DHL Global Connectedness Index 2014

DHL Global Connectedness Index 2014

DHL Global Connectedness Index 2014

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DHL</strong> <strong>Global</strong> <strong>Connectedness</strong> <strong>Index</strong> <strong>2014</strong><br />

65<br />

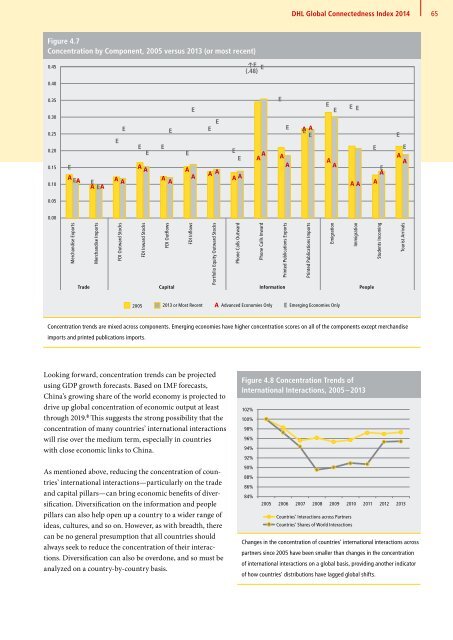

Figure 4.7<br />

Concentration by Component, 2005 versus 2013 (or most recent)<br />

0.45<br />

↑E<br />

(.48)<br />

E<br />

0.40<br />

0.35<br />

0.30<br />

0.25<br />

0.20<br />

0.15<br />

0.10<br />

A<br />

E<br />

E<br />

A A<br />

E<br />

E<br />

E A E<br />

A A<br />

E<br />

E<br />

A<br />

A<br />

E<br />

E<br />

A<br />

A<br />

E<br />

E<br />

A<br />

A<br />

E<br />

E<br />

A A<br />

E<br />

E<br />

E<br />

E A A A<br />

A A A<br />

A A<br />

A A<br />

AE A<br />

E<br />

E<br />

E<br />

E E<br />

E<br />

E<br />

A<br />

A<br />

E<br />

E<br />

A<br />

A<br />

0.05<br />

0.00<br />

Merchandise Exports<br />

Merchandise Imports<br />

FDI Outward Stocks<br />

FDI Inward Stocks<br />

FDI Outflows<br />

FDI Inflows<br />

Portfolio Equity Outward Stocks<br />

Phone Calls Outward<br />

Phone Calls Inward<br />

Printed Publications Exports<br />

Printed Publications Imports<br />

Emigration<br />

Immigration<br />

Students Incoming<br />

Trade Capital Information People<br />

Tourist Arrivals<br />

2005 2013 or Most Recent A Advanced Economies Only E Emerging Economies Only<br />

Concentration trends are mixed across components. Emerging economies have higher concentration scores on all of the components except merchandise<br />

imports and printed publications imports.<br />

Looking forward, concentration trends can be projected<br />

using GDP growth forecasts. Based on IMF forecasts,<br />

China’s growing share of the world economy is projected to<br />

drive up global concentration of economic output at least<br />

through 2019. 8 This suggests the strong possibility that the<br />

concentration of many countries’ international interactions<br />

will rise over the medium term, especially in countries<br />

with close economic links to China.<br />

As mentioned above, reducing the concentration of countries’<br />

international interactions—particularly on the trade<br />

and capital pillars—can bring economic benefits of diversification.<br />

Diversification on the information and people<br />

pillars can also help open up a country to a wider range of<br />

ideas, cultures, and so on. However, as with breadth, there<br />

can be no general presumption that all countries should<br />

always seek to reduce the concentration of their interactions.<br />

Diversification can also be overdone, and so must be<br />

analyzed on a country-by-country basis.<br />

Figure 4.8 Concentration Trends of<br />

International Interactions, 2005 – 2013<br />

102%<br />

100%<br />

98%<br />

96%<br />

94%<br />

92%<br />

90%<br />

88%<br />

86%<br />

84%<br />

2005 2006 2007 2008 2009 2010 2011 2012 2013<br />

Countries’ Interactions across Partners<br />

Countries’ Shares of World Interactions<br />

Changes in the concentration of countries’ international interactions across<br />

partners since 2005 have been smaller than changes in the concentration<br />

of international interactions on a global basis, providing another indicator<br />

of how countries’ distributions have lagged global shifts.