- Page 1 and 2:

Energy Systems and Technologies for

- Page 3 and 4:

ContentsSessions overview 1Programm

- Page 5 and 6:

sessions overview08:00-09:00Coffee

- Page 7 and 8:

11:00 - 12:30 session 6A - Bioenerg

- Page 9 and 10:

ContactSustainable Energy, Technica

- Page 11 and 12:

Penetration of new energy technolog

- Page 13 and 14:

how decisions are made and by whom

- Page 15 and 16:

(9) is the logaritimic expansion of

- Page 17 and 18:

(16)we may finally write Eq(14) in

- Page 19 and 20:

Table 1: Fast track cases for new r

- Page 21 and 22:

Peterka V. Macrodynamics of technol

- Page 23 and 24:

Growth in clean and reliable energy

- Page 25 and 26:

Conclusion - an ambitious vision an

- Page 27 and 28:

"Spurring investments in renewable

- Page 29 and 30:

Integrating climate change adaptati

- Page 31 and 32:

transport, and finance. Energy prov

- Page 33 and 34:

northern South America, the Caribbe

- Page 35 and 36:

Table 1: Energy system adaptation s

- Page 37 and 38:

More generally, a number of no- or

- Page 39 and 40:

6 ReferencesADB, 2005. Climate proo

- Page 41 and 42:

Sailor, D.J., Smith, M., Hart, M.,

- Page 43 and 44:

Factors affecting stakeholder perce

- Page 45 and 46:

Another study conducted in Japan wa

- Page 47 and 48:

4 The effect of information on stak

- Page 49 and 50:

Furthermore, communication to stake

- Page 51 and 52:

Shackley S, McLachlan C, Gough C (2

- Page 53 and 54:

Figure 1: Potential CO 2 storage si

- Page 55 and 56:

The Upper Jurassic - Lower Cretaceo

- Page 57 and 58:

The majority of the individual stru

- Page 59 and 60:

Development. Project no. ENK6-CT-19

- Page 61 and 62:

Section 5 summarises the key issue

- Page 63 and 64:

Table 1. Efficiencies for new large

- Page 65 and 66:

In addition, district heating syste

- Page 67 and 68:

6.4 Model results from EFDA-TIMESIn

- Page 69 and 70:

Maisonnier, D., et al. (2007), Powe

- Page 71 and 72:

1Efficiency and effectiveness of pr

- Page 73 and 74:

3Stromerzeugung [TWh/a]250200150100

- Page 75 and 76:

54 Country-specific Lessons learned

- Page 77 and 78:

7100%90%80%quota fullfilment (%)70%

- Page 79 and 80:

[5] Haas R., et al: Efficiency and

- Page 81 and 82:

The development and diffusion of re

- Page 83 and 84:

a. Offshore wind in DenmarkDenmark

- Page 85 and 86:

applicants are invited to submit a

- Page 87 and 88:

nies that provide upstream and down

- Page 89 and 90:

for both technology users and produ

- Page 91 and 92:

Trade Disputes over Renewable Energ

- Page 93 and 94:

treatment to imported renewable ene

- Page 95 and 96:

In Canada, the federal government i

- Page 97 and 98:

grid access, subsidies and land off

- Page 99 and 100:

In 2010, China’s total wind insta

- Page 101 and 102:

Source: Renewables 2010 Global Stat

- Page 103 and 104:

Source: REN 21, Renewables 2010 Glo

- Page 105 and 106:

Source: adapted from REN21, 2010It

- Page 107 and 108:

their precise scope and nature diff

- Page 109 and 110:

60 daysBy 2 nd DSBmeetingConsultati

- Page 111 and 112:

discriminatory manner on domestic a

- Page 113 and 114:

the European Union, the North Ameri

- Page 115:

ended. China lost this case because

- Page 118 and 119:

As most countries in the world are

- Page 120 and 121:

Session 3A - Energy SystemsRisø In

- Page 122 and 123:

1 IntroductionWith the introduction

- Page 124 and 125:

occur. This is an undesirably burea

- Page 126 and 127:

This curve could be used as a new t

- Page 128 and 129:

ut for the total consumption, and i

- Page 130 and 131:

This gives the LBR an opportunity t

- Page 132 and 133:

concludes that the subsurface conta

- Page 134 and 135:

to constrain the evaluation. In add

- Page 136 and 137:

Fig. 2 SW-NE trending seismic profi

- Page 138 and 139:

Fig. 5. Petrophysical evaluation of

- Page 140 and 141:

ConclusionsThe Danish subsurface co

- Page 142 and 143:

Performance of Space Heating in aMo

- Page 144 and 145:

[5],[10],[11],[16],[18],[20],[26].

- Page 146 and 147:

2/3 Sun1 Coal1/3 ElPower plantHP1 H

- Page 148 and 149:

25002000Surplus(min(wind,prod-cons)

- Page 150 and 151:

160CO 2 emission per unit heat prod

- Page 152 and 153:

The calculations have been based on

- Page 154 and 155:

Session 3B - smart gridsRisø Inter

- Page 156 and 157:

2 Myopic Investments2.1 The Balmore

- Page 158 and 159:

Moreover, this model is formulated

- Page 160 and 161:

Reducing Electricity Demand Peaks b

- Page 162 and 163:

3 Event Driven Scheduling Algorithm

- Page 164 and 165:

5 Mapping Teletraffic Theory to Ene

- Page 166 and 167:

6.2 Results and Performance Metrics

- Page 168 and 169:

Energy Efficient Refrigeration and

- Page 170 and 171:

Virtual Power PlantAggregatorSuperm

- Page 172 and 173:

C p,rC p,fT rT fW cφ sT a(UA) raHe

- Page 174 and 175:

Total PowerP.G. #1P.G. #2C.R. #1201

- Page 176 and 177:

the availability payment.Simulation

- Page 178 and 179:

The constraint in Eq. (16) has the

- Page 180 and 181:

The FlexControl concept - a vision,

- Page 182 and 183:

can react on requests for power reg

- Page 184 and 185:

3 ControlThe concept is based solel

- Page 186 and 187:

one hour to the next - correspondin

- Page 188 and 189:

4 ProtectionThe protection of the p

- Page 190 and 191:

Session 4 - Efficiency Improvements

- Page 192 and 193:

the product portfolio point of view

- Page 194 and 195:

Figure 4: Principle flow sheet of t

- Page 196 and 197:

process information needed are seld

- Page 198 and 199:

AIRFINE®(Reference)MEROS®Ca(OH)2M

- Page 200 and 201:

4 Conclusion & DiscussionThe Eco-Ca

- Page 202 and 203:

1 Energy policy and EU directivesTh

- Page 204 and 205:

iomass CHP, heat pumps, electric bo

- Page 206 and 207:

Fig. 1: How to supply a growing hea

- Page 208 and 209:

Session 5A - Wind Energy IRisø Int

- Page 210 and 211:

The average cumulative growth rate

- Page 212 and 213:

turbines is expected to create a st

- Page 214 and 215:

O&MGridWindturbineSubstructureFigur

- Page 216 and 217:

Another idea is to harvest energy f

- Page 218 and 219:

9. Shimon Awerbuch, Determining the

- Page 220 and 221:

engaged in wind energy assessment,

- Page 222 and 223:

treated in such a way to make them

- Page 224 and 225:

Figure 5: Map showing the estimated

- Page 226 and 227:

Figure 9: The annual mean power den

- Page 228 and 229:

mix is required. For example diurna

- Page 230 and 231:

Session 5B - Wind Energy IIRisø In

- Page 232 and 233:

TABLE ISOME OF THE WIND TURBINE MAN

- Page 234 and 235:

China, has prompted all parties, in

- Page 236 and 237:

to the high shaft speed. Furthermor

- Page 238 and 239:

