- Page 1 and 2:

ACADEMIA ROMÂNĂ / ROMANIAN ACADEM

- Page 3 and 4:

CONTENTSARCHEOLOGY-HISTORYSIMONA LA

- Page 5 and 6:

PHILOSOPHY-SOCIOLOGYCONSTANTIN MIHA

- Page 7 and 8:

ARCHEOLOGY-HISTORYTYPES OF HABITAT

- Page 9 and 10:

Types of habitat at the end of the

- Page 11 and 12:

Types of habitat at the end of the

- Page 13 and 14:

Types of habitat at the end of the

- Page 15 and 16:

Types of habitat at the end of the

- Page 17 and 18:

Types of habitat at the end of the

- Page 19 and 20:

Types of habitat at the end of the

- Page 21:

Types of habitat at the end of the

- Page 24 and 25:

24Marin Tomawhat they understood by

- Page 26 and 27:

26Marin TomaIn the sound made by cl

- Page 28 and 29:

28Marin TomaAcross time, history sh

- Page 31 and 32:

HISTORY, LITERATURE AND ARTIN THE S

- Page 33 and 34:

History, literature and art in the

- Page 35 and 36:

History, literature and art in the

- Page 37 and 38:

History, literature and art in the

- Page 39 and 40:

THE ESTATES OF THE GLOGOVEANU BOYAR

- Page 41 and 42:

The estates of the Glogoveanu boyar

- Page 43 and 44:

The estates of the Glogoveanu boyar

- Page 45 and 46:

THE URBANISTIC EVOLUTION OF THE CIT

- Page 47 and 48:

The urbanistic evolution of the cit

- Page 49 and 50:

The urbanistic evolution of the cit

- Page 51 and 52:

The urbanistic evolution of the cit

- Page 53 and 54:

ÊTRE PRÉFET EN ROUMANIE, 1866-191

- Page 55 and 56:

Être préfet en Roumanie, 1866-191

- Page 57 and 58:

Être préfet en Roumanie, 1866-191

- Page 59 and 60:

Être préfet en Roumanie, 1866-191

- Page 61 and 62:

Être préfet en Roumanie, 1866-191

- Page 63 and 64:

Être préfet en Roumanie, 1866-191

- Page 65 and 66:

Être préfet en Roumanie, 1866-191

- Page 67 and 68:

Être préfet en Roumanie, 1866-191

- Page 69:

Être préfet en Roumanie, 1866-191

- Page 72 and 73:

72Marusia Cârsteala nécessité po

- Page 74 and 75:

74Marusia CârsteaC’est ce qui a

- Page 76 and 77:

76Marusia Cârsteaprojets visant la

- Page 79 and 80:

AN ATTEMPT OF MODERNIZATION IN CRAI

- Page 81 and 82:

An attempt of modernization in Crai

- Page 83 and 84:

An attempt of modernization in Crai

- Page 85 and 86:

An attempt of modernization in Crai

- Page 87 and 88:

THE ROMANIAN NATIONAL BANKAFTER NAT

- Page 89 and 90:

The Romanian National Bank after na

- Page 91 and 92:

The Romanian National Bank after na

- Page 93 and 94:

THE ROMANIAN LEGISLATION BETWEEN 19

- Page 95 and 96:

The Romanian legislation between 19

- Page 97 and 98:

The Romanian legislation between 19

- Page 99 and 100:

The Romanian legislation between 19

- Page 101 and 102:

The Romanian legislation between 19

- Page 103:

The Romanian legislation between 19

- Page 106 and 107:

106Narcisa Mituagricultural transfo

- Page 108 and 109:

108Narcisa Mituconsolidation of col

- Page 110 and 111:

110Narcisa Mitumachine and tractors

- Page 112 and 113:

112Gabriel Silviu Lohonminte/o fat

- Page 114 and 115:

114Gabriel Silviu Lohonputernică d

- Page 116 and 117:

116Gabriel Silviu Lohon

- Page 118 and 119:

118Mădălina Abagiuthan it is usua

- Page 120 and 121:

120Mădălina Abagiuthe monkey stag

- Page 122 and 123:

122Mădălina Abagiuécrivains, Cea

- Page 124 and 125:

124Nicolae VîlvoiThe “Vetre stra

- Page 126 and 127:

126Nicolae Vîlvoihave been kept, m

- Page 128 and 129:

128Nicolae Vîlvoiowners, due to la

- Page 130 and 131:

130Cosmin VilăuLe premier livre im

- Page 132 and 133:

132Cosmin VilăuL’édition de Râ

- Page 134 and 135:

134Cosmin Vilăurang, d’autant pl

- Page 136 and 137:

136Cosmin Vilău

- Page 138 and 139:

138Tudor NedelceaRomanian army, mea

- Page 140 and 141:

140Tudor NedelceaBalkans, while ver

- Page 142 and 143:

142Tudor Nedelceadisappeared” 23

- Page 144 and 145:

144Tudor Nedelceavisibly fading bef

- Page 146 and 147:

146Tudor Nedelcea

- Page 148 and 149:

148Iustina Burciother lexical micro

- Page 150 and 151:

150Iustina Burcidârvar - a servant

- Page 152 and 153:

152Iustina Burcivistier - a high of

- Page 154 and 155:

154Iustina BurciMÉTIERS ET EMPLOIS

- Page 156 and 157:

156Elena-Camelia ZăbavăLes noms i

- Page 158 and 159:

158Elena-Camelia Zăbavă2. Les nom

- Page 160 and 161:

160Elena-Camelia Zăbavăformules d

- Page 162 and 163:

162Elena-Camelia Zăbavăautres; P

- Page 164 and 165:

164Elena-Camelia ZăbavăANTHROPONY

- Page 166 and 167:

166Carmen Popescufalling into the c

- Page 168 and 169:

168Carmen Popescu“arbitrary noise

- Page 170 and 171:

170Carmen Popescunot fulfill our wi

- Page 172 and 173:

172Carmen PopescuWe risk hardening

- Page 174 and 175:

174Carmen Popescuhave not love, I a

- Page 176 and 177:

176Carmen Popescu

- Page 178 and 179:

178Mihaela Albumanaged to change us

- Page 180 and 181:

180Mihaela Albuvalues and imposing

- Page 182 and 183:

182Mihaela AlbuIt was an important

- Page 184 and 185:

184Isabel FernándezThe Direct Meth

- Page 186 and 187:

186Isabel FernándezTaking into acc

- Page 188 and 189:

188Isabel FernándezProfesor Univer

- Page 190 and 191:

190Gabriela BoangiuLaplantine’s E

- Page 192 and 193:

192Gabriela Boangiuby going over th

- Page 194 and 195:

194Gabriela Boangiuthe other hand.

- Page 196 and 197:

196Gabriela Boangiuit becomes the o

- Page 198 and 199:

198Gabriela Boangiu

- Page 200 and 201:

200Anca Ceauşescuspecially, the mo

- Page 202 and 203:

202Anca CeauşescuThe people from t

- Page 204 and 205:

204Anca CeauşescuThe image nr. 1 B

- Page 206 and 207:

206Anca Ceauşescuproportions betwe

- Page 208 and 209:

208Constantin Mihaiprimordiale du p

- Page 210 and 211:

210Constantin MihaiMircea Vulcănes

- Page 212 and 213:

212Constantin Mihaise résout pas d

- Page 214 and 215:

214Constantin Mihaicréation qui so

- Page 216 and 217:

216Constantin MihaiIls affirment la

- Page 218 and 219:

218Constantin Mihai«l’image d’

- Page 220 and 221:

220Constantin Mihaisa fonction n’

- Page 222 and 223:

222Constantin Mihai

- Page 224 and 225:

224Ana Maria Cincăd’opposition a

- Page 226 and 227:

226Ana Maria Cincăplotinienne, qui

- Page 228 and 229:

228Ana Maria Cincăc’est-à-dire

- Page 230 and 231:

230Ana Maria Cincă3. L’Eros hér

- Page 232 and 233:

232Ana Maria CincăReportée au ter

- Page 234 and 235:

234Ionel BuşeVlad III: héros ou m

- Page 236 and 237:

236Ionel Buşerégions rurales roum

- Page 238 and 239:

238Ionel BuşeCes productions litt

- Page 240 and 241:

240Ionel Buşepolitique après l’

- Page 242 and 243:

242Ionel Buşe

- Page 244 and 245:

244Rodica ŢuguiThe synthesis from

- Page 246 and 247:

246Rodica Ţuguidisease. 9 Decreasi

- Page 248 and 249:

248Rodica Ţuguifrom the modern wor

- Page 250 and 251:

250Rodica ŢuguiB. Perceptions and

- Page 252 and 253:

252Rodica Ţuguidie, and this could

- Page 254 and 255:

254Rodica Ţuguistrong feeling that

- Page 256 and 257:

256Rodica Ţuguialways announce tha

- Page 258 and 259:

258Rodica Ţuguion the need to defi

- Page 260 and 261:

260Rodica ŢuguiThe “HIV/AIDS ”

- Page 262 and 263:

262Rodica Ţuguiare mortals”. Als

- Page 264 and 265:

264Ileana Romanelements considered

- Page 266 and 267:

266Ileana RomanNo matter the type o

- Page 268 and 269:

268Ileana RomanThe role of the pare

- Page 270 and 271:

270Ileana RomanAfter the divorce, w

- Page 272 and 273:

272Ileana Roman

- Page 274 and 275:

274Costache Gheorghe, Mihaela Popes

- Page 276 and 277:

276Costache Gheorghe, Mihaela Popes

- Page 278 and 279:

278Costache Gheorghe, Mihaela Popes

- Page 280 and 281:

280Elena Alexandra IlincaIt is also

- Page 282 and 283:

282Elena Alexandra IlincaThe most i

- Page 284 and 285:

284Elena Alexandra Ilinca

- Page 286 and 287:

286Robert Paul Puică, Denisa Lored

- Page 288 and 289:

288Robert Paul Puică, Denisa Lored

- Page 290 and 291:

290Robert Paul Puică, Denisa Lored

- Page 292 and 293: 292Robert Paul Puică, Denisa Lored

- Page 294 and 295: 294Cristina Otovescu, Radu RizaDans

- Page 296 and 297: 296Cristina Otovescu, Radu RizaCett

- Page 299 and 300: REFORMING ROMANIAN PENSION SYSTEM:

- Page 301 and 302: Reforming Romanian Pension System:

- Page 303 and 304: Reforming Romanian Pension System:

- Page 305 and 306: Reforming Romanian Pension System:

- Page 307 and 308: Reforming Romanian Pension System:

- Page 309 and 310: SOME ASPECTS REGARDING THE “UNINO

- Page 311 and 312: Some Aspects Regarding the “Unino

- Page 313 and 314: LE DROIT UNIVERSELNicu VintilăDu p

- Page 315 and 316: Le droit universel 315côté de cet

- Page 317 and 318: ECONOMYTHE DEVELOPMENT OF THE INTER

- Page 319 and 320: The development of the internal mar

- Page 321 and 322: The development of the internal mar

- Page 323 and 324: The development of the internal mar

- Page 325 and 326: The development of the internal mar

- Page 327 and 328: The development of the internal mar

- Page 329 and 330: The development of the internal mar

- Page 331 and 332: The development of the internal mar

- Page 333 and 334: REGIONALISM AND GLOBALIZATIONIN THE

- Page 335 and 336: Some features of the English Legal

- Page 337 and 338: Some features of the English Legal

- Page 339 and 340: Some features of the English Legal

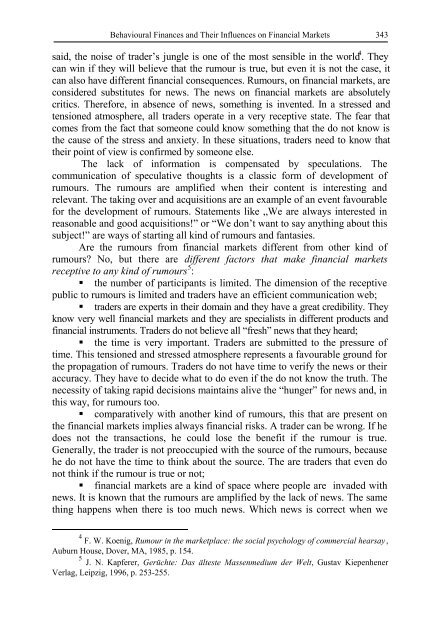

- Page 341: BEHAVIOURAL FINANCES AND THEIR INFL

- Page 345 and 346: Behavioural Finances and Their Infl

- Page 347 and 348: Behavioural Finances and Their Infl

- Page 349 and 350: THE LIBERALIZATION CAPITAL ACCOUNT

- Page 351 and 352: The liberalization capital account

- Page 353 and 354: The liberalization capital account

- Page 355 and 356: The liberalization capital account

- Page 357 and 358: LABOUR MARKET OF THE DEVELOPING REG

- Page 359 and 360: Labour market of the developing reg

- Page 361 and 362: Labour market of the developing reg

- Page 363 and 364: Labour market of the developing reg

- Page 365 and 366: THE GENETIC CONTROL FACTORS OF THE

- Page 367 and 368: The genetic control factors of the

- Page 369 and 370: The genetic control factors of the

- Page 371 and 372: The genetic control factors of the

- Page 373 and 374: REVIEWMichel Maffesoli, Le Réencha

- Page 375 and 376: Note, comentarii, recenzii 375the R

- Page 377 and 378: Note, comentarii, recenzii 377natur

- Page 379 and 380: SCIENTIFIC CHRONICLEThe Internation

- Page 381 and 382: On Sunday, the 21 st of April, unde

- Page 383 and 384: SCIENTIFIC LIFETHE ACTIVITY OF THE

- Page 385 and 386: ABBREVIATIONSAOAO s.n.AUBistB.A.R.B