EUR<br />

VCL 11 A 1,529% FRN 21/08/2015 LU EUR 230.926 231.180 0,33<br />

SMI 2009-1 A2 2,022% FRN 21/01/2055 GB GBP 179.609 201.270 0,29<br />

ARRCL 2006-1X C1 1,173% FRN 20/06/2025 NL GBP 346.389 193.309 0,28<br />

SMILE 2007-1 C 1,016% FRN 20/12/2053 NL EUR 349.965 186.927 0,27<br />

AMSTC 2007-1 B 1,019% FRN 25/03/2017 NL EUR 376.531 186.895 0,27<br />

FOSSM 2007-1X B3 0,94% FRN 18/10/2054 GB EUR 179.609 174.494 0,25<br />

CLOCK 2007-1 B2 1,069% FRN 25/02/2015 NL EUR 256.585 174.478 0,25<br />

Commonwealth Bank of Australia 5,00% 15/10/2019 AU USD 246.321 166.989 0,24<br />

Credit Suisse New York 5,50% 01/05/2014 CH USD 205.268 149.951 0,21<br />

LAMBD 2005-1X D2 1,793% FRN 15/11/2029 NL EUR 256.585 136.914 0,20<br />

Leek Finance 15X MC 0,976% FRN 21/03/2037 GB EUR 153.951 125.191 0,18<br />

SPARF 2007-1 C 1,556% FRN 15/07/2013 FR EUR 153.951 124.885 0,18<br />

Barclays 5,00% 22/09/2016 GB USD 153.951 105.665 0,15<br />

RMACS 2006-NS2X M1C 1,018% FRN 12/06/2044 GB EUR 487.511 104.803 0,15<br />

BRUNT 2007-1 C 1,058% FRN 15/01/2017 GB GBP 230.926 102.776 0,15<br />

GELDI 2007-TS C 1,244% FRN 08/09/2014 LU EUR 128.292 85.533 0,12<br />

Westpac Capital Trust 5,256% VRN (Perpetuo) Reg S US USD 153.951 83.621 0,12<br />