Superconductors must be kept cold b

- Page 240 and 241:

an annual increase in demand of 6%,

- Page 242 and 243:

Improved High Temperature Supercond

- Page 244 and 245:

our study to a single set of deposi

- Page 246 and 247:

3.2 Yttrium-enriched YBCO thin film

- Page 248 and 249:

Fig. 5. AC-susceptibility dependenc

- Page 250 and 251:

The j C (B) dependence at 50 K for

- Page 252 and 253:

Session 6A - Bioenergy IRisø Inter

- Page 254 and 255:

The European politicians are faced

- Page 256 and 257:

The fast growing demand for biomass

- Page 258 and 259:

Figure 2: Avedøre Power Plant in C

- Page 260 and 261:

Figure 5: Concept for a sustainable

- Page 262 and 263:

The role of biomass and CCS in Chin

- Page 264 and 265:

2.2.1 CCS Potential for ChinaCCS is

- Page 266 and 267: 80%70%60%China's share ofglobal CO

- Page 268 and 269: In general, if the CCS technology d

- Page 270 and 271: with high implementation of CCS Chi

- Page 272 and 273: The European Biofuels Policy: from

- Page 274 and 275: aimed to promote agriculture-based

- Page 276 and 277: (EC, 2009b), and internationally vi

- Page 278 and 279: Session 6B - Bio Energy IIRisø Int

- Page 280 and 281: The commercial scale production of

- Page 282 and 283: the production process parameters,

- Page 284 and 285: NutrientWaterAlgal cultureproductio

- Page 286 and 287: Schenk, P.M., Thomas-Hall, S.R., St

- Page 288 and 289: Liquid biofuels from blue biomassZs

- Page 290 and 291: Even though final ethanol yields we

- Page 292 and 293: Integrated Gasification SOFC Plant

- Page 294 and 295: 2.1 Modelling of SOFCThe SOFC model

- Page 296 and 297: where g 0 , R an T are the specific

- Page 298 and 299: hand side y-axis corresponds to eff

- Page 300 and 301: The moister content for these three

- Page 302 and 303: Use of Methanation for Optimization

- Page 304 and 305: power production from utilizing the

- Page 306 and 307: 2.1 Model DescriptionThe developed

- Page 308 and 309: Figure 3: Flow sheet of methanation

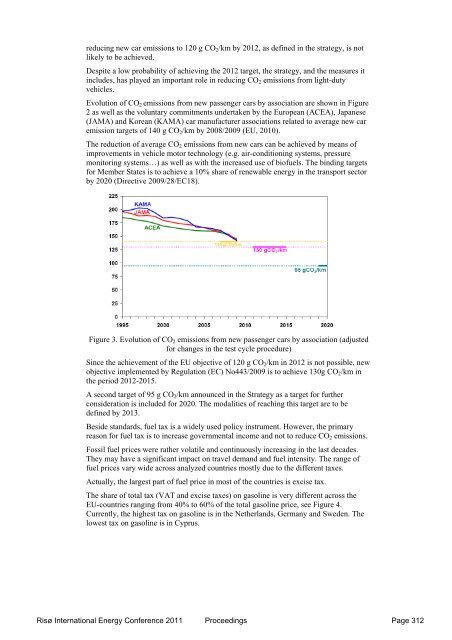

- Page 310 and 311: efficiency and turbine inlet temper

- Page 312 and 313: [14] DNA - A Thermal Energy System

- Page 314 and 315: On the effectiveness of standards v

- Page 318 and 319: In addition energy consumption E an

- Page 320 and 321: coefficient γ for the impact of fu

- Page 322 and 323: 400200Change in energy (PJ)01980 19

- Page 324 and 325: Figure 9 depict scenarios for the f

- Page 326 and 327: What are customers willing to pay f

- Page 328 and 329: Randomly, continuous up to ±50%Acc

- Page 330 and 331: The likelihood for the model is giv

- Page 332 and 333: eally means that this factor and no

- Page 334 and 335: Table 5-1 Parameter estimates from

- Page 336 and 337: Table 6-2 Willingness to pay for 10

- Page 338 and 339: Session 12 - Energy for Developing

- Page 340 and 341: Risø International Energy Conferen

- Page 342 and 343: Risø International Energy Conferen

- Page 344 and 345: Risø International Energy Conferen

- Page 346 and 347: Risø International Energy Conferen

- Page 348 and 349: Risø International Energy Conferen

- Page 350 and 351: existing renewable energy technolog

- Page 352 and 353: useful energyend energysecondary en

- Page 354 and 355: parts or the means of enforcing war

- Page 356 and 357: The development of micro-hydro proj

- Page 358 and 359: Table 1. Electric power generation

- Page 360 and 361: 5 ReferencesBajgain, S., Shakya, I.

- Page 362 and 363: IntroductionElectricity has become

- Page 364 and 365: of 2008, 43.6% of the total populat

- Page 366 and 367:

Hilmand provinces have comparativel

- Page 368 and 369:

….. eq. 5LCOE is the net present

- Page 370 and 371:

case of Nepal, it is 5% (Trading ec

- Page 372 and 373:

ing down the cost of solar PV modul

- Page 374 and 375:

3.3 Serving the rural areas with na

- Page 376 and 377:

The levelized costs of electricity

- Page 378 and 379:

Figure 4. Variation in LCOE with si

- Page 380 and 381:

The analysis reveals that fuel cost

- Page 382 and 383:

In case of DG, we have looked with

- Page 384 and 385:

Gross, R., Blyth, W., Heptonstall,

- Page 386 and 387:

Mode of Transport to Work, Car Owne

- Page 388 and 389:

power parity (PPP) basis, GDP per c

- Page 390 and 391:

83,385 to 109,108 while the number

- Page 392 and 393:

other purposes so that reduced fare

- Page 394 and 395:

emissions studies is that they were

- Page 396 and 397:

where I (·) is the indicator funct

- Page 398 and 399:

increases, individuals acquire more

- Page 400 and 401:

while that of other means of transp

- Page 402 and 403:

into CO 2 . For all oil and oil pro

- Page 404 and 405:

impact. In general, income is found

- Page 406 and 407:

7 ReferenceAlperovich, G., Deutsch,

- Page 408 and 409:

Table 1: Definitions of Variables a

- Page 410 and 411:

Session 13 - Energy StorageRisø In

- Page 412 and 413:

2 Storage demand and resulting stor

- Page 414 and 415:

compressed air storages, demand sit

- Page 416 and 417:

Fig. 3: Options for underground sto

- Page 418 and 419:

3.5 Geological potential in EuropeF

- Page 420 and 421:

Sensitivity on Battery Prices and C

- Page 422 and 423:

3.1 Base caseA northern European en

- Page 424 and 425:

4 ResultsThe model is run on a comp

- Page 426 and 427:

Furthermore, a slight decrease in t

- Page 428 and 429:

Night time charging increases with

- Page 430 and 431:

Lithuanian Energy Institute, PSE In

- Page 432 and 433:

atteries, Compressed Air Energy Sto

- Page 434 and 435:

negative net load, can be expected

- Page 436 and 437:

25%Pct. of the year20%15%10%5%0.5-0

- Page 438 and 439:

800006000040000MWh200000Netload-200

- Page 440 and 441:

[4] B. V. Mathiesen and H. Lund, "C

- Page 442 and 443:

Compressed Air Energy Storage in Of

- Page 444 and 445:

compressed air caverns, corrosion-r

- Page 446 and 447:

Figure 3: Distribution of salt depo

- Page 448 and 449:

Figure 6: EWEA's 20 year Offshore N

- Page 450 and 451:

spinning reserves can be provided b

- Page 452 and 453:

7 Discussion and conclusionsThis pa

- Page 454:

Risø DTU is the National Laborator