DHL Global Connectedness Index 2014

DHL Global Connectedness Index 2014

DHL Global Connectedness Index 2014

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

60 4. The Breadth of <strong>Global</strong> <strong>Connectedness</strong><br />

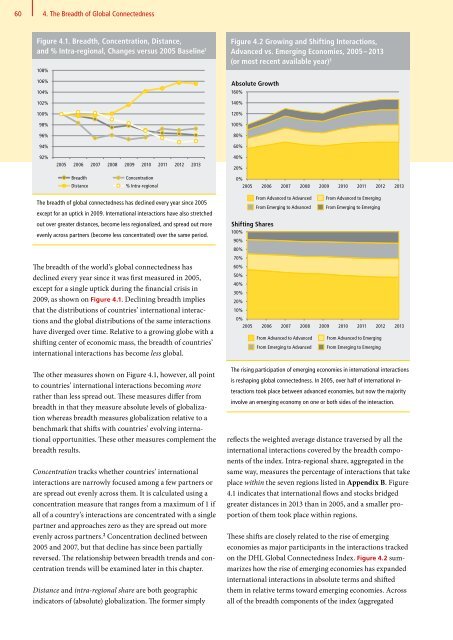

Figure 4.1. Breadth, Concentration, Distance,<br />

and % Intra-regional, Changes versus 2005 Baseline 1<br />

108%<br />

106%<br />

104%<br />

102%<br />

100%<br />

98%<br />

96%<br />

94%<br />

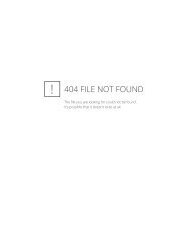

Figure 4.2 Growing and Shifting Interactions,<br />

Advanced vs. Emerging Economies, 2005 – 2013<br />

(or most recent available year) 3<br />

Absolute Growth<br />

160%<br />

140%<br />

120%<br />

100%<br />

80%<br />

60%<br />

92%<br />

2005 2006 2007 2008 2009 2010 2011 2012 2013<br />

40%<br />

20%<br />

Breadth<br />

Distance<br />

Concentration<br />

% Intra-regional<br />

0%<br />

2005 2006 2007 2008 2009 2010 2011 2012 2013<br />

The breadth of global connectedness has declined every year since 2005<br />

except for an uptick in 2009. International interactions have also stretched<br />

out over greater distances, become less regionalized, and spread out more<br />

evenly across partners (become less concentrated) over the same period.<br />

From Advanced to Advanced<br />

From Emerging to Advanced<br />

Shifting Shares<br />

100%<br />

90%<br />

80%<br />

From Advanced to Emerging<br />

From Emerging to Emerging<br />

The breadth of the world’s global connectedness has<br />

declined every year since it was first measured in 2005,<br />

except for a single uptick during the financial crisis in<br />

2009, as shown on Figure 4.1. Declining breadth implies<br />

that the distributions of countries’ international interactions<br />

and the global distributions of the same interactions<br />

have diverged over time. Relative to a growing globe with a<br />

shifting center of economic mass, the breadth of countries’<br />

international interactions has become less global. 1<br />

The other measures shown on Figure 4.1, however, all point<br />

to countries’ international interactions becoming more<br />

rather than less spread out. These measures differ from<br />

breadth in that they measure absolute levels of globalization<br />

whereas breadth measures globalization relative to a<br />

benchmark that shifts with countries’ evolving international<br />

opportunities. These other measures complement the<br />

breadth results.<br />

Concentration tracks whether countries’ international<br />

interactions are narrowly focused among a few partners or<br />

are spread out evenly across them. It is calculated using a<br />

concentration measure that ranges from a maximum of 1 if<br />

all of a country’s interactions are concentrated with a single<br />

partner and approaches zero as they are spread out more<br />

evenly across partners. 2 Concentration declined between<br />

2005 and 2007, but that decline has since been partially<br />

reversed. The relationship between breadth trends and concentration<br />

trends will be examined later in this chapter.<br />

Distance and intra-regional share are both geographic<br />

indicators of (absolute) globalization. The former simply<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

2005 2006 2007 2008 2009 2010 2011 2012 2013<br />

From Advanced to Advanced<br />

From Emerging to Advanced<br />

From Advanced to Emerging<br />

From Emerging to Emerging<br />

The rising participation of emerging economies in international interactions<br />

is reshaping global connectedness. In 2005, over half of international interactions<br />

took place between advanced economies, but now the majority<br />

involve an emerging economy on one or both sides of the interaction.<br />

reflects the weighted average distance traversed by all the<br />

international interactions covered by the breadth components<br />

of the index. Intra-regional share, aggregated in the<br />

same way, measures the percentage of interactions that take<br />

place within the seven regions listed in Appendix B. Figure<br />

4.1 indicates that international flows and stocks bridged<br />

greater distances in 2013 than in 2005, and a smaller proportion<br />

of them took place within regions.<br />

These shifts are closely related to the rise of emerging<br />

economies as major participants in the interactions tracked<br />

on the <strong>DHL</strong> <strong>Global</strong> <strong>Connectedness</strong> <strong>Index</strong>. Figure 4.2 summarizes<br />

how the rise of emerging economies has expanded<br />

international interactions in absolute terms and shifted<br />

them in relative terms toward emerging economies. Across<br />

all of the breadth components of the index (aggregated