POVERTY REDUCTION STRATEGY TN

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

collected by state-owned enterprises. In non-tax revenue there is some potential for<br />

increases.<br />

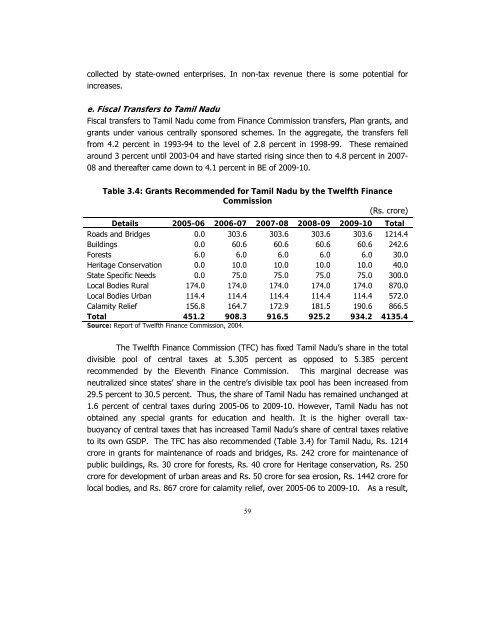

e. Fiscal Transfers to Tamil Nadu<br />

Fiscal transfers to Tamil Nadu come from Finance Commission transfers, Plan grants, and<br />

grants under various centrally sponsored schemes. In the aggregate, the transfers fell<br />

from 4.2 percent in 1993-94 to the level of 2.8 percent in 1998-99. These remained<br />

around 3 percent until 2003-04 and have started rising since then to 4.8 percent in 2007-<br />

08 and thereafter came down to 4.1 percent in BE of 2009-10.<br />

Table 3.4: Grants Recommended for Tamil Nadu by the Twelfth Finance<br />

Commission<br />

(Rs. crore)<br />

Details 2005-06 2006-07 2007-08 2008-09 2009-10 Total<br />

Roads and Bridges 0.0 303.6 303.6 303.6 303.6 1214.4<br />

Buildings 0.0 60.6 60.6 60.6 60.6 242.6<br />

Forests 6.0 6.0 6.0 6.0 6.0 30.0<br />

Heritage Conservation 0.0 10.0 10.0 10.0 10.0 40.0<br />

State Specific Needs 0.0 75.0 75.0 75.0 75.0 300.0<br />

Local Bodies Rural 174.0 174.0 174.0 174.0 174.0 870.0<br />

Local Bodies Urban 114.4 114.4 114.4 114.4 114.4 572.0<br />

Calamity Relief 156.8 164.7 172.9 181.5 190.6 866.5<br />

Total 451.2 908.3 916.5 925.2 934.2 4135.4<br />

Source: Report of Twelfth Finance Commission, 2004.<br />

The Twelfth Finance Commission (TFC) has fixed Tamil Nadu’s share in the total<br />

divisible pool of central taxes at 5.305 percent as opposed to 5.385 percent<br />

recommended by the Eleventh Finance Commission. This marginal decrease was<br />

neutralized since states’ share in the centre’s divisible tax pool has been increased from<br />

29.5 percent to 30.5 percent. Thus, the share of Tamil Nadu has remained unchanged at<br />

1.6 percent of central taxes during 2005-06 to 2009-10. However, Tamil Nadu has not<br />

obtained any special grants for education and health. It is the higher overall taxbuoyancy<br />

of central taxes that has increased Tamil Nadu’s share of central taxes relative<br />

to its own GSDP. The TFC has also recommended (Table 3.4) for Tamil Nadu, Rs. 1214<br />

crore in grants for maintenance of roads and bridges, Rs. 242 crore for maintenance of<br />

public buildings, Rs. 30 crore for forests, Rs. 40 crore for Heritage conservation, Rs. 250<br />

crore for development of urban areas and Rs. 50 crore for sea erosion, Rs. 1442 crore for<br />

local bodies, and Rs. 867 crore for calamity relief, over 2005-06 to 2009-10. As a result,<br />

59