POVERTY REDUCTION STRATEGY TN

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

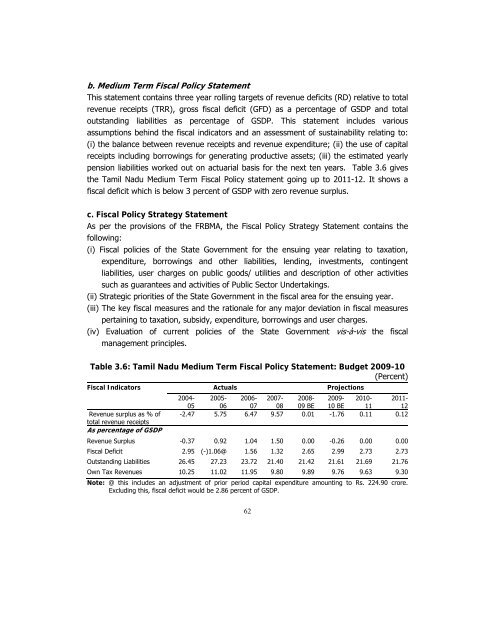

. Medium Term Fiscal Policy Statement<br />

This statement contains three year rolling targets of revenue deficits (RD) relative to total<br />

revenue receipts (TRR), gross fiscal deficit (GFD) as a percentage of GSDP and total<br />

outstanding liabilities as percentage of GSDP. This statement includes various<br />

assumptions behind the fiscal indicators and an assessment of sustainability relating to:<br />

(i) the balance between revenue receipts and revenue expenditure; (ii) the use of capital<br />

receipts including borrowings for generating productive assets; (iii) the estimated yearly<br />

pension liabilities worked out on actuarial basis for the next ten years. Table 3.6 gives<br />

the Tamil Nadu Medium Term Fiscal Policy statement going up to 2011-12. It shows a<br />

fiscal deficit which is below 3 percent of GSDP with zero revenue surplus.<br />

c. Fiscal Policy Strategy Statement<br />

As per the provisions of the FRBMA, the Fiscal Policy Strategy Statement contains the<br />

following:<br />

(i) Fiscal policies of the State Government for the ensuing year relating to taxation,<br />

expenditure, borrowings and other liabilities, lending, investments, contingent<br />

liabilities, user charges on public goods/ utilities and description of other activities<br />

such as guarantees and activities of Public Sector Undertakings.<br />

(ii) Strategic priorities of the State Government in the fiscal area for the ensuing year.<br />

(iii) The key fiscal measures and the rationale for any major deviation in fiscal measures<br />

pertaining to taxation, subsidy, expenditure, borrowings and user charges.<br />

(iv) Evaluation of current policies of the State Government vis-à-vis the fiscal<br />

management principles.<br />

Table 3.6: Tamil Nadu Medium Term Fiscal Policy Statement: Budget 2009-10<br />

(Percent)<br />

Fiscal Indicators Actuals Projections<br />

Revenue surplus as % of<br />

total revenue receipts<br />

As percentage of GSDP<br />

2004- 2005- 2006- 2007- 2008- 2009- 2010- 2011-<br />

05 06 07 08 09 BE 10 BE 11 12<br />

-2.47 5.75 6.47 9.57 0.01 -1.76 0.11 0.12<br />

Revenue Surplus -0.37 0.92 1.04 1.50 0.00 -0.26 0.00 0.00<br />

Fiscal Deficit 2.95 (-)1.06@ 1.56 1.32 2.65 2.99 2.73 2.73<br />

Outstanding Liabilities 26.45 27.23 23.72 21.40 21.42 21.61 21.69 21.76<br />

Own Tax Revenues 10.25 11.02 11.95 9.80 9.89 9.76 9.63 9.30<br />

Note: @ this includes an adjustment of prior period capital expenditure amounting to Rs. 224.90 crore.<br />

Excluding this, fiscal deficit would be 2.86 percent of GSDP.<br />

62