Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 10<br />

<br />

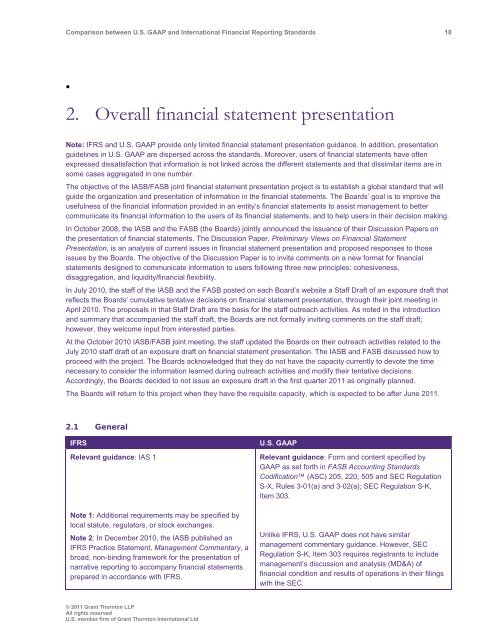

2. Overall financial statement presentation<br />

Note: IFRS <strong>and</strong> U.S. <strong>GAAP</strong> provide only limited financial statement presentation guidance. In addition, presentation<br />

guidelines in U.S. <strong>GAAP</strong> are dispersed across the st<strong>and</strong>ards. Moreover, users of financial statements have often<br />

expressed dissatisfaction that information is not linked across the different statements <strong>and</strong> that dissimilar items are in<br />

some cases aggregated in one number.<br />

The objective of the IASB/FASB joint financial statement presentation project is to establish a global st<strong>and</strong>ard that will<br />

guide the organization <strong>and</strong> presentation of information in the financial statements. The Boards’ goal is to improve the<br />

usefulness of the financial information provided in an entity’s financial statements to assist management to better<br />

communicate its financial information to the users of its financial statements, <strong>and</strong> to help users in their decision making.<br />

In October 2008, the IASB <strong>and</strong> the FASB (the Boards) jointly announced the issuance of their Discussion Papers on<br />

the presentation of financial statements. The Discussion Paper, Preliminary Views on Financial Statement<br />

Presentation, is an analysis of current issues in financial statement presentation <strong>and</strong> proposed responses to those<br />

issues by the Boards. The objective of the Discussion Paper is to invite comments on a new format for financial<br />

statements designed to communicate information to users following three new principles: cohesiveness,<br />

disaggregation, <strong>and</strong> liquidity/financial flexibility.<br />

In July 2010, the staff of the IASB <strong>and</strong> the FASB posted on each Board’s website a Staff Draft of an exposure draft that<br />

reflects the Boards’ cumulative tentative decisions on financial statement presentation, through their joint meeting in<br />

April 2010. The proposals in that Staff Draft are the basis for the staff outreach activities. As noted in the introduction<br />

<strong>and</strong> summary that accompanied the staff draft, the Boards are not formally inviting comments on the staff draft;<br />

however, they welcome input from interested parties.<br />

At the October 2010 IASB/FASB joint meeting, the staff updated the Boards on their outreach activities related to the<br />

July 2010 staff draft of an exposure draft on financial statement presentation. The IASB <strong>and</strong> FASB discussed how to<br />

proceed with the project. The Boards acknowledged that they do not have the capacity currently to devote the time<br />

necessary to consider the information learned during outreach activities <strong>and</strong> modify their tentative decisions.<br />

Accordingly, the Boards decided to not issue an exposure draft in the first quarter 2011 as originally planned.<br />

The Boards will return to this project when they have the requisite capacity, which is expected to be after June 2011.<br />

2.1 General<br />

IFRS<br />

Relevant guidance: IAS 1<br />

Note 1: Additional requirements may be specified by<br />

local statute, regulators, or stock exchanges.<br />

Note 2: In December 2010, the IASB published an<br />

IFRS Practice Statement, Management Commentary, a<br />

broad, non-binding framework for the presentation of<br />

narrative reporting to accompany financial statements<br />

prepared in accordance with IFRS.<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: Form <strong>and</strong> content specified by<br />

<strong>GAAP</strong> as set forth in FASB Accounting St<strong>and</strong>ards<br />

Codification (ASC) 205, 220, 505 <strong>and</strong> SEC Regulation<br />

S-X, Rules 3-01(a) <strong>and</strong> 3-02(a); SEC Regulation S-K,<br />

Item 303.<br />

Unlike IFRS, U.S. <strong>GAAP</strong> does not have similar<br />

management commentary guidance. However, SEC<br />

Regulation S-K, Item 303 requires registrants to include<br />

management’s discussion <strong>and</strong> analysis (MD&A) of<br />

financial condition <strong>and</strong> results of operations in their filings<br />

with the SEC.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd