Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

Informe semestral (pdf) - Cajastur

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

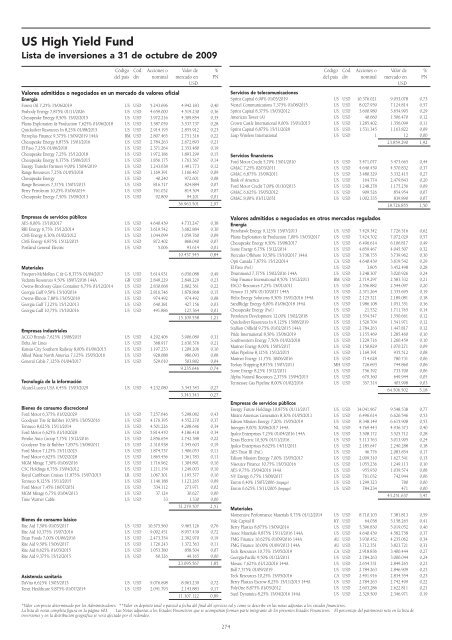

US High Yield Fund<br />

Lista de inversiones a 31 de octubre de 2009<br />

Código Cód. Acciones o Valor de %<br />

del país div nominal mercado en PN<br />

USD<br />

Valores admitidos o negociados en un mercado de valores oficial<br />

Energía<br />

Forest Oil 7,25% 15/06/2019 US USD 5.243.696 4.942.183 0,40<br />

Peabody Energy 7,875% 01/11/2026 US USD 4.659.000 4.519.230 0,36<br />

Chesapeake Energy 9,50% 15/02/2015 US USD 3.972.216 4.309.854 0,35<br />

Plains Exploration & Production 7,625% 01/06/2018 US USD 3.587.059 3.537.737 0,28<br />

Quicksilver Resources In 8,25% 01/08/2015 US USD 2.914.195 2.855.912 0,23<br />

Petroplus Finance 9,375% 15/09/2019 144A BM USD 2.807.465 2.751.316 0,22<br />

Chesapeake Energy 6,875% 15/01/2016 US USD 2.784.263 2.672.893 0,21<br />

El Paso 7,25% 01/06/2018 US USD 2.371.264 2.353.480 0,19<br />

Chesapeake Energy 7,25% 15/12/2018 US USD 1.972.186 1.893.299 0,15<br />

Chesapeake Energy 6,375% 15/06/2015 US USD 1.856.175 1.763.367 0,14<br />

Energy Transfer Partners 9,00% 15/04/2019 US USD 1.243.638 1.491.773 0,12<br />

Range Resources 7,25% 01/05/2018 US USD 1.169.391 1.166.467 0,09<br />

Chesapeake Energy US USD 40.240 972.601 0,08<br />

Range Resources 7,375% 15/07/2013 US USD 816.717 824.884 0,07<br />

Berry Petroleum 10,25% 01/06/2014 US USD 761.032 814.304 0,07<br />

Chesapeake Energy 7,50% 15/09/2013 US USD 92.809 94.201 0,01<br />

36.963.501 2,97<br />

Código Cód. Acciones o Valor de %<br />

del país div nominal mercado en PN<br />

USD<br />

Servicios de telecomunicaciones<br />

Sprint Capital 6,90% 01/05/2019 US USD 10.376.021 9.053.078 0,73<br />

Nextel Communications 7,375% 01/08/2015 US USD 8.027.959 7.124.814 0,57<br />

Sprint Capital 8,375% 15/03/2012 US USD 3.600.980 3.654.995 0,29<br />

American Tower (A) US USD 40.660 1.506.470 0,12<br />

Crown Castle International 9,00% 15/01/2015 US USD 1.285.402 1.356.099 0,11<br />

