- Page 1 and 2:

Exploring Unknown the Selected Docu

- Page 3 and 4:

I-11 President John F. Kennedy to H

- Page 5 and 6:

II-2 S.M. Greenfield and W.W. Kello

- Page 7 and 8:

II-23 Arnold W. Frutkin, Memorandum

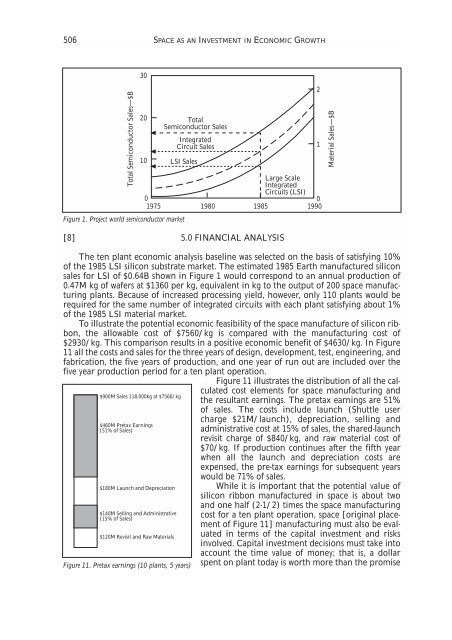

- Page 9 and 10:

II-46-II-48 Gregory W. Withee, Acti

- Page 11 and 12:

III-18 “Space Commercialization M

- Page 13 and 14:

Acknowledgments This volume is the

- Page 15 and 16:

Introduction One of the most import

- Page 17 and 18:

The editorial method we adopted for

- Page 19 and 20:

Joseph N. Pelton is a professor of

- Page 21 and 22:

GAO . . . . . . . . . . . . . . . .

- Page 23 and 24:

Chapter One The History of Satellit

- Page 25 and 26:

EXPLORING THE UNKNOWN 3 satellite f

- Page 27 and 28:

EXPLORING THE UNKNOWN 5 different v

- Page 29 and 30:

EXPLORING THE UNKNOWN 7 satellite s

- Page 31 and 32:

EXPLORING THE UNKNOWN 9 This unique

- Page 33 and 34:

EXPLORING THE UNKNOWN 11 technology

- Page 35 and 36:

EXPLORING THE UNKNOWN 13 7. In the

- Page 37 and 38:

EXPLORING THE UNKNOWN 15 16. The re

- Page 39 and 40:

applies only to the closest possibl

- Page 41 and 42:

EXPLORING THE UNKNOWN 19 arrangemen

- Page 43 and 44:

EXPLORING THE UNKNOWN 21 Conclusion

- Page 45 and 46:

entific and engineering work and to

- Page 47 and 48:

observations indicated strong refle

- Page 49 and 50:

EXPLORING THE UNKNOWN 27 Oval-shape

- Page 51 and 52:

Number of Randomly Spaced Satellite

- Page 53 and 54:

Document I-4 Document Title: Memora

- Page 55 and 56:

EXPLORING THE UNKNOWN 33 6. How can

- Page 57 and 58:

EXPLORING THE UNKNOWN 35 RECOMMENDA

- Page 59 and 60:

[3] 2. SUMMARY OF TECHNICAL FEATURE

- Page 61 and 62:

[28] 7. CONCLUSIONS AND RECOMMENDAT

- Page 63 and 64:

EXPLORING THE UNKNOWN 41 d. NASA’

- Page 65 and 66:

EXPLORING THE UNKNOWN 43 [1] PUBLIC

- Page 67 and 68:

EXPERIMENTATION The Commission is e

- Page 69 and 70:

EXPLORING THE UNKNOWN 47 During dis

- Page 71 and 72:

facilities in intercontinental comm

- Page 73 and 74:

Ground Transmitting Station at Holm

- Page 75 and 76:

EXPLORING THE UNKNOWN 53 diodes, so

- Page 77 and 78:

EXPLORING THE UNKNOWN 55 Bell Telep

- Page 79 and 80:

