Poverty and Human Development Report 2009 - UNDP in Tanzania

Poverty and Human Development Report 2009 - UNDP in Tanzania

Poverty and Human Development Report 2009 - UNDP in Tanzania

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

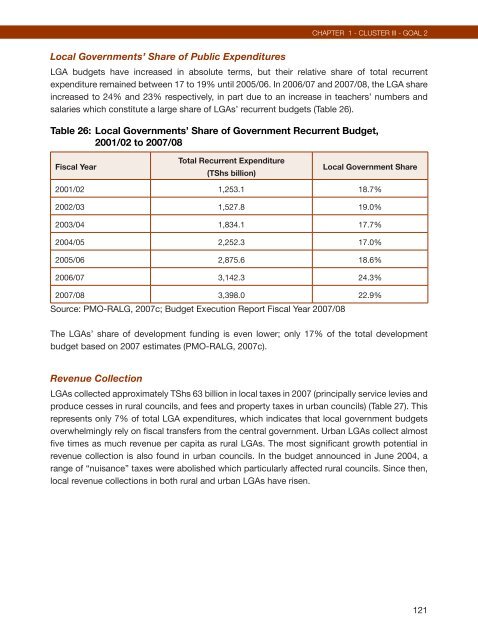

Local Governments’ Share of Public Expenditures<br />

LGA budgets have <strong>in</strong>creased <strong>in</strong> absolute terms, but their relative share of total recurrent<br />

expenditure rema<strong>in</strong>ed between 17 to 19% until 2005/06. In 2006/07 <strong>and</strong> 2007/08, the LGA share<br />

<strong>in</strong>creased to 24% <strong>and</strong> 23% respectively, <strong>in</strong> part due to an <strong>in</strong>crease <strong>in</strong> teachers’ numbers <strong>and</strong><br />

salaries which constitute a large share of LGAs’ recurrent budgets (Table 26).<br />

Table 26: Local Governments’ Share of Government Recurrent Budget,<br />

2001/02 to 2007/08<br />

Fiscal Year<br />

Total Recurrent Expenditure<br />

(TShs billion)<br />

Local Government Share<br />

2001/02 1,253.1 18.7%<br />

2002/03 1,527.8 19.0%<br />

2003/04 1,834.1 17.7%<br />

2004/05 2,252.3 17.0%<br />

2005/06 2,875.6 18.6%<br />

2006/07 3,142.3 24.3%<br />

2007/08 3,398.0 22.9%<br />

Source: PMO-RALG, 2007c; Budget Execution <strong>Report</strong> Fiscal Year 2007/08<br />

CHAPTER 1 - CLUSTER III - GOAL 2<br />

The LGAs’ share of development fund<strong>in</strong>g is even lower; only 17% of the total development<br />

budget based on 2007 estimates (PMO-RALG, 2007c).<br />

Revenue Collection<br />

LGAs collected approximately TShs 63 billion <strong>in</strong> local taxes <strong>in</strong> 2007 (pr<strong>in</strong>cipally service levies <strong>and</strong><br />

produce cesses <strong>in</strong> rural councils, <strong>and</strong> fees <strong>and</strong> property taxes <strong>in</strong> urban councils) (Table 27). This<br />

represents only 7% of total LGA expenditures, which <strong>in</strong>dicates that local government budgets<br />

overwhelm<strong>in</strong>gly rely on fiscal transfers from the central government. Urban LGAs collect almost<br />

five times as much revenue per capita as rural LGAs. The most significant growth potential <strong>in</strong><br />

revenue collection is also found <strong>in</strong> urban councils. In the budget announced <strong>in</strong> June 2004, a<br />

range of “nuisance” taxes were abolished which particularly affected rural councils. S<strong>in</strong>ce then,<br />

local revenue collections <strong>in</strong> both rural <strong>and</strong> urban LGAs have risen.<br />

121