Sprint Capital 6,875% 15/11/2028 US USD 1.531.345 1.163.822 0,09<br />

Leap Wireless International US USD 1 12 0,00<br />

23.859.290 1,92<br />

Servicios financieros<br />

Ford Motor Credit 5,70% 15/01/2010 US USD 5.471.077 5.473.665 0,44<br />

GMAC 7,25% 02/03/2011 US USD 4.640.439 4.570.832 0,37<br />

GMAC 6,875% 15/09/2011 US USD 3.480.329 3.332.415 0,27<br />

Bank of America US USD 164.774 2.479.843 0,20<br />

Ford Motor Credit 7,00% 01/10/2013 US USD 1.248.278 1.175.256 0,09<br />

GMAC 6,625% 15/05/2012 US USD 909.526 854.954 0,07<br />

GMAC 8,00% 01/11/2031 US USD 1.002.335 839.890 0,07<br />

18.726.855 1,50<br />

Empresas de servicios públicos<br />

AES 8,00% 15/10/2017 US USD 4.640.439 4.733.247 0,38<br />

RRI Energy 6,75% 15/12/2014 US USD 3.619.542 3.682.884 0,30<br />

CMS Energy 6,30% 01/02/2012 US USD 1.044.099 1.059.760 0,09<br />

CMS Energy 6,875% 15/12/2015 US USD 872.402 868.040 0,07<br />

Portland General Electric US USD 5.006 93.614 0,01<br />

10.437.545 0,84<br />

Materiales<br />

Freeport-McMoRan C & G 8,375% 01/04/2017 US USD 5.614.931 6.050.088 0,49<br />

Vedanta Resources 9,50% 18/07/2018 144A GB USD 2.849.229 2.849.229 0,23<br />

Owens-Brockway Glass Container 6,75% 01/12/2014 US USD 2.830.668 2.802.361 0,22<br />

Georgia Gulf 9,50% 15/10/2014 US USD 2.816.746 1.878.868 0,15<br />

Owens-Illinois 7,80% 15/05/2018 US USD 974.492 974.492 0,08<br />

Georgia Gulf 7,125% 15/12/2013 US USD 640.381 427.156 0,03<br />

Georgia Gulf 10,75% 15/10/2016 US USD 491.886 127.364 0,01<br />

15.109.558 1,21<br />

Empresas industriales<br />

ACCO Brands 7,625% 15/08/2015 US USD 4.292.406 3.906.089 0,31<br />

Delta Air Lines US USD 368.917 2.630.376 0,21<br />

Kansas City Southern Railway 8,00% 01/06/2015 US USD 1.197.233 1.209.206 0,10<br />

Allied Waste North America 7,125% 15/05/2016 US USD 928.088 986.093 0,08<br />

General Cable 7,125% 01/04/2017 US USD 529.010 503.882 0,04<br />

9.235.646 0,74<br />

Tecnología de la información<br />

Alcatel-Lucent USA 6,45% 15/03/2029 US USD 4.232.080 3.343.343 0,27<br />

3.343.343 0,27<br />

Bienes de consumo discrecional<br />

Ford Motor 6,375% 01/02/2029 US USD 7.257.646 5.298.082 0,43<br />

Goodyear Tire & Rubber 10,50% 15/05/2016 US USD 4.176.395 4.552.270 0,37<br />

Tenneco 8,625% 15/11/2014 US USD 4.501.226 4.208.646 0,34<br />

Ford Motor 6,625% 01/10/2028 US USD 5.814.470 4.186.418 0,34<br />

Penske Auto Group 7,75% 15/12/2016 US USD 2.856.654 2.742.388 0,22<br />

Goodyear Tire & Rubber 7,857% 15/08/2011 US USD 2.310.938 2.345.603 0,19<br />

Ford Motor 7,125% 15/11/2025 US USD 1.874.737 1.406.053 0,11<br />

Ford Motor 6,625% 15/02/2028 US USD 1.865.456 1.361.783 0,11<br />

MGM Mirage 7,50% 01/06/2016 US USD 1.716.962 1.304.891 0,10<br />

CSC Holdings 6,75% 15/04/2012 US USD 1.211.154 1.249.003 0,10<br />

Royal Caribbean Cruises 11,875% 15/07/2015 LR USD 1.067.301 1.195.377 0,10<br />

Tenneco 8,125% 15/11/2015 US USD 1.146.188 1.123.265 0,09<br />

Ford Motor 7,45% 16/07/2031 US USD 334.112 273.971 0,02<br />

MGM Mirage 6,75% 01/04/2013 US USD 37.124 30.627 0,00<br />

Time Warner Cable US USD 33 1.330 0,00<br />

31.279.707 2,51<br />

Bienes de consumo básico<br />

Rite Aid 7,50% 01/03/2017 US USD 10.575.560 9.465.126 0,76<br />

Rite Aid 10,375% 15/07/2016 US USD 9.002.451 8.957.439 0,72<br />

Dean Foods 7,00% 01/06/2016 US USD 2.473.354 2.392.970 0,19<br />

Rite Aid 9,50% 15/06/2017 US USD 1.726.243 1.372.363 0,11<br />

Rite Aid 8,625% 01/03/2015 US USD 1.053.380 858.504 0,07<br />

Rite Aid 9,375% 15/12/2015 US USD 60.326 49.165 0,00<br />

23.095.567 1,85<br />

Asistencia sanitaria<br />

DaVita 6,625% 15/03/2013 US USD 9.076.698 8.963.239 0,72<br />

Tenet Healthcare 9,875% 01/07/2014 US USD 2.041.793 2.143.883 0,17<br />

11.107.122 0,89<br />

274<br />

Valores admitidos o negociados en otros mercados regulados<br />

Energía<br />

Petrohawk Energy 9,125% 15/07/2013 US USD 7.429.342 7.726.516 0,62<br />

Plains Exploration & Production 7,00% 15/03/2017 US USD 7.424.702 7.072.029 0,57<br />

Chesapeake Energy 6,50% 15/08/2017 US USD 6.496.614 6.106.817 0,49<br />

Stone Energy 6,75% 15/12/2014 US USD 4.859.467 4.045.507 0,32<br />

Hercules Offshore 10,50% 15/10/2017 144A US USD 3.758.755 3.739.962 0,30<br />

Opti Canada 7,875% 15/12/2014 CA USD 4.640.439 3.619.542 0,29<br />

El Paso (Pref.) US USD 3.805 3.452.498 0,28<br />

Drummond 7,375% 15/02/2016 144A US USD 3.248.307 3.020.926 0,24<br />

Ship Finance International 8,50% 15/12/2013 BM USD 2.719.297 2.583.332 0,21<br />

EXCO Resources 7,25% 15/01/2011 US USD 2.556.882 2.544.097 0,20<br />

Venoco 11,50% 01/10/2017 144A US USD 2.371.264 2.335.695 0,19<br />

Helix Energy Solutions 9,50% 15/01/2016 144A US USD 2.125.321 2.189.081 0,18<br />

