POVERTY REDUCTION STRATEGY TN

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

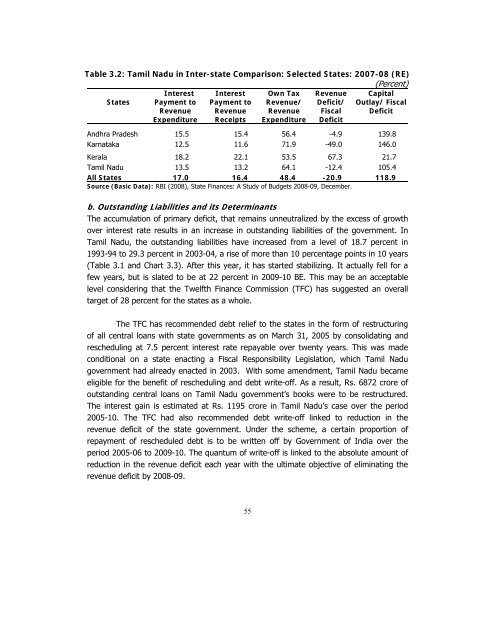

Table 3.2: Tamil Nadu in Inter-state Comparison: Selected States: 2007-08 (RE)<br />

(Percent)<br />

States<br />

Interest<br />

Payment to<br />

Revenue<br />

Expenditure<br />

Interest<br />

Payment to<br />

Revenue<br />

Receipts<br />

Own Tax<br />

Revenue/<br />

Revenue<br />

Expenditure<br />

Revenue<br />

Deficit/<br />

Fiscal<br />

Deficit<br />

Capital<br />

Outlay/ Fiscal<br />

Deficit<br />

Andhra Pradesh 15.5 15.4 56.4 -4.9 139.8<br />

Karnataka 12.5 11.6 71.9 -49.0 146.0<br />

Kerala 18.2 22.1 53.5 67.3 21.7<br />

Tamil Nadu 13.5 13.2 64.1 -12.4 105.4<br />

All States 17.0 16.4 48.4 -20.9 118.9<br />

Source (Basic Data): RBI (2008), State Finances: A Study of Budgets 2008-09, December.<br />

b. Outstanding Liabilities and its Determinants<br />

The accumulation of primary deficit, that remains unneutralized by the excess of growth<br />

over interest rate results in an increase in outstanding liabilities of the government. In<br />

Tamil Nadu, the outstanding liabilities have increased from a level of 18.7 percent in<br />

1993-94 to 29.3 percent in 2003-04, a rise of more than 10 percentage points in 10 years<br />

(Table 3.1 and Chart 3.3). After this year, it has started stabilizing. It actually fell for a<br />

few years, but is slated to be at 22 percent in 2009-10 BE. This may be an acceptable<br />

level considering that the Twelfth Finance Commission (TFC) has suggested an overall<br />

target of 28 percent for the states as a whole.<br />

The TFC has recommended debt relief to the states in the form of restructuring<br />

of all central loans with state governments as on March 31, 2005 by consolidating and<br />

rescheduling at 7.5 percent interest rate repayable over twenty years. This was made<br />

conditional on a state enacting a Fiscal Responsibility Legislation, which Tamil Nadu<br />

government had already enacted in 2003. With some amendment, Tamil Nadu became<br />

eligible for the benefit of rescheduling and debt write-off. As a result, Rs. 6872 crore of<br />

outstanding central loans on Tamil Nadu government’s books were to be restructured.<br />

The interest gain is estimated at Rs. 1195 crore in Tamil Nadu’s case over the period<br />

2005-10. The TFC had also recommended debt write-off linked to reduction in the<br />

revenue deficit of the state government. Under the scheme, a certain proportion of<br />

repayment of rescheduled debt is to be written off by Government of India over the<br />

period 2005-06 to 2009-10. The quantum of write-off is linked to the absolute amount of<br />

reduction in the revenue deficit each year with the ultimate objective of eliminating the<br />

revenue deficit by 2008-09.<br />

55