REC 5 A 0,824% FRN 25/07/2016 GB GBP 75.204 64.470 0,09<br />

SKYL 2007-1 E 4,237% FRN 22/07/2043 NL EUR 153.951 58.678 0,08<br />

PPCRE 2006-1X B 0,987% FRN 22/04/2014 FR EUR 74.008 53.610 0,08<br />

CLOCK 2007-1 C2 1,249% FRN 25/02/2015 NL EUR 102.634 51.317 0,07<br />

FOSSM 2007-1X C3 1,29% FRN 18/10/2054 GB EUR 51.317 49.104 0,07<br />

Volkswagen Car Lease 0,56% FRN 21/04/2012 LU EUR 49.812 48.459 0,07<br />

KeyBank 0,979% FRN 21/11/2011 EMTN US EUR 51.317 46.924 0,07<br />

RMAC 2005-NS4X M2A 1,15% FRN 12/12/2043 GB GBP 217.772 45.168 0,06<br />

CAR 2006-1 B 0,628% FRN 25/10/2020 FR EUR 51.317 43.141 0,06<br />

ARRCL 2006-1X B2 1,096% FRN 20/06/2025 NL EUR 51.317 35.922 0,05<br />

Barclays 6,05% 04/12/2017 144A GB USD 51.317 35.668 0,05<br />

EPIC MLDN C 1,148% FRN 15/07/2017 IE GBP 102.634 33.482 0,05<br />

THEAT 2007-1 C 1,268% FRN 15/10/2031 GB GBP 50.434 15.726 0,02<br />

EPIC BROD D 1,217% FRN 22/01/2016 IE EUR 34.405 10.278 0,01<br />

THEAT 2007-2 D 1,518% FRN 15/10/2031 GB GBP 50.434 8.303 0,01<br />

Northern Rock 6,594% (Perpetuo) 144A GB USD 51.317 4.355 0,01<br />

7.702.948 10,99<br />

Gobierno<br />

US Treasury 3,50% 15/02/2039** US USD 1.282.923 760.466 1,09<br />

US Treasury 4,50% 15/08/2039 US USD 256.585 181.287 0,26<br />

US Treasury 4,25% 15/05/2039 US USD 179.609 121.756 0,17<br />

1.063.509 1,52<br />

Fondo de capital variable<br />

Fidelity Institutional Cash Fund - The Euro Fund IE EUR 37 513.249 0,73<br />

513.249 0,73<br />

Instrumentos del mercado monetario<br />

MPU Offshore Lift CD 16,10% 23/07/2008 (Impago)* NO NOK 1.026.339 1 0,00<br />

1 0,00<br />

Valores no admitidos a cotización<br />

Servicios financieros<br />

EURO 23X C 1,143% FRN 15/02/2019* IE EUR 509.214 234.238 0,33<br />

HFCHC 2005-2 A2 0,555% FRN 20/01/2035 US USD 304.833 169.326 0,24<br />

PROUD 1 D 1,389% FRN 18/08/2017* IE EUR 513.169 153.951 0,22<br />

BBVAP 4 C 1,441% FRN 19/08/2038* ES EUR 459.248 68.887 0,10<br />

EURO 23X D 1,283% FRN 15/02/2019* IE EUR 231.374 46.275 0,07<br />

MARSB 2006 C 1,144% FRN 28/08/2014* NL EUR 51.317 25.338 0,04<br />

COMIT 1 E 3,191% FRN 29/06/2013* DE EUR 201.814 20.181 0,03<br />

COMIT 1 D 1,341% FRN 29/06/2013* DE EUR 161.451 16.145 0,02<br />

Sedna 5,625% FRN 23/12/2008 EMTN (Impago)* KY EUR 615.803 6 0,00<br />

NGALE 2007-11 1 1,829% FRN 07/06/2010* GB USD 679.949 5 0,00<br />

Sedna Finance 1,523% FRN 15/03/2010 EMTN* KY EUR 538.828 5 0,00<br />

AXON 07-1A A1 5,96% FRN 04/04/2017 (Impago)* KY USD 461.852 3 0,00<br />

Links Finance 0,00% 15/09/2009 EMTN (Impago)* KY USD 513.169 3 0,00<br />

734.363 1,05<br />

Total de inversiones (Coste 61.487.174 EUR) 67.349.841 96,10<br />

Servicios financieros<br />

Banco Bilbao Vizcaya 3,00% 09/10/2014 ES EUR 641.462 633.957 0,90<br />

Iberdrola Ireland 3,80% 11/09/2014 Reg S IE USD 872.388 596.044 0,85<br />

Mapfre 5,921% VRN 24/07/2037 ES EUR 538.828 459.990 0,66<br />

ZFS Finance USA Trust I 6,15% VRN (Perpetuo) 144A US USD 744.096 444.583 0,63<br />

SHLD 1 B 1,009% FRN 20/01/2014 NL EUR 461.852 430.968 0,61<br />

US Bank 4,375% VRN 28/02/2017 EMTN US EUR 333.560 317.583 0,45<br />

GMF 1X BC 0,923% FRN 11/10/2041 GB EUR 359.219 316.098 0,45<br />

FOSSM 2007-1X M3 1,09% FRN 18/10/2054 GB EUR 307.902 297.279 0,42<br />

ZFS Finance USA Trust I 5,875% VRN (Perpetuo) US USD 522.920 286.414 0,41<br />

Banco Santander 3,875% 27/05/2014 ES EUR 256.585 265.113 0,38<br />

Wells Fargo & Company 3,75% 01/10/2014 US USD 384.877 259.485 0,37<br />

COMP 2004-1 B 1,249% FRN 25/05/2014 FR EUR 256.585 255.948 0,37<br />

Cód. div. Exposición Ganancias/(pérdidas) %<br />

subyacente no materializadas PN<br />

EUR<br />

Swaps de incumplimiento crediticio<br />

Compra de protección de Republic of Hungary 20/09/2014 USD 333.560 (13.963) (0,02)<br />

Compra de protección de Itraxx Europe High Vol 20/06/2014 EUR 2.078.336 (216.031) (0,31)<br />

(229.994) (0,33)<br />

249