SandRidge Energy 8,00% 01/06/2018 144A US USD 1.986.108 1.951.351 0,16<br />

Chesapeake Energy (Pref.) US USD 21.532 1.711.765 0,14<br />

Petroleum Development 12,00% 15/02/2018 US USD 1.554.547 1.550.661 0,12<br />

Quicksilver Resources In 9,125% 15/08/2019 US USD 1.526.704 1.541.971 0,12<br />

Stallion Oilfield 9,75% 01/02/2015 144A US USD 2.784.263 1.447.817 0,12<br />

Pride International 8,50% 15/06/2019 US USD 1.155.469 1.285.460 0,10<br />

Southwestern Energy 7,50% 01/02/2018 US USD 1.229.716 1.260.459 0,10<br />

Mariner Energy 8,00% 15/05/2017 US USD 1.150.829 1.070.271 0,09<br />

Atlas Pipeline 8,125% 15/12/2015 US USD 1.169.391 935.512 0,08<br />

Mariner Energy 11,75% 30/06/2016 US USD 714.628 780.731 0,06<br />

Teekay Shipping 8,875% 15/07/2011 MH USD 726.693 744.860 0,06<br />

Stone Energy 8,25% 15/12/2011 US USD 756.392 733.700 0,06<br />

Alpha Natural Resources 2,375% 15/04/2015 US USD 679.360 649.944 0,05<br />

Tennessee Gas Pipeline 8,00% 01/02/2016 US USD 357.314 405.998 0,03<br />

64.506.502 5,18<br />

Empresas de servicios públicos<br />

Energy Future Holdings 10,875% 01/11/2017 US USD 14.041.967 9.548.538 0,77<br />

Mirant Americas Generation 8,30% 01/05/2011 US USD 6.496.614 6.626.546 0,53<br />

Edison Mission Energy 7,20% 15/05/2019 US USD 8.348.149 6.615.908 0,53<br />

Intergen 9,00% 30/06/2017 144A NL USD 4.769.443 4.936.373 0,40<br />

Ipalco Enterprises 7,25% 01/04/2016 144A US USD 3.508.172 3.525.712 0,28<br />

Texas Electric 10,50% 01/11/2016 US USD 5.113.763 3.013.995 0,24<br />

Ipalco Enterprises 8,625% 14/11/2011 US USD 2.185.647 2.240.288 0,18<br />

AES Trust III (Pref.) US USD 46.776 2.083.854 0,17<br />

Edison Mission Energy 7,00% 15/05/2017 US USD 2.009.310 1.627.541 0,13<br />

Nisource Finance 10,75% 15/03/2016 US USD 1.055.236 1.249.113 0,10<br />

AES 9,75% 15/04/2016 144A US USD 955.930 1.039.574 0,08<br />

NV Energy 6,75% 15/08/2017 US USD 761.032 742.944 0,06<br />

Enron 6,40% 15/07/2006 (Impago) US USD 1.299.323 780 0,00<br />

Enron 6,625% 15/11/2005 (Impago) US USD 784.234 471 0,00<br />

43.251.637 3,47<br />

Materiales<br />

Momentive Performance Materials 9,75% 01/12/2014 US USD 8.710.103 7.381.813 0,59<br />

Vale Capital II KY USD 64.038 5.158.265 0,41<br />

Berry Plastics 8,875% 15/09/2014 US USD 5.396.830 5.019.052 0,40<br />

Assoc Materials 9,875% 15/11/2016 144A US USD 4.640.439 4.582.758 0,37<br />

FMG Finance 10,625% 01/09/2016 144A AU USD 3.930.452 4.235.062 0,34<br />

FMG Finance 10,00% 01/09/2013 144A AU USD 3.712.351 3.823.721 0,31<br />

Teck Resources 10,75% 15/05/2019 CA USD 2.918.836 3.400.444 0,27<br />

Georgia-Pacific 9,50% 01/12/2011 US USD 2.784.263 3.000.044 0,24<br />

Mosaic 7,625% 01/12/2016 144A US USD 2.654.331 2.849.265 0,23<br />

Ball 7,375% 01/09/2019 US USD 2.784.263 2.846.909 0,23<br />

Teck Resources 10,25% 15/05/2016 CA USD 2.491.916 2.834.554 0,23<br />

Berry Plastics Escrow 8,25% 15/11/2015 144A US USD 2.784.263 2.742.499 0,22<br />

PolyOne 8,875% 01/05/2012 US USD 2.603.286 2.622.811 0,21<br />

Steel Dynamics 8,25% 15/04/2016 144A US USD 2.329.500 2.346.971 0,19<br />

*Valor con precio determinado por los Administradores. **Valor en depósito total o parcial a fecha del final del ejercicio tal y como se describe en las notas adjuntas a los estados financieros.<br />

La lista de notas completa figura en la página 603. Las Notas adjuntas a los Estados Financieros que se acompañan forman parte integrante de los presentes Estados Financieros. El porcentaje del patrimonio neto en la lista de<br />

inversiones y en la distribución geográfica se verá afectado por el redondeo.