DHL Global Connectedness Index 2014

DHL Global Connectedness Index 2014

DHL Global Connectedness Index 2014

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>DHL</strong> <strong>Global</strong> <strong>Connectedness</strong> <strong>Index</strong> <strong>2014</strong><br />

15<br />

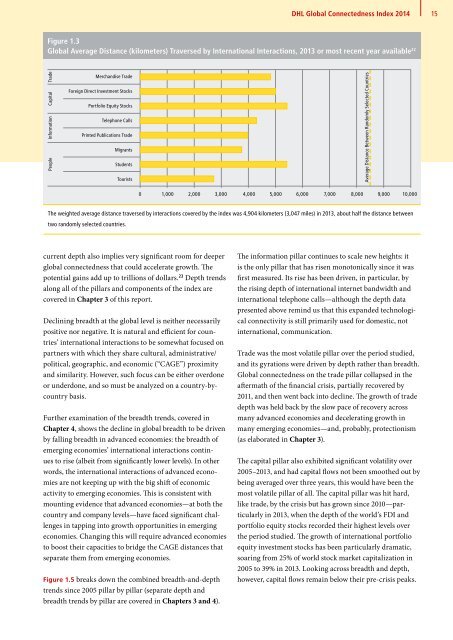

Figure 1.3<br />

<strong>Global</strong> Average Distance (kilometers) Traversed by International Interactions, 2013 or most recent year available 22<br />

People Information Capital Trade<br />

Merchandise Trade<br />

Foreign Direct Investment Stocks<br />

Portfolio Equity Stocks<br />

Telephone Calls<br />

Printed Publications Trade<br />

Migrants<br />

Students<br />

Tourists<br />

Average Distance Between Randomly Selected Countries<br />

0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,00010,000<br />

The weighted average distance traversed by interactions covered by the index was 4,904 kilometers (3,047 miles) in 2013, about half the distance between<br />

two randomly selected countries.<br />

current depth also implies very significant room for deeper<br />

global connectedness that could accelerate growth. The<br />

potential gains add up to trillions of dollars. 23 Depth trends<br />

along all of the pillars and components of the index are<br />

covered in Chapter 3 of this report. 22<br />

Declining breadth at the global level is neither necessarily<br />

positive nor negative. It is natural and efficient for countries’<br />

international interactions to be somewhat focused on<br />

partners with which they share cultural, administrative/<br />

political, geographic, and economic (“CAGE”) proximity<br />

and similarity. However, such focus can be either overdone<br />

or underdone, and so must be analyzed on a country-bycountry<br />

basis.<br />

Further examination of the breadth trends, covered in<br />

Chapter 4, shows the decline in global breadth to be driven<br />

by falling breadth in advanced economies: the breadth of<br />

emerging economies’ international interactions continues<br />

to rise (albeit from significantly lower levels). In other<br />

words, the international interactions of advanced economies<br />

are not keeping up with the big shift of economic<br />

activity to emerging economies. This is consistent with<br />

mounting evidence that advanced economies—at both the<br />

country and company levels—have faced significant challenges<br />

in tapping into growth opportunities in emerging<br />

economies. Changing this will require advanced economies<br />

to boost their capacities to bridge the CAGE distances that<br />

separate them from emerging economies.<br />

Figure 1.5 breaks down the combined breadth-and-depth<br />

trends since 2005 pillar by pillar (separate depth and<br />

breadth trends by pillar are covered in Chapters 3 and 4).<br />

The information pillar continues to scale new heights: it<br />

is the only pillar that has risen monotonically since it was<br />

first measured. Its rise has been driven, in particular, by<br />

the rising depth of international internet bandwidth and<br />

international telephone calls—although the depth data<br />

presented above remind us that this expanded technological<br />

connectivity is still primarily used for domestic, not<br />

international, communication.<br />

Trade was the most volatile pillar over the period studied,<br />

and its gyrations were driven by depth rather than breadth.<br />

<strong>Global</strong> connectedness on the trade pillar collapsed in the<br />

aftermath of the financial crisis, partially recovered by<br />

2011, and then went back into decline. The growth of trade<br />

depth was held back by the slow pace of recovery across<br />

many advanced economies and decelerating growth in<br />

many emerging economies—and, probably, protectionism<br />

(as elaborated in Chapter 3).<br />

The capital pillar also exhibited significant volatility over<br />

2005–2013, and had capital flows not been smoothed out by<br />

being averaged over three years, this would have been the<br />

most volatile pillar of all. The capital pillar was hit hard,<br />

like trade, by the crisis but has grown since 2010—particularly<br />

in 2013, when the depth of the world’s FDI and<br />

portfolio equity stocks recorded their highest levels over<br />

the period studied. The growth of international portfolio<br />

equity investment stocks has been particularly dramatic,<br />

soaring from 25% of world stock market capitalization in<br />

2005 to 39% in 2013. Looking across breadth and depth,<br />

however, capital flows remain below their pre-crisis peaks.