DHL Global Connectedness Index 2014

DHL Global Connectedness Index 2014

DHL Global Connectedness Index 2014

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>DHL</strong> <strong>Global</strong> <strong>Connectedness</strong> <strong>Index</strong> <strong>2014</strong><br />

45<br />

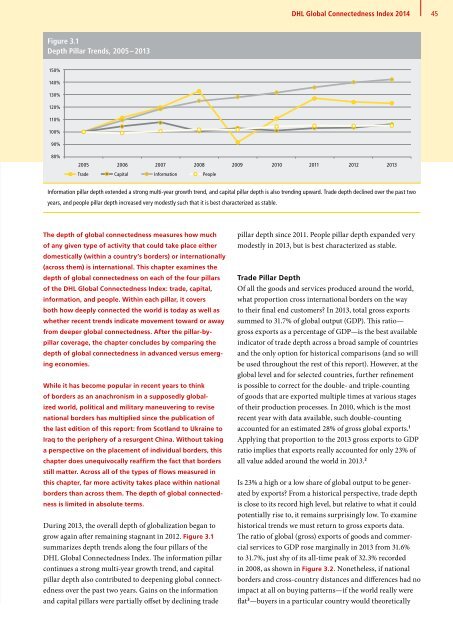

Figure 3.1<br />

Depth Pillar Trends, 2005 – 2013<br />

150%<br />

140%<br />

130%<br />

120%<br />

110%<br />

100%<br />

90%<br />

80%<br />

2005 2006 2007 2008 2009 2010 2011 2012 2013<br />

Trade Capital Information People<br />

Information pillar depth extended a strong multi-year growth trend, and capital pillar depth is also trending upward. Trade depth declined over the past two<br />

years, and people pillar depth increased very modestly such that it is best characterized as stable.<br />

The depth of global connectedness measures how much<br />

of any given type of activity that could take place either<br />

domestically (within a country’s borders) or internationally<br />

(across them) is international. This chapter examines the<br />

depth of global connectedness on each of the four pillars<br />

of the <strong>DHL</strong> <strong>Global</strong> <strong>Connectedness</strong> <strong>Index</strong>: trade, capital,<br />

information, and people. Within each pillar, it covers<br />

both how deeply connected the world is today as well as<br />

whether recent trends indicate movement toward or away<br />

from deeper global connectedness. After the pillar-bypillar<br />

coverage, the chapter concludes by comparing the<br />

depth of global connectedness in advanced versus emerging<br />

economies.<br />

While it has become popular in recent years to think<br />

of borders as an anachronism in a supposedly globalized<br />

world, political and military maneuvering to revise<br />

national borders has multiplied since the publication of<br />

the last edition of this report: from Scotland to Ukraine to<br />

Iraq to the periphery of a resurgent China. Without taking<br />

a perspective on the placement of individual borders, this<br />

chapter does unequivocally reaffirm the fact that borders<br />

still matter. Across all of the types of flows measured in<br />

this chapter, far more activity takes place within national<br />

borders than across them. The depth of global connectedness<br />

is limited in absolute terms.<br />

During 2013, the overall depth of globalization began to<br />

grow again after remaining stagnant in 2012. Figure 3.1<br />

summarizes depth trends along the four pillars of the<br />

<strong>DHL</strong> <strong>Global</strong> <strong>Connectedness</strong> <strong>Index</strong>. The information pillar<br />

continues a strong multi-year growth trend, and capital<br />

pillar depth also contributed to deepening global connectedness<br />

over the past two years. Gains on the information<br />

and capital pillars were partially offset by declining trade<br />

pillar depth since 2011. People pillar depth expanded very<br />

modestly in 2013, but is best characterized as stable.<br />

Trade Pillar Depth<br />

Of all the goods and services produced around the world,<br />

what proportion cross international borders on the way<br />

to their final end customers In 2013, total gross exports<br />

summed to 31.7% of global output (GDP). This ratio—<br />

gross exports as a percentage of GDP—is the best available<br />

indicator of trade depth across a broad sample of countries<br />

and the only option for historical comparisons (and so will<br />

be used throughout the rest of this report). However, at the<br />

global level and for selected countries, further refinement<br />

is possible to correct for the double- and triple-counting<br />

of goods that are exported multiple times at various stages<br />

of their production processes. In 2010, which is the most<br />

recent year with data available, such double-counting<br />

accounted for an estimated 28% of gross global exports. 1<br />

Applying that proportion to the 2013 gross exports to GDP<br />

ratio implies that exports really accounted for only 23% of<br />

all value added around the world in 2013. 2<br />

Is 23% a high or a low share of global output to be generated<br />

by exports From a historical perspective, trade depth<br />

is close to its record high level, but relative to what it could<br />

potentially rise to, it remains surprisingly low. To examine<br />

historical trends we must return to gross exports data.<br />

The ratio of global (gross) exports of goods and commercial<br />

services to GDP rose marginally in 2013 from 31.6%<br />

to 31.7%, just shy of its all-time peak of 32.3% recorded<br />

in 2008, as shown in Figure 3.2. Nonetheless, if national<br />

borders and cross-country distances and differences had no<br />

impact at all on buying patterns—if the world really were<br />

flat 3 —buyers in a particular country would theoretically