EXPLORING THE UNKNOWN 57 Our estima

- Page 81 and 82:

EXPLORING THE UNKNOWN 59 implicatio

- Page 83 and 84:

EXPLORING THE UNKNOWN 61 as quickly

- Page 85 and 86:

EXPLORING THE UNKNOWN 63 Commission

- Page 87 and 88:

EXPLORING THE UNKNOWN 65 Document t

- Page 89 and 90:

EXPLORING THE UNKNOWN 67 licenses,

- Page 91 and 92:

EXPLORING THE UNKNOWN 69 opment of

- Page 93 and 94:

EXPLORING THE UNKNOWN 71 any system

- Page 95 and 96:

In the end, the administration bill

- Page 97 and 98:

EXPLORING THE UNKNOWN 75 program in

- Page 99 and 100:

your bill and some of the major asp

- Page 101 and 102:

EXPLORING THE UNKNOWN 79 1934, as a

- Page 103 and 104:

EXPLORING THE UNKNOWN 81 or appropr

- Page 105 and 106:

U.S.C. 310) [citation in margin:

- Page 107 and 108:

interest; and (iii) an evaluation o

- Page 109 and 110:

EXPLORING THE UNKNOWN 87 ment on Ap

- Page 111 and 112:

EXPLORING THE UNKNOWN 89 aspects of

- Page 113 and 114:

Document title: Memorandum from J.

- Page 115 and 116:

EXPLORING THE UNKNOWN 93 tiated by

- Page 117 and 118:

cations satellite system rather tha

- Page 119 and 120:

___________________________________

- Page 121 and 122:

telegram are as follows: (A) Policy

- Page 123 and 124:

tems. Diversion of Government traff

- Page 125 and 126:

quality of services and charges for

- Page 127 and 128:

EXPLORING THE UNKNOWN 105 tions is

- Page 129 and 130:

EXPLORING THE UNKNOWN 107 A. Techno

- Page 131 and 132:

Report of the United States Delegat

- Page 133 and 134:

States, Vatican City State, Venezue

- Page 135 and 136:

EXPLORING THE UNKNOWN 113 structure

- Page 137 and 138:

EXPLORING THE UNKNOWN 115 U.S. posi

- Page 139 and 140:

EXPLORING THE UNKNOWN 117 agreed th

- Page 141 and 142:

EXPLORING THE UNKNOWN 119 VII. Futu

- Page 143 and 144:

EXPLORING THE UNKNOWN 121 to explor

- Page 145 and 146:

EXPLORING THE UNKNOWN 123 (b) to af

- Page 147 and 148:

EXPLORING THE UNKNOWN 125 the natio

- Page 149 and 150:

EXPLORING THE UNKNOWN 127 and Order

- Page 151 and 152:

EXPLORING THE UNKNOWN 129 own stron

- Page 153 and 154:

EXPLORING THE UNKNOWN 131 We are en

- Page 155 and 156:

EXPLORING THE UNKNOWN 133 and meeti

- Page 157 and 158:

EXPLORING THE UNKNOWN 135 Plumbrook

- Page 159 and 160:

cant background information and wor

- Page 161 and 162:

EXPLORING THE UNKNOWN 139 Applicati

- Page 163 and 164:

earth terminals, high-gain satellit

- Page 165 and 166:

20 watts of power per kilogram. New

- Page 167 and 168:

EXPLORING THE UNKNOWN 145 the devel

- Page 169 and 170:

No additional items were reviewed.

- Page 171 and 172:

Specifically, this report concludes

- Page 173 and 174:

[55] THE SECRETARY OF COMMERCE Wash

- Page 175 and 176:

A memorandum of law concerning Arti

- Page 177 and 178:

156 OBSERVING THE EARTH FROM SPACE

- Page 179 and 180:

158 OBSERVING THE EARTH FROM SPACE

- Page 181 and 182:

160 OBSERVING THE EARTH FROM SPACE

- Page 183 and 184:

162 OBSERVING THE EARTH FROM SPACE

- Page 185 and 186:

164 OBSERVING THE EARTH FROM SPACE

- Page 187 and 188:

166 OBSERVING THE EARTH FROM SPACE

- Page 189 and 190:

168 OBSERVING THE EARTH FROM SPACE

- Page 191 and 192:

170 OBSERVING THE EARTH FROM SPACE

- Page 193 and 194:

172 OBSERVING THE EARTH FROM SPACE

- Page 195 and 196:

174 OBSERVING THE EARTH FROM SPACE

- Page 197 and 198:

176 OBSERVING THE EARTH FROM SPACE

- Page 199 and 200:

178 OBSERVING THE EARTH FROM SPACE

- Page 201 and 202:

180 OBSERVING THE EARTH FROM SPACE

- Page 203 and 204:

182 OBSERVING THE EARTH FROM SPACE

- Page 205 and 206:

184 OBSERVING THE EARTH FROM SPACE

- Page 207 and 208:

186 OBSERVING THE EARTH FROM SPACE

- Page 209 and 210:

188 OBSERVING THE EARTH FROM SPACE

- Page 211 and 212:

190 OBSERVING THE EARTH FROM SPACE

- Page 213 and 214:

192 OBSERVING THE EARTH FROM SPACE

- Page 215 and 216:

194 OBSERVING THE EARTH FROM SPACE

- Page 217 and 218:

196 scanned from extreme altitudes

- Page 219 and 220:

198 winds, cumulus clouds that have

- Page 221 and 222:

200 bends back on itself with incre

- Page 223 and 224:

202 OBSERVING THE EARTH FROM SPACE

- Page 225 and 226:

204 required for Project TIROS in e

- Page 227 and 228:

206 OBSERVING THE EARTH FROM SPACE

- Page 229 and 230:

208 OBSERVING THE EARTH FROM SPACE

- Page 231 and 232:

210 OBSERVING THE EARTH FROM SPACE

- Page 233 and 234:

212 [1] [rubber stamped: “AUG 15

- Page 235 and 236:

214 These two letters, one from Con

- Page 237 and 238:

216 OBSERVING THE EARTH FROM SPACE

- Page 239 and 240:

218 OBSERVING THE EARTH FROM SPACE

- Page 241 and 242:

220 Budget Authority (BA) and Outla

- Page 243 and 244:

222 OBSERVING THE EARTH FROM SPACE

- Page 245 and 246:

224 Document II-11 Document title:

- Page 247 and 248:

226 OBSERVING THE EARTH FROM SPACE

- Page 249 and 250:

228 OBSERVING THE EARTH FROM SPACE

- Page 251 and 252:

230 OBSERVING THE EARTH FROM SPACE

- Page 253 and 254:

232 International Applications Area

- Page 255 and 256:

234 OBSERVING THE EARTH FROM SPACE

- Page 257 and 258:

236 Agricultural Geographic Geologi

- Page 259 and 260:

238 OBSERVING THE EARTH FROM SPACE

- Page 261 and 262:

240 that a number of important user

- Page 263 and 264:

242 [1] For the Record SAR/Robert G

- Page 265 and 266:

244 make every effort to ensure tha

- Page 267 and 268:

246 monitor the earth’s volcanoes

- Page 269 and 270:

248 OBSERVING THE EARTH FROM SPACE

- Page 271 and 272:

250 with us in this area). Encourag

- Page 273 and 274:

252 OBSERVING THE EARTH FROM SPACE

- Page 275 and 276:

254 the memorandum be explicitly br

- Page 277 and 278:

256 should officially participate i

- Page 279 and 280:

258 [1] APR 14, 1970 Honorable Walt

- Page 281 and 282:

260 One persuasive argument for cre

- Page 283 and 284:

262 General Assembly’s First Comm

- Page 285 and 286:

264 [1] July 24, 1974 Summary OBSER

- Page 287 and 288:

266 OBSERVING THE EARTH FROM SPACE

- Page 289 and 290:

268 OBSERVING THE EARTH FROM SPACE

- Page 291 and 292:

270 in the months following the lau

- Page 293 and 294:

272 Document II-26 Document title:

- Page 295 and 296:

274 their goals by making improved

- Page 297 and 298:

276 OBSERVING THE EARTH FROM SPACE

- Page 299 and 300:

278 recommended that continuity of

- Page 301 and 302:

280 gap in data availability would

- Page 303 and 304:

282 ment—considering the budgetar

- Page 305 and 306:

284 vices required for a multipurpo

- Page 307 and 308:

286 and for maintaining archives of

- Page 309 and 310:

288 OBSERVING THE EARTH FROM SPACE

- Page 311 and 312:

290 OBSERVING THE EARTH FROM SPACE

- Page 313 and 314:

292 D. Conclusions and Consequences

- Page 315 and 316:

294 Document II-31 Document title:

- Page 317 and 318:

296 OBSERVING THE EARTH FROM SPACE

- Page 319 and 320:

298 Assumptions This document was d

- Page 321 and 322:

300 OBSERVING THE EARTH FROM SPACE

- Page 323 and 324:

302 OBSERVING THE EARTH FROM SPACE

- Page 325 and 326:

304 training and technology transfe

- Page 327 and 328:

306 the payment of appropriate fees

- Page 329 and 330:

308 • The sub-issues that will ne

- Page 331 and 332:

310 OBSERVING THE EARTH FROM SPACE

- Page 333 and 334:

312 OBSERVING THE EARTH FROM SPACE

- Page 335 and 336:

314 development, either alone or in

- Page 337 and 338:

316 rity and foreign policy implica

- Page 339 and 340:

318 OBSERVING THE EARTH FROM SPACE

- Page 341 and 342:

320 report or explicitly address th

- Page 343 and 344:

322 OBSERVING THE EARTH FROM SPACE

- Page 345 and 346:

324 OBSERVING THE EARTH FROM SPACE

- Page 347 and 348:

326 OBSERVING THE EARTH FROM SPACE

- Page 349 and 350:

328 OBSERVING THE EARTH FROM SPACE

- Page 351 and 352:

330 [no pagination] PUBLIC LAW 98-3

- Page 353 and 354:

332 OBSERVING THE EARTH FROM SPACE

- Page 355 and 356:

334 OBSERVING THE EARTH FROM SPACE

- Page 357 and 358:

336 OBSERVING THE EARTH FROM SPACE

- Page 359 and 360:

338 OBSERVING THE EARTH FROM SPACE

- Page 361 and 362:

340 OBSERVING THE EARTH FROM SPACE

- Page 363 and 364:

342 OBSERVING THE EARTH FROM SPACE

- Page 365 and 366:

344 AUTHORIZATION OF APPROPRIATIONS

- Page 367 and 368:

346 [no pagination] For Immediate R

- Page 369 and 370:

348 This management plan spells out

- Page 371 and 372:

350 funding adjustments as agreed t

- Page 373 and 374:

352 Includes: • Ground System Dev

- Page 375 and 376:

354 OBSERVING THE EARTH FROM SPACE

- Page 377 and 378:

356 OBSERVING THE EARTH FROM SPACE

- Page 379 and 380:

358 OBSERVING THE EARTH FROM SPACE

- Page 381 and 382:

360 OBSERVING THE EARTH FROM SPACE

- Page 383 and 384:

362 OBSERVING THE EARTH FROM SPACE

- Page 385 and 386:

364 OBSERVING THE EARTH FROM SPACE

- Page 387 and 388:

366 OBSERVING THE EARTH FROM SPACE

- Page 389 and 390:

368 TITLE VI—PROHIBITION OF COMME

- Page 391 and 392:

370 Document II-42 Honorable George

- Page 393 and 394:

372 The Honorable John H. Gibbons A

- Page 395 and 396:

374 (b) Make government-owned Lands

- Page 397 and 398:

376 The letter from NOAA’s Gregor

- Page 399 and 400:

378 There is currently considerable

- Page 401 and 402:

380 7. During periods when national

- Page 403 and 404:

382 OBSERVING THE EARTH FROM SPACE

- Page 405 and 406:

Chapter Three Space as an Investmen

- Page 407 and 408:

EXPLORING THE UNKNOWN 387 However,

- Page 409 and 410:

EXPLORING THE UNKNOWN 389 sectors o

- Page 411 and 412:

EXPLORING THE UNKNOWN 391 the devel

- Page 413 and 414:

EXPLORING THE UNKNOWN 393 during th

- Page 415 and 416:

EXPLORING THE UNKNOWN 395 Internati

- Page 417 and 418:

EXPLORING THE UNKNOWN 397 Committee

- Page 419 and 420:

EXPLORING THE UNKNOWN 399 are not s

- Page 421 and 422:

still many hurdles for the space in

- Page 423 and 424:

[1] SUMMARY AND CONCLUSIONS EXPLORI

- Page 425 and 426:

EXPLORING THE UNKNOWN 405 developme

- Page 427 and 428:

important role in raising funds for

- Page 429 and 430:

nomic growth. The focus was on aggr

- Page 431 and 432:

the quality of goods and services d

- Page 433 and 434:

findings indicated that most of the

- Page 435 and 436:

This study showed an overall seven-

- Page 437 and 438:

sible to forecast the impacts on ma

- Page 439 and 440:

Our formulation of γ is as follows

- Page 441 and 442:

EXPLORING THE UNKNOWN 421 Table 4 I

- Page 443 and 444:

already shown above (Table 5) the m

- Page 445 and 446:

Significance of Findings Significan

- Page 447 and 448:

David Cross and I will be glad to d

- Page 449 and 450:

EXPLORING THE UNKNOWN 429 • The d

- Page 451 and 452:

EXPLORING THE UNKNOWN 431 [i] NASA

- Page 453 and 454:

EXPLORING THE UNKNOWN 433 The major

- Page 455 and 456:

their momentous insight when they d

- Page 457 and 458:

The direct social impact of NASA co

- Page 459 and 460:

[32] Microwave Systems Internal Gas

- Page 461 and 462:

[34] Internal Gas Dynamics Telemetr

- Page 463 and 464:

Impact of NASA Combinations High Mo

- Page 465 and 466:

Percentage of Economic Impact Alrea

- Page 467 and 468:

“less” to a “more” preferre

- Page 469 and 470:

[8] 4. NASTRAN NASTRAN (NASA Struct

- Page 471 and 472:

The following sections will discuss

- Page 473 and 474:

Diff. From Baseline, Thousands Figu

- Page 475 and 476: EXPLORING THE UNKNOWN 455 expenditu

- Page 477 and 478: [2] II. CREATING OPPORTUNITIES FOR

- Page 479 and 480: 10. Private Launch Ranges: The Admi

- Page 481 and 482: products and services to the avoida

- Page 483 and 484: — With respect to technologies ge

- Page 485 and 486: EXPLORING THE UNKNOWN 465 presence

- Page 487 and 488: EXPLORING THE UNKNOWN 467 (c) DoD,

- Page 489 and 490: (4) To stimulate private sector inv

- Page 491 and 492: EXPLORING THE UNKNOWN 471 (iii)Supp

- Page 493 and 494: develop design guidelines for futur

- Page 495 and 496: B. SATELLITE COMMUNICATIONS Satelli

- Page 497 and 498: Tended Facilities (MTFs) each offer

- Page 499 and 500: amount of R&D activity which can be

- Page 501 and 502: Long-Term Prospects for Development

- Page 503 and 504: [261] Environment: 1) Monitoring po

- Page 505 and 506: EXPLORING THE UNKNOWN 485 ly possib

- Page 507 and 508: In many religions the wealth of the

- Page 509 and 510: EXPLORING THE UNKNOWN 489 [no pagin

- Page 511 and 512: EXPLORING THE UNKNOWN 491 The follo

- Page 513 and 514: EXPLORING THE UNKNOWN 493 commercia

- Page 515 and 516: EXPLORING THE UNKNOWN 495 The first

- Page 517 and 518: EXPLORING THE UNKNOWN 497 tion was

- Page 519 and 520: August 3, 1983 Space Commercializat

- Page 521 and 522: EXPLORING THE UNKNOWN 501 Outline o

- Page 523 and 524: EXPLORING THE UNKNOWN 503 space ind

- Page 525: EXPLORING THE UNKNOWN 505 guide, di

- Page 529 and 530: Return on Investment*—$M 50 40 30

- Page 531 and 532: the desired average expected return

- Page 533 and 534: Patents Trade Secrets Liabilities I

- Page 535 and 536: Risk Adjusted Return on Investment

- Page 537 and 538: EXPLORING THE UNKNOWN 517 Implement

- Page 539 and 540: As they look to the turn of the cen

- Page 541 and 542: Exports (Dollar Per Capita) $500 $4

- Page 543 and 544: Supply (Years) Rate of Increase 200

- Page 545 and 546: EXPLORING THE UNKNOWN 525 Table 1.

- Page 547 and 548: Investment Cost Per Satellite Voice

- Page 549 and 550: EXPLORING THE UNKNOWN 529 (4) Altho

- Page 551 and 552: For five of the thirty-two the terr

- Page 553 and 554: Projected Annual and Cumulative Rev

- Page 555 and 556: EXPLORING THE UNKNOWN 535 growth, a

- Page 557 and 558: EXPLORING THE UNKNOWN 537 that firm

- Page 559 and 560: this study could exercise the syste

- Page 561 and 562: Our recent work with live cell mate

- Page 563 and 564: [no page number] Annual Gross Sales

- Page 565 and 566: to ensure that its accounting syste

- Page 567 and 568: Proposal for Enhancing NASA Technol

- Page 569 and 570: e) A Special Mission Development Di

- Page 571 and 572: “NASA Social Impact,” I have su

- Page 573 and 574: flow of technology information to s

- Page 575 and 576: 1976. This figure includes net bene

- Page 577 and 578:

EXPLORING THE UNKNOWN 557 It is imp

- Page 579 and 580:

EXPLORING THE UNKNOWN 559 Document

- Page 581 and 582:

EXPLORING THE UNKNOWN 561 earlier b

- Page 583 and 584:

Finally, the medical end use catego

- Page 585 and 586:

EXPLORING THE UNKNOWN 565 (3) provi

- Page 587 and 588:

EXPLORING THE UNKNOWN 567 Effective

- Page 589 and 590:

EXPLORING THE UNKNOWN 569 [10] A br

- Page 591 and 592:

EXPLORING THE UNKNOWN 571 [14] POLI

- Page 593 and 594:

EXPLORING THE UNKNOWN 573 activitie

- Page 595 and 596:

NASA’s technology transfer progra

- Page 597 and 598:

EXPLORING THE UNKNOWN 577 Tech Brie

- Page 599 and 600:

Ralph Braibanti joined the Departme

- Page 601 and 602:

F Philip J. Farley (1916- ) earned

- Page 603 and 604:

Lyndon B. Johnson (1908-1973) (D-TX

- Page 605 and 606:

M Leonard H. Marks was one of the o

- Page 607 and 608:

Robert C. Seamans, Jr. (1918- ), ha

- Page 609 and 610:

Robert M. White (1923- ) served as

- Page 611 and 612:

Bullington, Kenneth, 25 Bush, Georg

- Page 613 and 614:

Defense Satellite Communications Sy

- Page 615 and 616:

I Indiana University, 388 Initial D

- Page 617 and 618:

METOP satellite series, 166 Midwest

- Page 619 and 620:

O O’Connell, James D., 91-95, 99-

- Page 621 and 622:

and “Long-Term Prospects for Deve

- Page 623 and 624:

Reference Works, NASA SP-4000 The N

- Page 625 and 626:

SP-4207 not published. Compton, W.