Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

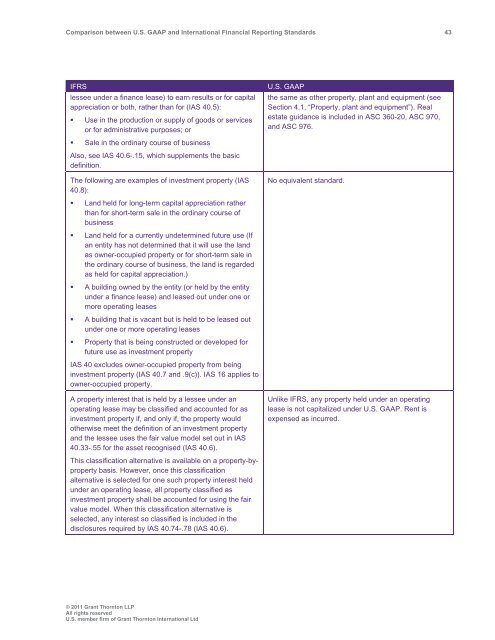

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 43<br />

IFRS<br />

lessee under a finance lease) to earn results or for capital<br />

appreciation or both, rather than for (IAS 40.5):<br />

• Use in the production or supply of goods or services<br />

or for administrative purposes; or<br />

• Sale in the ordinary course of business<br />

Also, see IAS 40.6-.15, which supplements the basic<br />

definition.<br />

The following are examples of investment property (IAS<br />

40.8):<br />

U.S. <strong>GAAP</strong><br />

the same as other property, plant <strong>and</strong> equipment (see<br />

Section 4.1, “Property, plant <strong>and</strong> equipment”). Real<br />

estate guidance is included in ASC 360-20, ASC 970,<br />

<strong>and</strong> ASC 976.<br />

No equivalent st<strong>and</strong>ard.<br />

• L<strong>and</strong> held for long-term capital appreciation rather<br />

than for short-term sale in the ordinary course of<br />

business<br />

• L<strong>and</strong> held for a currently undetermined future use (If<br />

an entity has not determined that it will use the l<strong>and</strong><br />

as owner-occupied property or for short-term sale in<br />

the ordinary course of business, the l<strong>and</strong> is regarded<br />

as held for capital appreciation.)<br />

• A building owned by the entity (or held by the entity<br />

under a finance lease) <strong>and</strong> leased out under one or<br />

more operating leases<br />

• A building that is vacant but is held to be leased out<br />

under one or more operating leases<br />

• Property that is being constructed or developed for<br />

future use as investment property<br />

IAS 40 excludes owner-occupied property from being<br />

investment property (IAS 40.7 <strong>and</strong> .9(c)). IAS 16 applies to<br />

owner-occupied property.<br />

A property interest that is held by a lessee under an<br />

operating lease may be classified <strong>and</strong> accounted for as<br />

investment property if, <strong>and</strong> only if, the property would<br />

otherwise meet the definition of an investment property<br />

<strong>and</strong> the lessee uses the fair value model set out in IAS<br />

40.33-.55 for the asset recognised (IAS 40.6).<br />

Unlike IFRS, any property held under an operating<br />

lease is not capitalized under U.S. <strong>GAAP</strong>. Rent is<br />

expensed as incurred.<br />

This classification alternative is available on a property-byproperty<br />

basis. However, once this classification<br />

alternative is selected for one such property interest held<br />

under an operating lease, all property classified as<br />

investment property shall be accounted for using the fair<br />

value model. When this classification alternative is<br />

selected, any interest so classified is included in the<br />

disclosures required by IAS 40.74-.78 (IAS 40.6).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd