Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

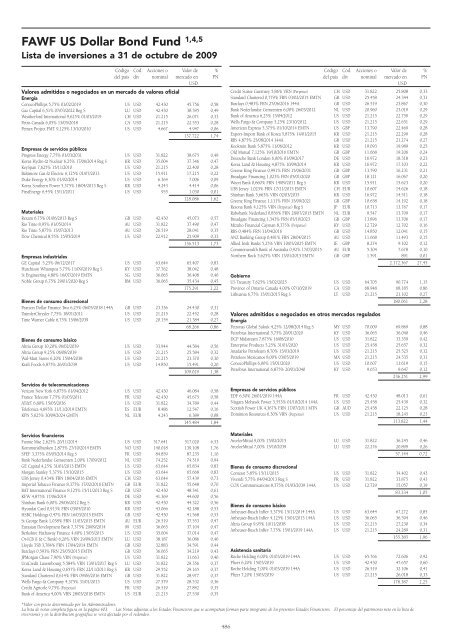

FAWF US Dollar Bond Fund 1,4,5<br />

Lista de inversiones a 31 de octubre de 2009<br />

Código Cód. Acciones o Valor de %<br />

del país div nominal mercado en PN<br />

USD<br />

Valores admitidos o negociados en un mercado de valores oficial<br />

Energía<br />

ConocoPhillips 5,75% 01/02/2019 US USD 42.430 45.756 0,58<br />

Gaz Capital 6,51% 07/03/2022 Reg S LU USD 42.430 38.395 0,49<br />

Weatherford International 9,625% 01/03/2019 CH USD 21.215 26.071 0,33<br />

Petro-Canada 6,05% 15/05/2018 CA USD 21.215 22.553 0,28<br />

Pemex Project FMT 9,125% 13/10/2010 US USD 4.667 4.947 0,06<br />

137.722 1,74<br />

Empresas de servicios públicos<br />

Progress Energy 7,75% 01/03/2031 US USD 31.822 38.675 0,49<br />

Korea Hydro & Nuclear 6,25% 17/06/2014 Reg S KR USD 35.004 37.346 0,47<br />

KeySpan 7,625% 15/11/2010 US USD 21.215 22.400 0,28<br />

Baltimore Gas & Electric 6,125% 01/07/2013 US USD 15.911 17.215 0,22<br />

Duke Energy 6,30% 01/02/2014 US USD 6.364 7.006 0,09<br />

Korea Southern Power 5,375% 18/04/2013 Reg S KR USD 4.243 4.414 0,06<br />

FirstEnergy 6,45% 15/11/2011 US USD 955 1.030 0,01<br />

128.086 1,62<br />

Materiales<br />

Rexam 6,75% 01/06/2013 Reg S GB USD 42.430 45.073 0,57<br />

Rio Tinto 8,95% 01/05/2014 AU USD 31.822 37.490 0,47<br />

Rio Tinto 5,875% 15/07/2013 AU USD 26.519 28.041 0,35<br />

Dow Chemical 8,55% 15/05/2019 US USD 22.912 25.909 0,33<br />

136.513 1,73<br />

Empresas industriales<br />

GE Capital 5,25% 06/12/2017 US USD 63.644 65.407 0,83<br />

Hutchison Whampoa 5,75% 11/09/2019 Reg S KY USD 37.762 38.042 0,48<br />

St Engineering 4,80% 16/07/2019 EMTN SG USD 36.065 36.408 0,46<br />

Noble Group 6,75% 29/01/2020 Reg S BM USD 36.065 35.434 0,45<br />

175.291 2,22<br />

Bienes de consumo discrecional<br />

Pearson Dollar Finance Two 6,25% 06/05/2018 144A GB USD 23.336 24.430 0,31<br />

DaimlerChrysler 7,75% 18/01/2011 US USD 21.215 22.452 0,28<br />

Time Warner Cable 6,75% 15/06/2039 US USD 20.154 21.384 0,27<br />

68.266 0,86<br />

Bienes de consumo básico<br />

Altria Group 10,20% 06/02/2039 US USD 33.944 44.584 0,56<br />

Altria Group 9,25% 06/08/2019 US USD 21.215 25.584 0,32<br />

Wal-Mart Stores 6,20% 15/04/2038 US USD 21.215 23.370 0,30<br />

Kraft Foods 6,875% 26/01/2039 US USD 14.850 15.491 0,20<br />

109.029 1,38<br />

Servicios de telecomunicaciones<br />

Verizon New York 6,875% 01/04/2012 US USD 42.430 46.084 0,58<br />

France Telecom 7,75% 01/03/2011 FR USD 42.430 45.675 0,58<br />

AT&T 6,80% 15/05/2036 US USD 31.822 34.789 0,44<br />

Telefonica 4,693% 11/11/2019 EMTN ES EUR 8.486 12.547 0,16<br />

KPN 5,625% 30/09/2024 GMTN NL EUR 4.243 6.389 0,08<br />

145.484 1,84<br />

Servicios financieros<br />

Fannie Mae 2,625% 20/11/2014 US USD 517.641 517.020 6,53<br />

Kommunalbanken 2,875% 27/10/2014 EMTN NO USD 140.018 139.108 1,76<br />

SFEF 3,375% 05/05/2014 Reg S FR USD 84.859 87.235 1,10<br />

Bank Nederlandse Gemeenten 2,00% 17/09/2012 NL USD 74.252 74.319 0,94<br />

GE Capital 4,25% 31/01/2013 EMTN US USD 63.644 65.834 0,83<br />

Morgan Stanley 5,375% 15/10/2015 US USD 63.644 65.668 0,83<br />

UBS Jersey 0,434% FRN 18/04/2016 EMTN CH USD 63.644 57.439 0,73<br />

Imperial Tobacco Finance 8,375% 17/02/2016 EMTN GB EUR 31.822 55.648 0,70<br />

BAT International Finance 8,125% 15/11/2013 Reg S GB USD 42.430 48.341 0,61<br />

KFW 4,875% 17/06/2019 DE USD 41.369 44.600 0,56<br />

Shinhan Bank 6,00% 29/06/2012 Reg S KR USD 42.430 44.322 0,56<br />

Hyundai Card 0,913% FRN 03/05/2010 KR USD 43.066 42.188 0,53<br />

HSBC Holdings 0,47% FRN 16/03/2015 EMTN GB USD 42.430 41.568 0,53<br />

St George Bank 1,038% FRN 11/03/2015 EMTN AU EUR 26.519 37.553 0,47<br />

Eurasian Development Bank 7,375% 29/09/2014 99 USD 36.065 37.104 0,47<br />

Berkshire Hathaway Finance 4,60% 15/05/2013 US USD 35.004 37.014 0,47<br />

Or-ICB (I & C Bank) 6,20% VRN 29/09/2015 EMTN LU USD 38.187 36.086 0,46<br />

Lloyds TSB 3,784% FRN 17/04/2014 EMTN GB USD 32.883 34.591 0,44<br />

Barclays 0,593% FRN 25/05/2015 EMTN GB USD 36.065 34.219 0,43<br />

JPMorgan Chase 7,90% VRN (Perpetuo) US USD 31.822 31.663 0,40<br />

UniCredit Luxembourg 5,584% VRN 13/01/2017 Reg S LU USD 31.822 29.356 0,37<br />

Korea Land & Housing 0,657% FRN 22/11/2011 Reg S KR USD 29.552 29.165 0,37<br />

Standard Chartered 0,614% FRN 09/06/2016 EMTN GB USD 31.822 28.977 0,37<br />

Wells Fargo & Company 4,375% 31/01/2013 US USD 27.579 28.532 0,36<br />

Credit Agricole 9,75% (Perpetuo) FR USD 26.519 27.842 0,35<br />

Bank of America 4,00% VRN 28/03/2018 EMTN US EUR 21.215 27.530 0,35<br />

Código Cód. Acciones o Valor de %<br />

del país div nominal mercado en PN<br />

USD<br />

Credit Suisse Guernsey 5,86% VRN (Perpetuo) CH USD 31.822 25.808 0,33<br />

Standard Chartered 0,779% FRN 03/02/2015 EMTN GB USD 25.458 24.344 0,31<br />

Barclays 0,483% FRN 27/06/2016 144A GB USD 26.519 23.867 0,30<br />

Bank Nederlandse Gemeenten 6,00% 26/03/2012 NL USD 20.960 23.019 0,29<br />

Bank of America 6,25% 15/04/2012 US USD 21.215 22.759 0,29<br />

Wells Fargo & Company 5,25% 23/10/2012 US USD 21.215 22.651 0,29<br />

American Express 5,375% 01/10/2014 EMTN US GBP 13.790 22.469 0,28<br />

Export-Import Bank of Korea 5,875% 14/01/2015 KR USD 21.215 22.299 0,28<br />

RBS 4,875% 25/08/2014 144A GB USD 21.215 21.274 0,27<br />

Kookmin Bank 5,875% 11/06/2012 KR USD 19.093 19.989 0,25<br />

Old Mutual 7,125% 19/10/2016 EMTN GB GBP 11.668 19.206 0,24<br />

Deutsche Bank London 6,00% 01/09/2017 DE USD 16.972 18.318 0,23<br />

Korea Land & Housing 4,875% 10/09/2014 KR USD 16.972 17.103 0,22<br />

Greene King Finance 0,991% FRN 15/06/2031 GB GBP 13.790 16.231 0,21<br />

Broadgate Financing 1,023% FRN 05/01/2020 GB GBP 18.121 16.067 0,20<br />

Woori Bank 0,660% FRN 14/09/2011 Reg S KR USD 15.911 15.623 0,20<br />

UBS Jersey 1,023% FRN 17/11/2015 EMTN CH EUR 10.607 14.626 0,18<br />

Shinhan Bank 5,663% VRN 02/03/2035 KR USD 16.972 14.511 0,18<br />

Greene King Finance 1,111% FRN 15/09/2021 GB GBP 10.658 14.192 0,18<br />

Resona Bank 4,125% VRN (Perpetuo) Reg S JP EUR 10.713 13.767 0,17<br />

Rabobank Nederland 0,856% FRN 28/07/2015 EMTN NL EUR 9.547 13.709 0,17<br />

Broadgate Financing 1,343% FRN 05/10/2023 GB GBP 13.896 13.706 0,17<br />

Mizuho Financial Cayman 8,375% (Perpetuo) KY USD 12.729 12.702 0,16<br />

RBS 0,484% FRN 11/04/2016 GB USD 14.850 12.041 0,15<br />

ANZ Banking Group 0,481% FRN 28/04/2015 AU USD 11.668 11.493 0,15<br />

Allied Irish Banks 5,25% VRN 10/03/2025 EMTN IE GBP 8.274 9.102 0,12<br />

Commonwealth Bank of Australia 0,92% 17/03/2015 AU EUR 5.304 7.678 0,10<br />

Northern Rock 5,625% VRN 13/01/2015 EMTN GB GBP 1.591 891 0,01<br />

2.172.367 27,45<br />

Gobierno<br />

US Treasury 7,625% 15/02/2025 US USD 64.705 90.774 1,15<br />

Province of Ontario Canada 4,00% 07/10/2019 CA USD 68.948 68.185 0,86<br />

Lithuania 6,75% 15/01/2015 Reg S LT USD 21.215 21.102 0,27<br />

180.061 2,28<br />

Valores admitidos o negociados en otros mercados regulados<br />

Energía<br />

Petronas Global Sukuk 4,25% 12/08/2014 Reg S MY USD 70.009 69.869 0,88<br />

Petrobras International 5,75% 20/01/2020 KY USD 36.065 36.040 0,46<br />

DCP Midstream 7,875% 16/08/2010 US USD 31.822 33.359 0,42<br />

Enterprise Products 5,25% 31/01/2020 US USD 25.458 25.657 0,32<br />

Anadarko Petroleum 8,70% 15/03/2019 US USD 21.215 25.525 0,32<br />

Petroleos Mexicanos 8,00% 03/05/2019 MX USD 21.215 24.535 0,31<br />

ConocoPhillips 6,00% 15/01/2020 US USD 10.607 11.619 0,15<br />

Petrobras International 6,875% 20/01/2040 KY USD 9.653 9.647 0,12<br />

236.251 2,99<br />

Empresas de servicios públicos<br />

EDF 6,50% 26/01/2019 144A FR USD 42.430 48.013 0,61<br />

Niagara Mohawk Power 3,553% 01/10/2014 144A US USD 25.458 25.439 0,32<br />

Scottish Power UK 4,367% FRN 17/07/2011 MTN GB AUD 25.458 22.125 0,28<br />

Dominion Resources 6,30% VRN (Perpetuo) US USD 21.215 18.245 0,23<br />

113.822 1,44<br />

Materiales<br />

ArcelorMittal 9,00% 15/02/2015 LU USD 31.822 36.245 0,46<br />

ArcelorMittal 7,00% 15/10/2039 LU USD 22.276 20.899 0,26<br />

57.144 0,72<br />

Bienes de consumo discrecional<br />

Comcast 5,85% 15/11/2015 US USD 31.822 34.402 0,43<br />

Vivendi 5,75% 04/04/2013 Reg S FR USD 31.822 33.875 0,43<br />

COX Communications 8,375% 01/03/2039 144A US USD 12.729 15.057 0,19<br />

83.334 1,05<br />

Bienes de consumo básico<br />

Anheuser-Busch InBev 5,375% 15/11/2014 144A US USD 63.644 67.272 0,85<br />

Anheuser-Busch InBev 4,125% 15/01/2015 144A US USD 36.065 36.594 0,46<br />

Altria Group 9,95% 10/11/2038 US USD 21.215 27.230 0,34<br />

Anheuser-Busch InBev 7,75% 15/01/2019 144A US USD 21.215 24.289 0,31<br />

155.385 1,96<br />

Asistencia sanitaria<br />

Roche Holding 6,00% 01/03/2019 144A US USD 65.766 72.606 0,92<br />

Pfizer 6,20% 15/03/2019 US USD 42.430 47.657 0,60<br />

Roche Holding 7,00% 01/03/2039 144A US USD 26.519 32.106 0,41<br />

Pfizer 7,20% 15/03/2039 US USD 21.215 26.018 0,33<br />

178.387 2,25<br />

*Valor con precio determinado por los Administradores.<br />

La lista de notas completa figura en la página 603. Las Notas adjuntas a los Estados Financieros que se acompañan forman parte integrante de los presentes Estados Financieros. El porcentaje del patrimonio neto en la lista de<br />

inversiones y en la distribución geográfica se verá afectado por el redondeo.<br />

486