- Page 1 and 2:

I. Inaugural Ceremony TRANSLATION O

- Page 3 and 4:

The National Assembly ratified seve

- Page 5 and 6:

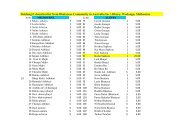

allot. A brief curriculum vitae of

- Page 7 and 8:

Sonam Wangchuk from Zhemgang won th

- Page 9 and 10:

Bodo militants in the country pose

- Page 11 and 12:

Goendeys in the country continue to

- Page 13 and 14:

1. The military capability of the a

- Page 15 and 16:

ate is 4.5%, and the balance of pay

- Page 17 and 18:

of the Basochhu Hydropower Project

- Page 19 and 20:

3. The Department of Education has

- Page 21 and 22:

As Gross National Happiness places

- Page 23 and 24:

Since people-centred development li

- Page 25 and 26:

Recognizing the deep reverence that

- Page 27 and 28:

conference. This is an indication o

- Page 29 and 30:

safeguard the sovereignty of the co

- Page 31 and 32:

They also expressed their profound

- Page 33 and 34:

ooklet on the financial report of Y

- Page 35 and 36:

Nu.260 million was spent on purchas

- Page 37 and 38:

Nu.381 million increase in the budg

- Page 39 and 40:

would be incurred. Although the cur

- Page 41 and 42:

udget presentation by the Hon’ble

- Page 43 and 44:

The fact that the debt service rati

- Page 45 and 46:

the territories of Assam and Bengal

- Page 47 and 48:

Since many of the plan projects cou

- Page 49 and 50:

issue of the Thimphu-Phuntsholing h

- Page 51 and 52:

the Department should ensure that t

- Page 53 and 54:

Sarpang Dzongkhag. He extended the

- Page 55 and 56:

The Speaker underlined the signific

- Page 57 and 58:

Kuensel and the Bhutan Broadcasting

- Page 59 and 60:

The Hon’ble Minister for Health a

- Page 61 and 62:

A Royal Advisory Councillor and the

- Page 63 and 64:

The Speaker noted that the governme

- Page 65 and 66:

failed to resolve the problem, ther

- Page 67 and 68:

serious resentment and animosity be

- Page 69 and 70:

The NDFB militants are fighting the

- Page 71 and 72:

affected the security of the countr

- Page 73 and 74:

The ULFA delegation said that they

- Page 75 and 76:

again to find a solution to the pro

- Page 77 and 78:

led by the Home Minister and the UL

- Page 79 and 80:

epresent a government since they ar

- Page 81 and 82:

Bhutanese people. Last December, wi

- Page 83 and 84:

ii. Two rounds of Security Coordina

- Page 85 and 86:

undergone militia training and serv

- Page 87 and 88:

left but to resort to military acti

- Page 89 and 90:

shops. In such situations, the loca

- Page 91 and 92:

would be better to act in accordanc

- Page 93 and 94:

He informed the members that, under

- Page 95 and 96:

and working to this end without eve

- Page 97 and 98:

security of the nation is of the ut

- Page 99 and 100:

however, be in our interest to endo

- Page 101 and 102:

agreement signed with the Royal Gov

- Page 103 and 104:

there was no longer any conscriptio

- Page 105 and 106:

genuine volunteers should be forwar

- Page 107 and 108:

the time to make excuses regarding

- Page 109 and 110:

militia force, and after returning

- Page 111 and 112:

The people’s representatives of T

- Page 113 and 114:

They wondered where all the organiz

- Page 115 and 116:

faction which does not have camps i

- Page 117 and 118:

pressing on this issue, the problem

- Page 119 and 120:

informed the house the Lhengyel Zhu

- Page 121 and 122:

apprehended and brought to justice.

- Page 123 and 124:

The Foreign Minister informed the h

- Page 125 and 126:

this regard, the Royal Government w

- Page 127 and 128:

who left after committing terrorist

- Page 129 and 130:

and the agreement reached by Bhutan

- Page 131 and 132:

2. The hon’ble members are aware

- Page 133 and 134:

verification provides ample time an

- Page 135 and 136:

In his presentation on the issue, t

- Page 137 and 138:

deliberately trying to delay the pa

- Page 139 and 140:

obbery and destruction of service i

- Page 141 and 142:

emain in the country. These people

- Page 143 and 144:

The people in the camps in Nepal co

- Page 145 and 146:

during the 14 th round, Bhutan had

- Page 147 and 148:

abide by the resolutions of the Nat

- Page 149 and 150:

However, it is most important that

- Page 151 and 152:

effective treatment or vaccine, and

- Page 153 and 154:

The Secretary also pointed out that

- Page 155 and 156:

supervision and guidance. The Assem

- Page 157 and 158:

local Forest Office. This takes abo

- Page 159 and 160:

4. To enhance sustainable use of fo

- Page 161 and 162:

For conifer species, Nu.40 per tree

- Page 163 and 164:

per truckload. Further, in order to

- Page 165 and 166: A Royal Advisory Councillor said th

- Page 167 and 168: workforce were reduced, the Bhutane

- Page 169 and 170: issue. Furthermore, the Cabinet has

- Page 171 and 172: numbering about 60,000 and coming t

- Page 173 and 174: proposing the issue of the expatria

- Page 175 and 176: Penden Cement Plants are Bhutanese.

- Page 177 and 178: the government offices take the nat

- Page 179 and 180: Punakha Chimi those people on whom

- Page 181 and 182: the competence of the Bhutanese in

- Page 183 and 184: are private sector candidates who r

- Page 185 and 186: aspects and those who are unable to

- Page 187 and 188: Jabmi. It would be beneficial if th

- Page 189 and 190: fees for Jabmis would not be approp

- Page 191 and 192: their decisions should be given due

- Page 193 and 194: material inducements to innocent vi

- Page 195 and 196: Another Chimi from Samtse Dzongkhag

- Page 197 and 198: It is the responsibility of the Gup

- Page 199 and 200: The Dorji Lopen of the Central Monk

- Page 201 and 202: The Minister expressed appreciation

- Page 203 and 204: Zhungtshog to direct the Government

- Page 205 and 206: The Minister pointed out that Part

- Page 207 and 208: Among many other provisions, the ac

- Page 209 and 210: flourishes. A strong and clear Chat

- Page 211 and 212: The Minister informed the Assembly

- Page 213 and 214: In Article 12 of Chapter 4 on page

- Page 215: Therefore, it is being submitted to

- Page 219 and 220: and in the interest of the poor, it

- Page 221 and 222: Therefore, it is important that PIT

- Page 223 and 224: session. Moreover, a revised copy o

- Page 225 and 226: The rule of law is a basic requirem

- Page 227 and 228: country depend upon the presence of

- Page 229 and 230: The National Assembly has the full

- Page 231 and 232: The Punakha Chimi also commented on

- Page 233 and 234: A lot of good experience has been g

- Page 235 and 236: meat in the country should decrease

- Page 237 and 238: therefore face lots of difficulties

- Page 239 and 240: If two or three Chathrims rather th

- Page 241 and 242: XX. Expression of Appreciation and

- Page 243 and 244: tourists and other non-governmental

- Page 245 and 246: people of different geogs to identi

- Page 247 and 248: gained by the members of the DYT an

- Page 249 and 250: of the Kurichu Hydro Power Project.

- Page 251 and 252: institutes besides centers of Buddh

- Page 253 and 254: that it has become a majestic icon

- Page 255 and 256: promotion of the national language.

- Page 257 and 258: those belonging to neighbouring Dzo

- Page 259 and 260: secondly due to the concerted effor

- Page 261 and 262: of a child, the Hon’ble chairman

- Page 263 and 264: order to avoid problems related to

- Page 265 and 266: Of the five killed, four were fores

- Page 267 and 268:

and sorrow at the incident. He said

- Page 269 and 270:

Among the dead in the recent incide

- Page 271 and 272:

greatly undermine the friendship an

- Page 273 and 274:

confidence and appreciation of the

- Page 275 and 276:

teachings of the Buddha to flourish

- Page 277 and 278:

opportunities and challenges associ

- Page 279 and 280:

3. Grants a. GoI Program Grants 800

- Page 281 and 282:

While there was a substantial incre

- Page 283 and 284:

would continue to monitor the size

- Page 285 and 286:

The Royal Government will, as annou

- Page 287 and 288:

power tariff for the rural consumer

- Page 289 and 290:

The domestic revenue forecast for t

- Page 291 and 292:

Customs duties on yarn have been ab

- Page 293 and 294:

The Royal Government continues to a

- Page 295 and 296:

The Royal Government is, therefore,

- Page 297 and 298:

The Ministry of Finance will study

- Page 299 and 300:

climate for private sector developm

- Page 301 and 302:

4. Gross International Millions of

- Page 303:

303