POVERTY REDUCTION STRATEGY TN

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

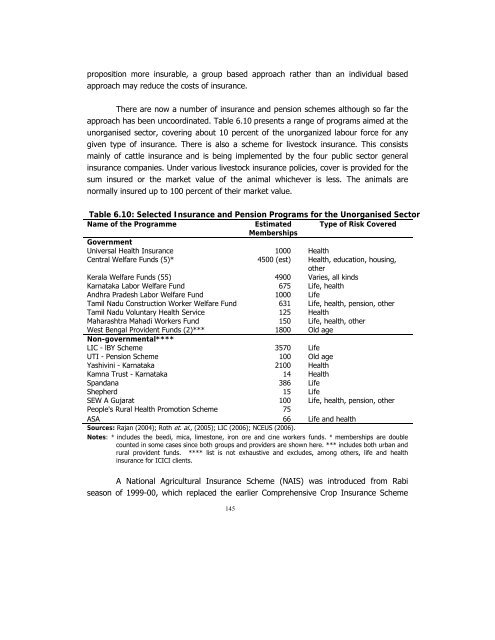

proposition more insurable, a group based approach rather than an individual based<br />

approach may reduce the costs of insurance.<br />

There are now a number of insurance and pension schemes although so far the<br />

approach has been uncoordinated. Table 6.10 presents a range of programs aimed at the<br />

unorganised sector, covering about 10 percent of the unorganized labour force for any<br />

given type of insurance. There is also a scheme for livestock insurance. This consists<br />

mainly of cattle insurance and is being implemented by the four public sector general<br />

insurance companies. Under various livestock insurance policies, cover is provided for the<br />

sum insured or the market value of the animal whichever is less. The animals are<br />

normally insured up to 100 percent of their market value.<br />

Table 6.10: Selected Insurance and Pension Programs for the Unorganised Sector<br />

Name of the Programme<br />

Estimated Type of Risk Covered<br />

Memberships<br />

Government<br />

Universal Health Insurance 1000 Health<br />

Central Welfare Funds (5)* 4500 (est) Health, education, housing,<br />

other<br />

Kerala Welfare Funds (55) 4900 Varies, all kinds<br />

Karnataka Labor Welfare Fund 675 Life, health<br />

Andhra Pradesh Labor Welfare Fund 1000 Life<br />

Tamil Nadu Construction Worker Welfare Fund 631 Life, health, pension, other<br />

Tamil Nadu Voluntary Health Service 125 Health<br />

Maharashtra Mahadi Workers Fund 150 Life, health, other<br />

West Bengal Provident Funds (2)*** 1800 Old age<br />

Non-governmental****<br />

LIC - lBY Scheme 3570 Life<br />

UTI - Pension Scheme 100 Old age<br />

Yashivini - Karnataka 2100 Health<br />

Kamna Trust - Karnataka 14 Health<br />

Spandana 386 Life<br />

Shepherd 15 Life<br />

SEW A Gujarat 100 Life, health, pension, other<br />

People's Rural Health Promotion Scheme 75<br />

ASA 66 Life and health<br />

Sources: Rajan (2004); Roth et. al., (2005); LIC (2006); NCEUS (2006).<br />

Notes: * includes the beedi, mica, limestone, iron ore and cine workers funds. * memberships are double<br />

counted in some cases since both groups and providers are shown here. *** includes both urban and<br />

rural provident funds. **** list is not exhaustive and excludes, among others, life and health<br />

insurance for ICICI clients.<br />

A National Agricultural Insurance Scheme (NAIS) was introduced from Rabi<br />

season of 1999-00, which replaced the earlier Comprehensive Crop Insurance Scheme<br />

145