Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

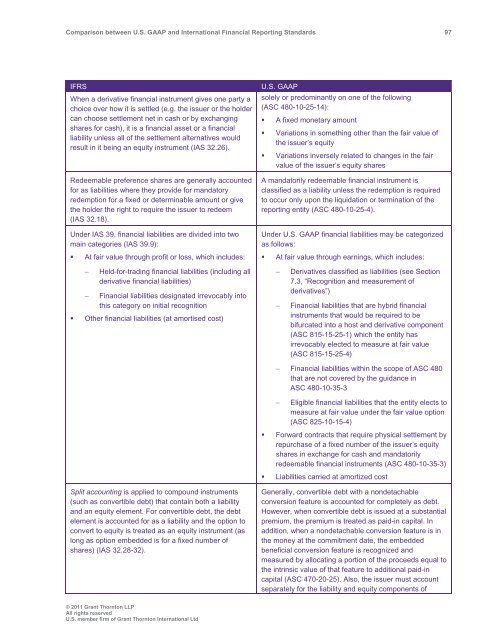

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 97<br />

IFRS<br />

When a derivative financial instrument gives one party a<br />

choice over how it is settled (e.g. the issuer or the holder<br />

can choose settlement net in cash or by exchanging<br />

shares for cash), it is a financial asset or a financial<br />

liability unless all of the settlement alternatives would<br />

result in it being an equity instrument (IAS 32.26).<br />

Redeemable preference shares are generally accounted<br />

for as liabilities where they provide for m<strong>and</strong>atory<br />

redemption for a fixed or determinable amount or give<br />

the holder the right to require the issuer to redeem<br />

(IAS 32.18).<br />

Under IAS 39, financial liabilities are divided into two<br />

main categories (IAS 39.9):<br />

• At fair value through profit or loss, which includes:<br />

U.S. <strong>GAAP</strong><br />

solely or predominantly on one of the following<br />

(ASC 480-10-25-14):<br />

• A fixed monetary amount<br />

• Variations in something other than the fair value of<br />

the issuer’s equity<br />

• Variations inversely related to changes in the fair<br />

value of the issuer’s equity shares<br />

A m<strong>and</strong>atorily redeemable financial instrument is<br />

classified as a liability unless the redemption is required<br />

to occur only upon the liquidation or termination of the<br />

reporting entity (ASC 480-10-25-4).<br />

Under U.S. <strong>GAAP</strong> financial liabilities may be categorized<br />

as follows:<br />

• At fair value through earnings, which includes:<br />

<br />

Held-for-trading financial liabilities (including all<br />

derivative financial liabilities)<br />

Financial liabilities designated irrevocably into<br />

this category on initial recognition<br />

• Other financial liabilities (at amortised cost)<br />

<br />

<br />

Derivatives classified as liabilities (see Section<br />

7.3, “Recognition <strong>and</strong> measurement of<br />

derivatives”)<br />

Financial liabilities that are hybrid financial<br />

instruments that would be required to be<br />

bifurcated into a host <strong>and</strong> derivative component<br />

(ASC 815-15-25-1) which the entity has<br />

irrevocably elected to measure at fair value<br />

(ASC 815-15-25-4)<br />

Financial liabilities within the scope of ASC 480<br />

that are not covered by the guidance in<br />

ASC 480-10-35-3<br />

Eligible financial liabilities that the entity elects to<br />

measure at fair value under the fair value option<br />

(ASC 825-10-15-4)<br />

• Forward contracts that require physical settlement by<br />

repurchase of a fixed number of the issuer’s equity<br />

shares in exchange for cash <strong>and</strong> m<strong>and</strong>atorily<br />

redeemable financial instruments (ASC 480-10-35-3)<br />

• Liabilities carried at amortized cost<br />

Split accounting is applied to compound instruments<br />

(such as convertible debt) that contain both a liability<br />

<strong>and</strong> an equity element. For convertible debt, the debt<br />

element is accounted for as a liability <strong>and</strong> the option to<br />

convert to equity is treated as an equity instrument (as<br />

long as option embedded is for a fixed number of<br />

shares) (IAS 32.28-32).<br />

Generally, convertible debt with a nondetachable<br />

conversion feature is accounted for completely as debt.<br />

However, when convertible debt is issued at a substantial<br />

premium, the premium is treated as paid-in capital. In<br />

addition, when a nondetachable conversion feature is in<br />

the money at the commitment date, the embedded<br />

beneficial conversion feature is recognized <strong>and</strong><br />

measured by allocating a portion of the proceeds equal to<br />

the intrinsic value of that feature to additional paid-in<br />

capital (ASC 470-20-25). Also, the issuer must account<br />

separately for the liability <strong>and</strong> equity components of<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd