Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

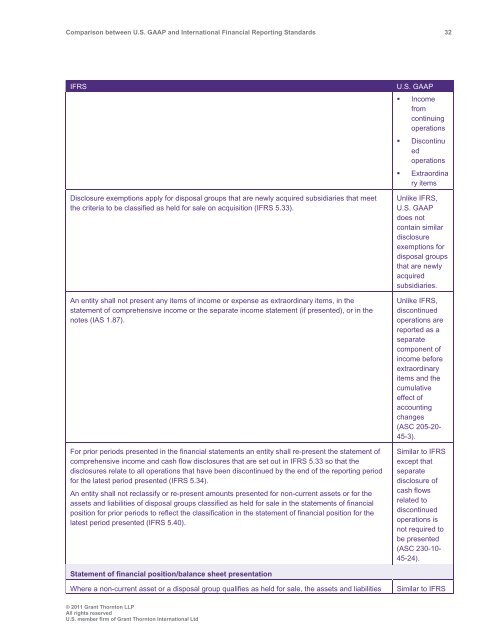

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 32<br />

IFRS<br />

Disclosure exemptions apply for disposal groups that are newly acquired subsidiaries that meet<br />

the criteria to be classified as held for sale on acquisition (IFRS 5.33).<br />

An entity shall not present any items of income or expense as extraordinary items, in the<br />

statement of comprehensive income or the separate income statement (if presented), or in the<br />

notes (IAS 1.87).<br />

For prior periods presented in the financial statements an entity shall re-present the statement of<br />

comprehensive income <strong>and</strong> cash flow disclosures that are set out in IFRS 5.33 so that the<br />

disclosures relate to all operations that have been discontinued by the end of the reporting period<br />

for the latest period presented (IFRS 5.34).<br />

An entity shall not reclassify or re-present amounts presented for non-current assets or for the<br />

assets <strong>and</strong> liabilities of disposal groups classified as held for sale in the statements of financial<br />

position for prior periods to reflect the classification in the statement of financial position for the<br />

latest period presented (IFRS 5.40).<br />

U.S. <strong>GAAP</strong><br />

• Income<br />

from<br />

continuing<br />

operations<br />

• Discontinu<br />

ed<br />

operations<br />

• Extraordina<br />

ry items<br />

Unlike IFRS,<br />

U.S. <strong>GAAP</strong><br />

does not<br />

contain similar<br />

disclosure<br />

exemptions for<br />

disposal groups<br />

that are newly<br />

acquired<br />

subsidiaries.<br />

Unlike IFRS,<br />

discontinued<br />

operations are<br />

reported as a<br />

separate<br />

component of<br />

income before<br />

extraordinary<br />

items <strong>and</strong> the<br />

cumulative<br />

effect of<br />

accounting<br />

changes<br />

(ASC 205-20-<br />

45-3).<br />

Similar to IFRS<br />

except that<br />

separate<br />

disclosure of<br />

cash flows<br />

related to<br />

discontinued<br />

operations is<br />

not required to<br />

be presented<br />

(ASC 230-10-<br />

45-24).<br />

Statement of financial position/balance sheet presentation<br />

Where a non-current asset or a disposal group qualifies as held for sale, the assets <strong>and</strong> liabilities<br />

Similar to IFRS<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd