DHL Global Connectedness Index 2014

DHL Global Connectedness Index 2014

DHL Global Connectedness Index 2014

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>DHL</strong> <strong>Global</strong> <strong>Connectedness</strong> <strong>Index</strong> <strong>2014</strong><br />

39<br />

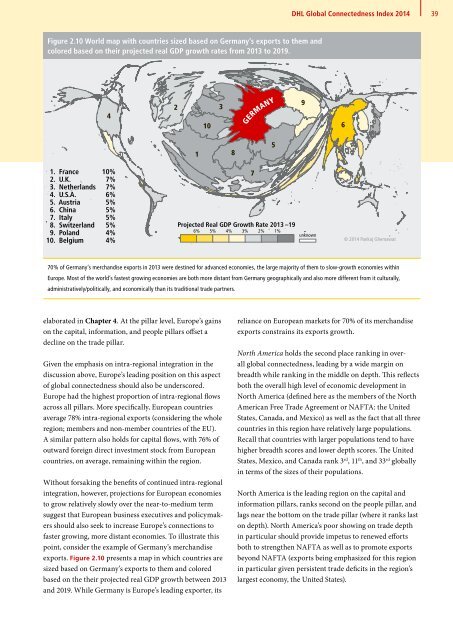

Figure 2.10 World map with countries sized based on Germany’s exports to them and<br />

colored based on their projected real GDP growth rates from 2013 to 2019.<br />

4<br />

2<br />

10<br />

3<br />

GERMANY<br />

9<br />

6<br />

1<br />

8<br />

5<br />

1. France 10%<br />

2. U.K. 7%<br />

7<br />

3. Netherlands 7%<br />

4. U.S.A. 6%<br />

5. Austria 5%<br />

6. China 5%<br />

7. Italy 5%<br />

8. Switzerland 5%<br />

Projected Real GDP Growth Rate 2013 –19<br />

6% 5% 4% 3% 2% 1%<br />

9. Poland 4%<br />

unknown<br />

10. Belgium 4% © <strong>2014</strong> Pankaj Ghemawat<br />

70% of Germany’s merchandise exports in 2013 were destined for advanced economies, the large majority of them to slow-growth economies within<br />

Europe. Most of the world’s fastest growing economies are both more distant from Germany geographically and also more different from it culturally,<br />

administratively/politically, and economically than its traditional trade partners.<br />

elaborated in Chapter 4. At the pillar level, Europe’s gains<br />

on the capital, information, and people pillars offset a<br />

decline on the trade pillar.<br />

Given the emphasis on intra-regional integration in the<br />

discussion above, Europe’s leading position on this aspect<br />

of global connectedness should also be underscored.<br />

Europe had the highest proportion of intra-regional flows<br />

across all pillars. More specifically, European countries<br />

average 78% intra-regional exports (considering the whole<br />

region; members and non-member countries of the EU).<br />

A similar pattern also holds for capital flows, with 76% of<br />

outward foreign direct investment stock from European<br />

countries, on average, remaining within the region.<br />

Without forsaking the benefits of continued intra-regional<br />

integration, however, projections for European economies<br />

to grow relatively slowly over the near-to-medium term<br />

suggest that European business executives and policymakers<br />

should also seek to increase Europe’s connections to<br />

faster growing, more distant economies. To illustrate this<br />

point, consider the example of Germany’s merchandise<br />

exports. Figure 2.10 presents a map in which countries are<br />

sized based on Germany’s exports to them and colored<br />

based on the their projected real GDP growth between 2013<br />

and 2019. While Germany is Europe’s leading exporter, its<br />

reliance on European markets for 70% of its merchandise<br />

exports constrains its exports growth.<br />

North America holds the second place ranking in overall<br />

global connectedness, leading by a wide margin on<br />

breadth while ranking in the middle on depth. This reflects<br />

both the overall high level of economic development in<br />

North America (defined here as the members of the North<br />

American Free Trade Agreement or NAFTA: the United<br />

States, Canada, and Mexico) as well as the fact that all three<br />

countries in this region have relatively large populations.<br />

Recall that countries with larger populations tend to have<br />

higher breadth scores and lower depth scores. The United<br />

States, Mexico, and Canada rank 3 rd , 11 th , and 33 rd globally<br />

in terms of the sizes of their populations.<br />

North America is the leading region on the capital and<br />

information pillars, ranks second on the people pillar, and<br />

lags near the bottom on the trade pillar (where it ranks last<br />

on depth). North America’s poor showing on trade depth<br />

in particular should provide impetus to renewed efforts<br />

both to strengthen NAFTA as well as to promote exports<br />

beyond NAFTA (exports being emphasized for this region<br />

in particular given persistent trade deficits in the region’s<br />

largest economy, the United States).